#ca ipcc

Text

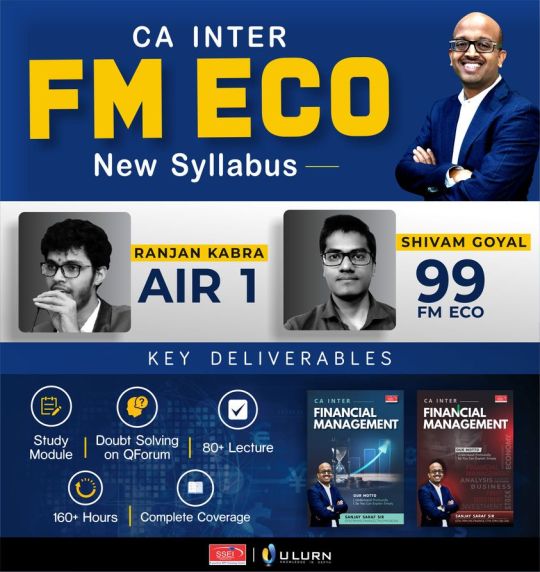

clear your exam with CA Final Intermediate New Syllabus online courses, study materials & video lectures for your CA Intermediate Exam exclusively at ULURN.

#CA Inter#CA Intermediate#best faculty for ca inter fm eco#ca inter fm eco#CA Intermediate Pendrive Classes#best pen drive classes for ca ipcc

0 notes

Text

CA Intermediate is second level exam in the Chartered Accountancy Course in India. The students after clearing the Common Proficiency Test or CA Foundation becomes eligible to register for the CA Intermediate.

#CA Inter#CA Intermediate#ca inter pendrive classes#best pendrive classes for ca ipcc#CA Intermediate Pendrive Classes#CA Inter EFF & FM Pendrive#best faculty for ca inter fm eco

0 notes

Text

PREPRight is a premier coaching institution providing high-quality education and courses to its students. We provide training to students from the preparation of professional courses like CA | CS | CMA | ACCA & more.

Teaching is not just our profession but our biggest passion. Here we endeavor to teach in a very innovative manner, making learning really interesting and fun for our students.

0 notes

Link

#ca exam preparation#preparation for ca exam#How To Prepare For CA Exams#classes for ca in Mumbai#ipcc classes in Mumbai

0 notes

Text

Best Institute Or CA /CS Coaching In Chandigarh

College of commerce is the best institute in chandigarh. Its a prospering Academic for in commerce coaching

#cs executive coaching#cs coaching in chandigarh#ca cpt entrance exam#CA Ipcc Coaching#ca entrance coaching#b.com courses after 12th commerce#bcom operational coaching#accounts coaching classes#Class 11 commerce coaching

0 notes

Text

youtube

CA Inter Costing revision, Cost Accounting System Chapter revision for all CA Intermediate Students.

#CA Inter#CA Intermediate#ca inter pendrive classes#best pen drive classes for ca ipcc#ca inter accounts pendrive classes#CA Intermediate Pendrive Classes#Youtube

0 notes

Text

youtube

CA Inter Costing, Overhead Chapter Revision, Very Important Exam Before revision for all CA Inter Students.

#CA Inter#CA Intermediate#ca inter pendrive classes#best pen drive classes for ca ipcc#ca inter accounts pendrive classes#CA Intermediate Pendrive Classes#Youtube

0 notes

Text

The Best Accounting Software for Small Businesses in 2023:

Introduction:

There are several accounting software options available for small businesses, including QuickBooks, Xero, FreshBooks, and Wave. These software programs can help small business owners manage their financial transactions, create invoices and track expenses, and generate financial reports. Some key factors to consider when choosing accounting software for a small business include the cost, ease of use, and the specific features and integrations that are important for the business's needs.

VNC is another term for perfection we are India's leading financial accounting and bookkeeping outsourcing Accounting Experts in India.

Accounting Expert in India:

An accounting expert is a professional with extensive knowledge and experience in the field of accounting. They may hold certifications such as a Certified Public Accountant (CPA) or Chartered Accountant (CA) and have a deep understanding of accounting principles, regulations, and financial reporting. They can assist with financial statement preparation, tax compliance, financial forecasting, budgeting, and other financial matters. It's important to note that accounting experts can specialize in different areas such as audit, tax, and management accounting.

What does an accountant do?

An accountant is a professional who performs financial tasks such as recording, classifying, and summarizing financial transactions to provide information that is useful in making business and economic decisions. Some of the specific responsibilities of an accountant include:

Recording and maintaining financial records, including those related to income, expenses, and assets.

Preparing financial statements such as balance sheets, income statements, and cash flow statements.

Analyzing financial information to identify and recommend ways to reduce costs and increase revenues.

Assisting with budgeting and forecasting.

Ensuring compliance with tax laws and regulations.

Providing advice on financial matters, such as raising capital or investing funds.

Auditing financial records to ensure accuracy and compliance with laws and regulations.

There are different types of accountants, such as public accountants, management accountants, and government accountants, each with its own specific responsibilities and focus areas.

Chartered Accountants in India:

Chartered Accountants (CA) in India are professionals who have completed a rigorous education and training process and have passed a series of exams in order to be recognized as a CA by the Institute of Chartered Accountants of India (ICAI). They are considered experts in the field of accounting, auditing, and tax.

VNC is another term for perfection we are India's leading financial accounting and bookkeeping outsourcing Accounting Experts in India.

The process to become a Chartered Accountant in India includes:

Completing an undergraduate program in commerce or a related field.

Registering as a student member of the ICAI.

Completing three levels of theoretical and practical education, including the Common Proficiency Test (CPT), the Integrated Professional Competence Course (IPCC), and the final exam.

Completing a certain period of practical training under a practicing CA.

Clearing an Ethics and Professionalism assessment.

Chartered Accountants in India are authorized to perform various roles such as auditing financial statements, filing tax returns, advising clients on tax planning and compliance, providing business and financial consulting services, and conducting internal audits for companies.

In addition, CAs are also authorized to provide services to the public, including certification of financial statements, providing opinions on financial matters, and carrying out due diligence exercises.

VNC is another term for perfection we are India's leading financial accounting and bookkeeping outsourcing Accounting Automation experts in Australia.

3 notes

·

View notes

Text

Ca final test series for ca exams preparation

Looking for CA Final Test Series for CA exams Preparation?

Join India No 1 Online CA Final Test Series Register today at catestseries Features: More than 100+Tests in which entire portion is covered Twice.

CA Test Series

We are the only platform to provide application based unseen questions in CA Final Online Mock Test Series, CA Inter Online Mock Test Series, and CA Foundation Online Mock Test Series as per the latest pattern of the ICAI Exam. The Quality of Questions and Evaluation makes CA Test Series the best online test series for CA Final Inter & Foundation.

More than 17 top faculties provide our test series to their students

All India Ranking out of 10k+

Test Papers are conducted according to ICAI pattern only

45-55% case study based questions

Detailed performance evaluation

4 types of notes will be provided

Experienced Faculty

Chartered Accountants having Min 5 years of experience design Papers and Evaluate. Content Quality is our upmost priority

Doubt Solving

Our Call | Whatsapp | Email | Doubt Panel is available for you till exams for any doubt. Ask any doubt regarding the subject

Ranking / Topper Sheet

Ranking will be provided to evaluate the performance among 10k+ Students. Toppers sheet will also shared for each test

Quick Result

Evaluated sheets along with examiners comment on each answer and guidance will be provided within 2-3 days

Study Planners

Comprehensive study planner with be provided as per each student’s capability, this helps to revise entire syllabus effectively

Personalized Guidance

Chapter-wise and subject-wise personalized guidance will be provided to each student. Concept, presentation and speed will be improved

Best Sheets for each Test are provided through which you can compare your performance with the topper Instant Doubt Solving by Faculty on call or Whatsapp Register for Online CA Test Series for CA-IPCC / Inter and Final

Check Online Test Series Syllabus & Fee Structure from here – https://www.catestseries.org/

Read more athttps://www.catestseries.org/

2 notes

·

View notes

Text

CA IPCC Result 2022 | Pass Percentage | Topper, Release Date

CA IPCC Result 2022 | Pass Percentage | Topper, Release Date

CA IPCC Result 2022 | Pass Percentage | Topper, Release Date: In this essay, we will give you with detailed information regarding the CA IPCC Result 2022. As a result, you will receive your results on time. Because we will tell you when and where your results will be released in our post. Our report will also include complete information about the topper and pass percentage. We hope you will read…

View On WordPress

2 notes

·

View notes

Text

clear your exam with CA Final Intermediate New Syllabus online courses, study materials & video lectures for your CA Intermediate Exam exclusively at ULURN.

#CA Inter#CA Intermediate#ca inter fm eco#best faculty for ca inter fm eco#CA Intermediate Pendrive Classes#ca inter pendrive classes#best pen drive classes for ca ipcc

0 notes

Link

#CA Inter#CA Intermediate#ca inter pendrive classes#CA Intermediate Pendrive Classes#best pendrive classes for ca ipcc

0 notes

Text

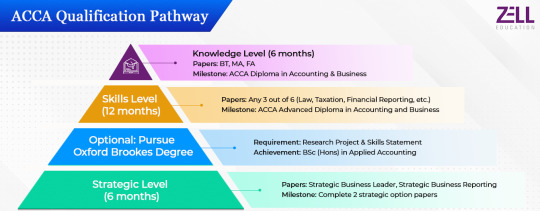

What is ACCA, Full Form & Course Details | Zell Education

What is ACCA? Course, Fees & More

What is ACCA? you might ask; The Association of Chartered Certified Accountants popularly know as ACCA is a globally recognized course with over 200,000 members and 600,000 students across 180+ countries. This qualification is considered the largest professional accounting qualification in the world. This course is one of the most prestigious certifications in accounting and is preferred by many students who want to build a successful career abroad.

What do you visualize when you think about accounting and finance careers? A few years ago, accounting meant working under heaps of paper. However, the scenario has drastically changed today. You can say that the finance and accounting sector has come a long way from manual bookkeeping to technology-driven methods. So, to build a career in accounting today, you must choose a dynamic course that matches the evolving accounting field. ACCA is one such professional certification course that trains candidates according to the current market standards and also keeps you updated with the regular changes happening in the industry.

Before taking a dig at more about careers after ACCA, let us brainstorm a bit about what is ACCA. Eight brilliant accountants came together to form the Association of Chartered Certified Accountants (ACCA) on 30th November 1904 in the UK. While the association started in the UK, it soon gained recognition globally and now it is present in as many as 180 countries worldwide. According to recent records, ACCA has more than 2,00,000 registered community members and more than 6,00,000 registered students.

In India, ACCA is said to be equivalent to CA and ACCA professionals are hired at the same salary in most companies such as PwC, KPMG, Deloitte, EY, Grant Thornton, and BDO.

youtube

What is ACCA Course Eligibility

Once you have decided to pursue the ACCA course, you must know what ACCA course eligibility is and whether you fit in or not. Here are the eligibility criteria that can help you to join the ACCA course.

The minimum eligibility criteria is to pass Class 12th with at least 50% marks. You must have also scored at least 65% in total of Accounts, English, and Mathematics.

In case you do not fulfill the above criteria, you must pursue and complete the Foundation in ACCA Diploma.

What are the ACCA Exemptions?

ACCA offers exemptions to Commerce Graduates, Post Graduate (M.Com) Inter CA Students and CA Qualified. Students who have just cleared their class 12 examinations, do not qualify as per the aforementioned criteria, but are still qualified to register for the ACCA Exam via Foundation in Accountancy (FIA) route.

Are you now a graduate and regret not joining the ACCA course immediately after completing your Class 12th? You do not have to worry because students with higher educational qualifications get ACCA exemptions.

So, you should know about the exam exemptions before you join the ACCA course.

1. Students who have joined the ACCA course just after Class 12th must appear in all the ACCA exams.

2. However, Commerce Graduates who’ve completed their BCom can gain up to 5 exemptions for their ACCA exams.

3. Also, CA IPCC candidates get exemptions from 5 ACCA exams.

4. Even many CA candidates today pursue the ACCA course and they get exemptions from 9 ACCA exams.

The ACCA course consists of three levels and you have to appear and pass 13 exams to complete the course. These ACCA levels are:

Foundation Level

Applied Skills Level

Professional Level

What are the ACCA Levels?

1. ACCA Foundation Level

This first level of the ACCA course offers basic level knowledge and information in financeand accounting. You have to appear in 3 exams to clear this level to proceed to the next level.

2. Applied Skills Level

This level is all about strategic skills and other accounting skills. These skills are based on the modules that you have gone through at the Foundation Level.

3. Professional Level

The final level is the most essential level in the ACCA course. It consists of an extended version of the strategic skills along with the professional skills required in the accounting industry.

Apart from the study modules, you also must complete a work experience of about 36 months in the relevant field. You can complete this work experience during the course or even after completing all the levels. You can claim the ACCA certification only after clearing all the levels and completing the work experience. QualificationsNumber of exams to give

Exemptions

Completion of Class 12th13 papers*NILCommerce Graduate9 papersBT, MA, FA, LWMCom Post Graduate9 papersBT, MA, FA, LWCA IPCC (Both Groups)8 papers**BT, MA, FA, TX, AACA4 papers**BT-FM (9 subjects)

*The applicant should have passed 5 subjects including English and Mathematics / Accounts, with 65% in at least 2 subjects and over 50% for the rest.

**A CA Final candidate is eligible to attain additional exemptions if they’ve scored 40 and above marks in their examination for relevant subjects.

You can also check Our Video on ACCA Exemptions

What are the Subjects in ACCA?

ACCA as a course covers aspects of Chartered Accountancy such as Accounting, Financial Reporting, Auditing, Taxation, Business Finance and Financial Management. ACCA Syllabus has a total of 13 examinations that a candidate must appear for. The 13 exams are split into 3 levels – Knowledge, Skill and Professional.

ACCA has three levels to cross for which you have to pass 13 exams. In total, there are 15 subjects available in the ACCA curriculum. You have to complete all the subjects in the first two levels. However, when you reach the third level, you have the option to select your subjects according to your specialization. The Knowledge Level exams are on-demand exams that can be appeared at any time in the 365 days of the year. The Skill and Professional Level exams are conducted every March, June, September and December.

Thinking about what are the 13 subjects in ACCA?

Here are the level-wise subjects to go through.

ACCA Knowledge Level

While Class 12th students have to appear in all the exams, commerce graduates and master’s degree holders get an exemption from appearing in these subject exams.

Accountant in Business (AB)

Management Accounting (MA)

Financial Accounting (FA)

ACCA Skill Level

CA IPCC candidates get exemptions from the above-level exams and 2 subjects from this level.

Corporate and Business Law (LW)

Performance Management (PM)

Taxation (TX)

Financial Reporting (FR)

Audit and Assurance (AA)

Financial Management (FM)

ACCA Strategic Professional Level

CA candidates just have to appear in this level exam to get the ACCA certification and membership.

Essential

Strategic Business Reporting (SBR)

Strategic Business Leader (SBL)

Optional (2 of 4)

Advanced Financial Management (AFM)

Advanced Performance Management (APM)

Advanced Taxation (ATX)

Advanced Audit and Assurance (AAA)

Ethics and Professional Skills Module

This module helps you gain professional and ethical skills required in real-time work situations.

ACCA Affiliate

To become an ACCA Affiliate member, students are required to complete 36 months of work experience and achieve about nine performance objectives. This experience documentation should be signed by a supervisor.

ACCA Exam Details

ACCA organizes its exam four times a year offering candidates the flexibility to appear in the exam at their convenience. You can appear in the ACCA exams in March, June, September, or December every year.

Exam patterns for modules at each level will be different. However, there are some common elements that you must remember while understanding ACCA exam details.

Each exam has two sections – Section A and Section B

Section A will have objective-type questions while Section B comprises long pattern questions.

The exam papers have 100 marks for each module.

You must secure at least 50% to pass the exam.

ACCA does not charge negative markings for wrong answers.

ACCA is not as difficult as CA. However, passing the exam levels can get more difficult than your graduation exams if you do not prepare well for them. The difficulty level increases with each ACCA level. For example, you may not find the Foundation Level very difficult. However, the Skill Level will get tougher than the first level, and so on. Consult a guide to prepare for the ACCA exam well and pass it smoothly.

Along with the ACCA learning skills, you must also have these many skills for your ACCA course and your accounting career in the future.

Mathematics skills

Accounting skills

Analytical skills and critical thinking

Decision Making skills

Professional ethics

Creativity

Global mindset

Communication skills

Why Should you Pursue ACCA?

One of the major questions that arise in many minds is why should you pursue ACCA when there are so many other accounting and finance courses available in the market. Here are some of the potential answers to this question.

More than CA:

A few years back, CA was the most prestigious accounting course in India. However, you will find now that many CA candidates also pursue the ACCA course. Even so many candidates prefer to choose ACCA over CA today. One of the major reasons is the difficulty level. Reliable sources have claimed that if the ACCA passing rate is 40%, the CA passing rate is just 4%.

Global Recognition:

So, what is so special about ACCA that even the CA candidates are pursuing the course? One of the prominent reasons is global recognition. Today, ACCA is available in as many as 180 countries worldwide. So, after completing the course, you can either work in a multinational company in your country or can enjoy exposure to other countries.

Promising Career:

Apart from global exposure, another essential reason to pursue ACCA is career growth. Most multinational companies wish to hire candidates with professional qualifications such as ACCA. ACCA candidates are experts in strategic skills and also highly trained in professional skills of communication and leadership, making them a favourite of various big-shot companies globally.

Decent Salary Package:

It is quite obvious that with career growth, you will start earning a decent salary package. Ambition Box mentioned that the annual salary of an ACCA is Rs. 12 lacs per annum with a few years of experience. This salary keeps on increasing with time and experience.

A Part of the ACCA Community:

Lastly, you happen to become a part of the reputed ACCA community. The association updates the ACCA members regularly with the latest happenings in the accounting industry. Also, you can discuss and seek advice on various areas from other community members.

Who Should Pursue the Association of Chartered Certified Accountants Course?

Even though you have the right eligibility to pursue the ACCA course, you may not have enough reasons to do so. It is essential to understand that the ACCA course is exactly for whom.

Education Qualifications:

If you have the educational eligibility required for the course, you are always welcome to pursue the course. However, you can either start immediately after Class 12th or can pursue the course after graduation and even after completing your CA program.

An Interest in Accounting:

The ACCA course is all about accounting in finance. So, you must have a keen interest in the accounting field to pursue the ACCA course.

Working Professionals:

The ACCA course demands you to complete work experience of 36 months along with the learning modules. So, if you already have work experience in accounting and finance, you can always pursue the ACCA course for career growth.

What are the Job Opportunities for ACCA?

The accounting industry offers ample job opportunities to ACCA members globally. Also, today ACCA candidates are very much in demand because of their dynamic training and updated skills. So, what are the job opportunities for ACCA? Here is a list of the most popular job opportunities that one can get after completing the ACCA course.

Management Accountant

Credit Controller

Tax Specialist

Forensic Accountant

Auditor

Financial Accountant

Finance Manager

Corporate Treasurer

Chief Financial Officer

Scope of ACCA in India

If you are pursuing the ACCA course in India, you will find great career opportunities in various multinational companies working in India. Here are some best career opportunities that you can have in India after ACCA. The scope of ACCA in India has been increasing tremendously over the last few years. Candidates who’ve successfully completed their ACCA certificate and gained professional skills are hired by the best of companies such as PwC, Deloitte, KPMG, EY, Grant Thornton, and BDO.

They are hired in various profiles such as Accounting Advisory, Risk Advisory, Statutory Audit, Internal Audit, Forensic Auditing, Mergers & Acquisitions, Valuations, and more. The ACCA salary (₹5 to 8 lacs) is the same as CAs, just with the same profile.

Accounting and Reporting

Financial Accounting

Business Valuation

Tax Consulting

Treasury & Cash Management

Companies such as TATA, Deloitte, and many more in India pay ACCA almost equivalent salary packages to CA. You can get good salary packages in these companies based on your skills, experience, and your interview.

Apart from joining a suitable company in different job positions, you can even join different coaching centres in India as ACCA faculty. Many ACCA candidates today prefer to start a fresh career as an ACCA learning partner with a standard institute after retiring from their actual jobs.

We at Zell Education, have placed hundreds of students in various companies across India, in Mumbai and Delhi and Pune. Simultaneously, we are in contact with thousands of ACCAs across India placed in prestigious corporations in all departments.

Scope of ACCA Overseas

ACCAs are hired across the world in 180+ countries. For students studying in India, the most popular countries are the UK, Canada, Australia, Singapore, and Dubai. ACCAs have signing authority in the majority of these countries.

ACCA Salary in India & World Wide

ACCA candidates in India and worldwide pocket a good salary package from the start of their careers. Here is an overview of the ACCA salary in India & worldwide.

India: Rs. 7 lacs – 19 lacs

UK: GBP 39,000 – 68,200

Hong Kong: KHD 17,4000 – 31, 900

UAE: AED 60,000 – 2,40,000

Which Countries Have ACCA Signing Authority?

Currently, ACCA is available worldwide. However, ACCA candidates do not have signing authorities all over the world. So, which countries have ACCA signing authority till now? Here is a list of popular countries where you can practice ACCA.

United Kingdom and Ireland

European Economic Area, Switzerland, and the European Union

Turkey

United States

Canada

Australia

CA ANZ Strategic Alliance

New Zealand

Caribbean

Sout6h and Central America

Kenya

Namibia

South Africa

Zimbabwe

China

HongKong

India

Macau

Malaysia

Nepal

Pakistan

Singapore

Taiwan

United Arab Emirates

What is the ACCA Course Fees?

The very first thing that you must do is to register for the ACCA course with an initial fee of Rs. 7625. Next, you must pay an annual subscription of Rs. 10,000, which you have to pay every year till the completion of the course.

Registration and Subscription Fees

Initial registration: £30

A one-time fee that students must pay when registering with ACCA.

Re-registration: £30

ACCA students who fail to pay fees when due will have their names removed from the ACCA register and must pay a re-registration fee (plus any unpaid fees) to be reinstated as a student.

Annual subscription 2024: £134

An annual subscription fee is due each year to keep your student status active.

Exemption Fees

An exemption fee is charged for each ACCA exam you are awarded exemption from.

Applied Knowledge Exams: £84

The fee is chargeable per exemption awarded.

Applied Skills Exams: £111

Apart from this basic fee structure, you also may have to pay exemption fees if you take exam exemptions. The exemption charges are different for different papers. So, you must contact a professional guide or coaching centre to assist you with exactly what ACCA course fee and other charges are.

Interesting Facts on ACCA Subscription

These subscription charges may, however, differ based on your current status. If you are an affiliate, which means if you’ve passed the ACCA exams and the ethics module, but haven’t completed your mandatory work experience you must pay an annual fee of £135. You can then hold ACCA affiliate status for almost three years. After that, if you wish to extend your affiliate status you will be required to pay an annual fees of £270.

Interesting Facts on ACCA Membership

Once you’ve completed all your papers, ethics module and mandatory work experience, you can apply for a full time membership of £270.

ACCA Coaching Fees

To make your ACCA degree truly count, you need a coaching institute that is known for this course throughout the globe. For this, you need to look for a platinum approved learning partner that ensures that your learning journey is a seamless one. Zell Education is a platinum approved coaching provider for ACCA that’s trusted by a thousands of students in India and abroad.

Due to Zell’s Platinum ALP status, you are entitled to exemption waivers of

Subjects: ₹1,00,000

Registration: ₹8,000

Subscription: £112

Here’s how much Zell’s coaching fee will cost you.

Our Expert Faculty

Contact details: You can reach out to the experts at Zell Education through this number +91 90046 92555.

Head office address: 602, Eco Space IT Park New Nagardas Road Mogra Village, Mogra Pada, Natwar Nagar, Jogeshwari East, Maharashtra

The ACCA qualification is recognized in over 180 countries including Canada, Singapore, and Australia. If you’ve made the decision to become a global CA and are contemplating your next move, we can help you take a step forward. Check out our Association of Chartered Certified Accountants (ACCA) course to learn more.

FAQs

What is the registration process for ACCA 2024?

You have to complete the registration process on the official website of ACCA Global. Create your account on the website and proceed with the registration payment and subscription payment. Contact a professional coaching centre such as Zell to help you well with the process.

What is the eligibility criteria for ACCA?

To qualify for ACCA course, you should be of 18 years of age and should have completed your 10+2 with 65% average score in Math and 50% average in English.

Can I pass ACCA in my first attempt?

Experts mention that about 40% to 50% of candidates pass the ACCA exams in the first attempt. Moreover, if you are dedicated and act according to proper study strategies, you can always clear your ACCA levels on the first attempt.

How many exemptions can one get for ACCA exams?

As per the official website of ACCA global, a maximum of nine Applied Knowledge and Applied Skills exams of the ACCA Qualification can be awarded. However, there are no exemptions awarded for the Strategic Professional Exams

How much does ACCA certification cost?

Several factors impact the ACCA certification cost. However, it may range between Rs. 50,000 to Rs. 2,50,000 depending upon the exemptions you are taking and other factors.

Can a student take multiple exams at once?

Yes, students can take multiple exams at once. However, once you have reached the Professional Level, you have seven years to clear all the exams.

Partham Barot is an ACCA-certified professional. showcasing his expertise in finance and accountancy. he’s revolutionising education by focusing on practical, real-world skills. Partham’s achievements underscore his commitment to elevating educational standards and empowering the next generation of professionals.

0 notes

Link

#Skills required for CA students#CA student skills#important skills for CA students#ca institute in mumbai#ipcc classes in mumbai#AJ Next Education

0 notes

Text

Who is BB Sir? An Introduction to CA Bhanwar Borana

CA Bhanwar Borana is a distinguished Faculty at our prestigious institution of higher learning for CA, CS, and CMA students. We shall discuss CA Bhanwar Borana's expertise, concentrating on his gallantry in CA Final/Inter Direct Tax. CA Bhanwar Borana is a well-known professor in the field of chartered accounting. BB sir has an enormous 8 years of teaching experience at CA IPCC & FINAL in Direct Tax and International Taxation. He has gained a lot of expertise over the years and is now a reputed faculty for CA Final/Inter Direct Taxation, and CA Final DT Fast Track at Smart Learning Destination.

The teaching techniques of BB Sir are highly understandable and have been successful for a great number of students. His distinctive intellectual clarity, practical application, and exam-focused approach define his teaching style.

He offers to go over all pertinent topics and subtopics, from the fundamentals to more complex ideas. Therefore, CA Bhanwar Borana’s students have achieved outstanding success in their CA Final/Inter Direct Tax and other professional exams.

Language of CA, CS, and CMA Courses and Video Lectures

1. Students can buy Hindi English Mix Lectures.

2. Best things are that South Indian Students can purchase fully English Lectures because they don’t understand Hindi.

You can also buy the latest course materials and video lectures of CA Bhanwar Borana Sir

CA Inter Direct Tax Old Syllabus Regular Batch By CA Bhanwar Borana – Click Here

CMA Inter Direct Taxation Regular Batch by CA Bhanwar Borana – Click Here

CMA Inter DT Regular Batch by CA Bhanwar Borana – Click Here

CMA Inter Direct Taxation Exam Oriented Fastrack Batch By CA Bhanwar Borana - Click Here

CA Inter Direct Tax Regular Batch By CA Bhanwar Borana - Click Here

CA Inter Direct Tax Fastrack Batch By CA Bhanwar Borana - Click Here

CA Final Direct Tax Regular Batch By CA Bhanwar Borana - Click Here

CMA Final Direct Tax Regular Batch By CA Bhanwar Borana - Click Here

CA Final Direct Tax Fastrack Batch By CA Bhanwar Borana - Click Here

CA Final DT Old Syllabus Regular Batch By CA Bhanwar Borana - Click Here

CMA Final Direct Tax Fastrack Batch By CA Bhanwar Borana - Click Here

CMA Final Direct Tax Old Syllabus Regular Batch By CA Bhanwar Borana - Click Here

You can visit Smartlearningdestination.com to enroll in Bhanwar Borana’s video Lectures and find out more about its renowned instructors who teach CA, CS, and CMA courses.

What is BB Virtual?

It is a well-known platform for CA Exam preparation. It was founded by CA Bhanwar Borana in 2017. The office address of BB Virtual is “Target Mall, 2nd Floor, Chandavarkar Road, Sundar Nagar, Borivali West, Mumbai, Maharashtra, and Pin-400091.

For more details visit the official website - https://bbvirtuals.com/

Brief Introduction about the Smart Learning Destination Private Limited (SLDINS)

The largest online exam preparation platform in India is Smart Learning Destination Private Limited (SLDINS) and founded in 2021 by Mr. Viraj Sharma. The company's head office is located in Indore City, the heart of Madhya Pradesh State. It offers more than 1500 HD-quality video courses and printed books. Currently, it has professional courses including ACCA, CA, CS, CMA, CFA, and several more.

We give people access to the top faculties in India by streaming their lectures online or sending them on pen drives and Google Drive. Additionally, these lectures are available for viewing as per the faculty's time period and view anytime and anywhere, wherever you are. Additionally, our devoted after-sale service makes it completely free to clarify any uncertainties and answer any inquiries along the way.

Advantages of ordering CA Pen Drive Classes from Smart Learning Destination

> Lowest Price Guaranteed

> Recorded Classes for All Courses

> HD Quality Video Lectures

> Free Delivery for All Courses

> 100% Genuine Products

> Safe and Secure Payment

> Fast Delivery

> Latest Video Lectures & Books

> Best Technical and after-sales support

> Visit Local Store for Study Materials or Any Query

> Recorded Videos Specially Designed for Exam Preparation

0 notes

Text

youtube

Complete Operation Costing Chapter Revision , Very Important and Conceptual CA inter Costing Revision.

For details call +91 9674006144

#CA Inter#CA Intermediate#ca inter pendrive classes#best pen drive classes for ca ipcc#ca inter accounts pendrive classes#CA Intermediate Pendrive Classes#Youtube

0 notes