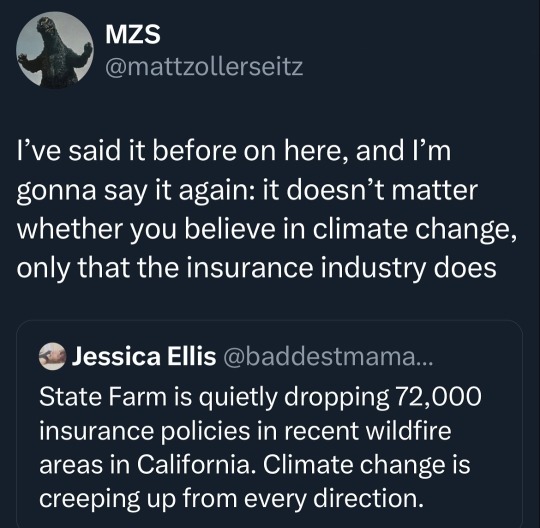

#INSURANCE

Text

Ask Floridians about their homeowners' insurance. The same state that Republicans banned using 'climate change' in government reports.

Climate ignorance is not the other side of a climate debate. Climate ignorance is funded by companies that increase climate destruction.

Insurance companies know the climate crisis is real. People like the Koch Brothers, who fund climate ignorance, know the climate crisis is real. Farmers know climate change is real.

Pretending climate ignorance is a valid opinion is completely moronic.

989 notes

·

View notes

Text

How to shatter the class solidarity of the ruling class

I'm touring my new, nationally bestselling novel The Bezzle! Catch me WEDNESDAY (Apr 11) at UCLA, then Chicago (Apr 17), Torino (Apr 21) Marin County (Apr 27), Winnipeg (May 2), Calgary (May 3), Vancouver (May 4), and beyond!

Audre Lorde counsels us that "The Master's Tools Will Never Dismantle the Master's House," while MLK said "the law cannot make a man love me, but it can restrain him from lynching me." Somewhere between replacing the system and using the system lies a pragmatic – if easily derailed – course.

Lorde is telling us that a rotten system can't be redeemed by using its own chosen reform mechanisms. King's telling us that unless we live, we can't fight – so anything within the system that makes it easier for your comrades to fight on can hasten the end of the system.

Take the problems of journalism. One old model of journalism funding involved wealthy newspaper families profiting handsomely by selling local appliance store owners the right to reach the townspeople who wanted to read sports-scores. These families expressed their patrician love of their town by peeling off some of those profits to pay reporters to sit through municipal council meetings or even travel overseas and get shot at.

In retrospect, this wasn't ever going to be a stable arrangement. It relied on both the inconstant generosity of newspaper barons and the absence of a superior way to show washing-machine ads to people who might want to buy washing machines. Neither of these were good long-term bets. Not only were newspaper barons easily distracted from their sense of patrician duty (especially when their own power was called into question), but there were lots of better ways to connect buyers and sellers lurking in potentia.

All of this was grossly exacerbated by tech monopolies. Tech barons aren't smarter or more evil than newspaper barons, but they have better tools, and so now they take 51 cents out of every ad dollar and 30 cents out of ever subscriber dollar and they refuse to deliver the news to users who explicitly requested it, unless the news company pays them a bribe to "boost" their posts:

https://www.eff.org/deeplinks/2023/04/saving-news-big-tech

The news is important, and people sign up to make, digest, and discuss the news for many non-economic reasons, which means that the news continues to struggle along, despite all the economic impediments and the vulture capitalists and tech monopolists who fight one another for which one will get to take the biggest bite out of the press. We've got outstanding nonprofit news outlets like Propublica, journalist-owned outlets like 404 Media, and crowdfunded reporters like Molly White (and winner-take-all outlets like the New York Times).

But as Hamilton Nolan points out, "that pot of money…is only large enough to produce a small fraction of the journalism that was being produced in past generations":

https://www.hamiltonnolan.com/p/what-will-replace-advertising-revenue

For Nolan, "public funding of journalism is the only way to fix this…If we accept that journalism is not just a business or a form of entertainment but a public good, then funding it with public money makes perfect sense":

https://www.hamiltonnolan.com/p/public-funding-of-journalism-is-the

Having grown up in Canada – under the CBC – and then lived for a quarter of my life in the UK – under the BBC – I am very enthusiastic about Nolan's solution. There are obvious problems with publicly funded journalism, like the politicization of news coverage:

https://www.theguardian.com/media/2023/jan/24/panel-approving-richard-sharp-as-bbc-chair-included-tory-party-donor

And the transformation of the funding into a cheap political football:

https://www.cbc.ca/news/politics/poilievre-defund-cbc-change-law-1.6810434

But the worst version of those problems is still better than the best version of the private-equity-funded model of news production.

But Nolan notes the emergence of a new form of hedge fund news, one that is awfully promising, and also terribly fraught: Hunterbrook Media, an investigative news outlet owned by short-sellers who pay journalists to research and publish damning reports on companies they hold a short position on:

https://hntrbrk.com/

For those of you who are blissfully distant from the machinations of the financial markets, "short selling" is a wager that a company's stock price will go down. A gambler who takes a short position on a company's stock can make a lot of money if the company stumbles or fails altogether (but if the company does well, the short can suffer literally unlimited losses).

Shorts have historically paid analysts to dig into companies and uncover the sins hidden on their balance-sheets, but as Matt Levine points out, journalists work for a fraction of the price of analysts and are at least as good at uncovering dirt as MBAs are:

https://www.bloomberg.com/opinion/articles/2024-04-02/a-hedge-fund-that-s-also-a-newspaper

What's more, shorts who discover dirt on a company still need to convince journalists to publicize their findings and trigger the sell-off that makes their short position pay off. Shorts who own a muckraking journalistic operation can skip this step: they are the journalists.

There's a way in which this is sheer genius. Well-funded shorts who don't care about the news per se can still be motivated into funding freely available, high-quality investigative journalism about corporate malfeasance (notoriously, one of the least attractive forms of journalism for advertisers). They can pay journalists top dollar – even bid against each other for the most talented journalists – and supply them with all the tools they need to ply their trade. A short won't ever try the kind of bullshit the owners of Vice pulled, paying themselves millions while their journalists lose access to Lexisnexis or the PACER database:

https://pluralistic.net/2024/02/24/anti-posse/#when-you-absolutely-positively-dont-give-a-solitary-single-fuck

The shorts whose journalists are best equipped stand to make the most money. What's not to like?

Well, the issue here is whether the ruling class's sense of solidarity is stronger than its greed. The wealthy have historically oscillated between real solidarity (think of the ultrawealthy lobbying to support bipartisan votes for tax cuts and bailouts) and "war of all against all" (as when wealthy colonizers dragged their countries into WWI after the supply of countries to steal ran out).

After all, the reason companies engage in the scams that shorts reveal is that they are profitable. "Behind every great fortune is a great crime," and that's just great. You don't win the game when you get into heaven, you win it when you get into the Forbes Rich List.

Take monopolies: investors like the upside of backing an upstart company that gobbles up some staid industry's margins – Amazon vs publishing, say, or Uber vs taxis. But while there's a lot of upside in that move, there's also a lot of risk: most companies that set out to "disrupt" an industry sink, taking their investors' capital down with them.

Contrast that with monopolies: backing a company that merges with its rivals and buys every small company that might someday grow large is a sure thing. Shriven of "wasteful competition," a company can lower quality, raise prices, capture its regulators, screw its workers and suppliers and laugh all the way to Davos. A big enough company can ignore the complaints of those workers, customers and regulators. They're not just too big to fail. They're not just too big to jail. They're too big to care:

https://pluralistic.net/2024/04/04/teach-me-how-to-shruggie/#kagi

Would-be monopolists are stuck in a high-stakes Prisoner's Dilemma. If they cooperate, they can screw over everyone else and get unimaginably rich. But if one party defects, they can raid the monopolist's margins, short its stock, and snitch to its regulators.

It's true that there's a clear incentive for hedge-fund managers to fund investigative journalism into other hedge-fund managers' portfolio companies. But it would be even more profitable for both of those hedgies to join forces and collude to screw the rest of us over. So long as they mistrust each other, we might see some benefit from that adversarial relationship. But the point of the 0.1% is that there aren't very many of them. The Aspen Institute can rent a hall that will hold an appreciable fraction of that crowd. They buy their private jets and bespoke suits and powdered rhino horn from the same exclusive sellers. Their kids go to the same elite schools. They know each other, and they have every opportunity to get drunk together at a charity ball or a society wedding and cook up a plan to join forces.

This is the problem at the core of "mechanism design" grounded in "rational self-interest." If you try to create a system where people do the right thing because they're selfish assholes, you normalize being a selfish asshole. Eventually, the selfish assholes form a cozy little League of Selfish Assholes and turn on the rest of us.

Appeals to morality don't work on unethical people, but appeals to immorality crowds out ethics. Take the ancient split between "free software" (software that is designed to maximize the freedom of the people who use it) and "open source software" (identical to free software, but promoted as a better way to make robust code through transparency and peer review).

Over the years, open source – an appeal to your own selfish need for better code – triumphed over free software, and its appeal to the ethics of a world of "software freedom." But it turns out that while the difference between "open" and "free" was once mere semantics, it's fully possible to decouple the two. Today, we have lots of "open source": you can see the code that Google, Microsoft, Apple and Facebook uses, and even contribute your labor to it for free. But you can't actually decide how the software you write works, because it all takes a loop through Google, Microsoft, Apple or Facebook's servers, and only those trillion-dollar tech monopolists have the software freedom to determine how those servers work:

https://pluralistic.net/2020/05/04/which-side-are-you-on/#tivoization-and-beyond

That's ruling class solidarity. The Big Tech firms have hidden a myriad of sins beneath their bafflegab and balance-sheets. These (as yet) undiscovered scams constitute a "bezzle," which JK Galbraith defined as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it."

The purpose of Hunterbrook is to discover and destroy bezzles, hastening the moment of realization that the wealth we all feel in a world of seemingly orderly technology is really an illusion. Hunterbrook certainly has its pick of bezzles to choose from, because we are living in a Golden Age of the Bezzle.

Which is why I titled my new novel The Bezzle. It's a tale of high-tech finance scams, starring my two-fisted forensic accountant Marty Hench, and in this volume, Hench is called upon to unwind a predatory prison-tech scam that victimizes the most vulnerable people in America – our army of prisoners – and their families:

https://us.macmillan.com/books/9781250865878/thebezzle

The scheme I fictionalize in The Bezzle is very real. Prison-tech monopolists like Securus and Viapath bribe prison officials to abolish calls, in-person visits, mail and parcels, then they supply prisoners with "free" tablets where they pay hugely inflated rates to receive mail, speak to their families, and access ebooks, distance education and other electronic media:

https://pluralistic.net/2024/04/02/captive-customers/#guillotine-watch

But a group of activists have cornered these high-tech predators, run them to ground and driven them to the brink of extinction, and they've done it using "the master's tools" – with appeals to regulators and the finance sector itself.

Writing for The Appeal, Dana Floberg and Morgan Duckett describe the campaign they waged with Worth Rises to bankrupt the prison-tech sector:

https://theappeal.org/securus-bankruptcy-prison-telecom-industry/

Here's the headline figure: Securus is $1.8 billion in debt, and it has eight months to find a financier or it will go bust. What's more, all the creditors it might reasonably approach have rejected its overtures, and its bonds have been downrated to junk status. It's a dead duck.

Even better is how this happened. Securus's debt problems started with its acquisition, a leveraged buyout by Platinum Equity, who borrowed heavily against the firm and then looted it with bogus "management fees" that meant that the debt continued to grow, despite Securus's $700m in annual revenue from America's prisoners. Platinum was just the last in a long line of PE companies that loaded up Securus with debt and merged it with its competitors, who were also mortgaged to make profits for other private equity funds.

For years, Securus and Platinum were able to service their debt and roll it over when it came due. But after Worth Rises got NYC to pass a law making jail calls free, creditors started to back away from Securus. It's one thing for Securus to charge $18 for a local call from a prison when it's splitting the money with the city jail system. But when that $18 needs to be paid by the city, they're going to demand much lower prices. To make things worse for Securus, prison reformers got similar laws passed in San Francisco and in Connecticut.

Securus tried to outrun its problems by gobbling up one of its major rivals, Icsolutions, but Worth Rises and its coalition convinced regulators at the FCC to block the merger. Securus abandoned the deal:

https://worthrises.org/blogpost/securusmerger

Then, Worth Rises targeted Platinum Equity, going after the pension funds and other investors whose capital Platinum used to keep Securus going. The massive negative press campaign led to eight-figure disinvestments:

https://www.latimes.com/business/story/2019-09-05/la-fi-tom-gores-securus-prison-phone-mass-incarceration

Now, Securus's debt became "distressed," trading at $0.47 on the dollar. A brief, covid-fueled reprieve gave Securus a temporary lifeline, as prisoners' families were barred from in-person visits and had to pay Securus's rates to talk to their incarcerated loved ones. But after lockdown, Securus's troubles picked up right where they left off.

They targeted Platinum's founder, Tom Gores, who papered over his bloody fortune by styling himself as a philanthropist and sports-team owner. After a campaign by Worth Rises and Color of Change, Gores was kicked off the Los Angeles County Museum of Art board. When Gores tried to flip Securus to a SPAC – the same scam Trump pulled with Truth Social – the negative publicity about Securus's unsound morals and financials killed the deal:

https://twitter.com/WorthRises/status/1578034977828384769

Meanwhile, more states and cities are making prisoners' communications free, further worsening Securus's finances:

https://pluralistic.net/2024/02/14/minnesota-nice/#shitty-technology-adoption-curve

Congress passed the Martha Wright-Reed Just and Reasonable Communications Act, giving the FCC the power to regulate the price of federal prisoners' communications. Securus's debt prices tumbled further:

https://www.govtrack.us/congress/bills/117/s1541

Securus's debts were coming due: it owes $1.3b in 2024, and hundreds of millions more in 2025. Platinum has promised a $400m cash infusion, but that didn't sway S&P Global, a bond-rating agency that re-rated Securus's bonds as "CCC" (compare with "AAA"). Moody's concurred. Now, Securus is stuck selling junk-bonds:

https://www.govtrack.us/congress/bills/117/s1541

The company's creditors have given Securus an eight-month runway to find a new lender before they force it into bankruptcy. The company's debt is trading at $0.08 on the dollar.

Securus's major competitor is Viapath (prison tech is a duopoly). Viapath is also debt-burdened and desperate, thanks to a parallel campaign by Worth Rises, and has tried all of Securus's tricks, and failed:

https://pestakeholder.org/news/american-securities-fails-to-sell-prison-telecom-company-viapath/

Viapath's debts are due next year, and if Securus tanks, no one in their right mind will give Viapath a dime. They're the walking dead.

Worth Rise's brilliant guerrilla warfare against prison-tech and its private equity backers are a master class in using the master's tools to dismantle the master's house. The finance sector isn't a friend of justice or working people, but sometimes it can be used tactically against financialization itself. To paraphrase MLK, "finance can't make a corporation love you, but it can stop a corporation from destroying you."

Yes, the ruling class finds solidarity at the most unexpected moments, and yes, it's easy for appeals to greed to institutionalize greediness. But whether it's funding unbezzling journalism through short selling, or freeing prisons by brandishing their cooked balance-sheets in the faces of bond-rating agencies, there's a lot of good we can do on the way to dismantling the system.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/08/money-talks/#bullshit-walks

Image:

KMJ (modified)

https://commons.wikimedia.org/wiki/File:Boerse_01_KMJ.jpg

CC BY-SA 3.0

https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#shorts#short sellers#news#private equity#private prisons#securus#prison profiteers#the bezzle#anything that cant go on forever eventually stop#steins law#hamilton nolan#Platinum Equity#American Securities#viapath#global tellink#debt#jpay#worth rises#insurance#spacs#fcc#bond rating#moodys#the appeal#saving the news from big tech#hunterbrook media#journalism

769 notes

·

View notes

Text

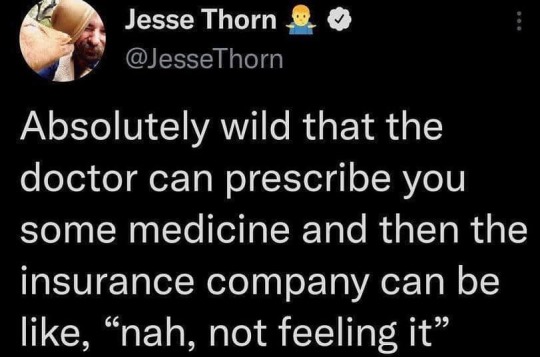

#funny#funny memes#dank memes#memes#humor#relatable#relatable memes#twitter#twitter memes#beyoncescock#healthcare#insurance

5K notes

·

View notes

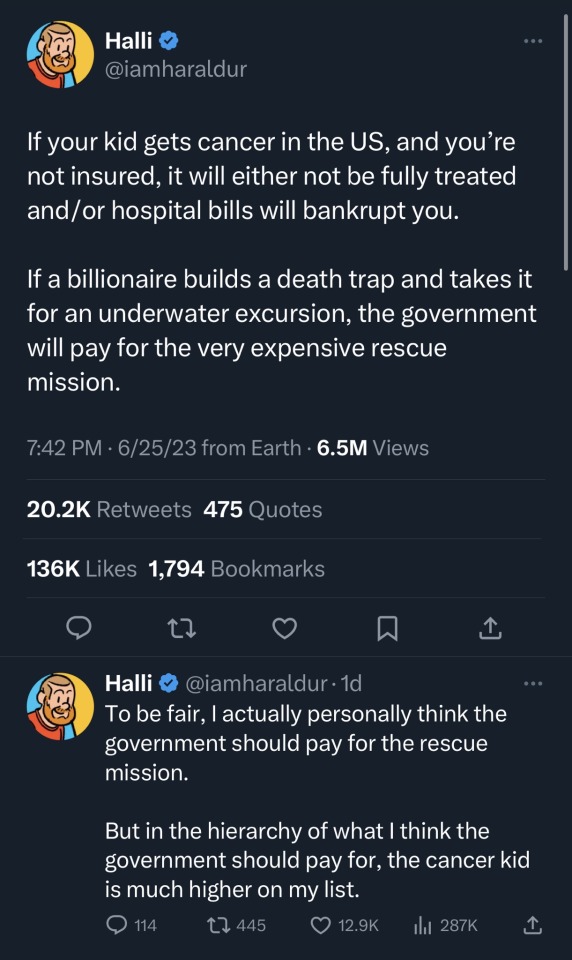

Text

1K notes

·

View notes

Text

2K notes

·

View notes

Text

Who the FUCK decided that insurance companies get to decide what’s medically necessary????????

#medically necessary#chronic pain#disabled#disability#actually disabled#chronic illness#physical disability#hypermobility#probably heds#probably Ehlers danlos syndrome#insurance#fuck insurance companies#i’m in so much pain#like walking is hard#braces#knee braces#just let me have my custom braces I’ve tried everything else

2K notes

·

View notes

Text

English added by me :)

768 notes

·

View notes

Text

#Three Things You Can Learn From This Here Old Log#tips#tricks#life hacks#helpful hints#advice#knowledge#tree#trees#log#logs#insurance#unreality

100 notes

·

View notes

Text

Check your policy if you have one 🤔

#pay attention#educate yourselves#educate yourself#knowledge is power#reeducate yourself#reeducate yourselves#think about it#think for yourselves#think for yourself#do your homework#do some research#do your own research#ask yourself questions#question everything#insurance#life insurance#news#we are the news

174 notes

·

View notes

Text

War, declared or undeclared, riot or insurrection.

136 notes

·

View notes

Text

“Shouldn’t my insurance pay for it if you ordered it?”- patient exasperated about the cost of a necessary but uncovered test. Welcome to America, where insurers without medical training determine what service is medically necessary.

124 notes

·

View notes

Text

Insurance companies are making climate risk worse

Tomorrow (November 29), I'm at NYC's Strand Books with my novel The Lost Cause, a solarpunk tale of hope and danger that Rebecca Solnit called "completely delightful."

Conservatives may deride the "reality-based community" as a drag on progress and commercial expansion, but even the most noxious pump-and-dump capitalism is supposed to remain tethered to reality by two unbreakable fetters: auditing and insurance:

https://en.wikipedia.org/wiki/Reality-based_community

No matter how much you value profit over ethics or human thriving, you still need honest books – even if you never show those books to the taxman or the marks. Even an outright scammer needs to know what's coming in and what's going out so they don't get caught in a liquidity trap (that is, "broke"), or overleveraged ("broke," again) exposed to market changes (you guessed it: "broke").

Unfortunately for capitalism, auditing is on its deathbed. The market is sewn up by the wildly corrupt and conflicted Big Four accounting firms that are the very definition of too big to fail/too big to jail. They keep cooking books on behalf of management to the detriment of investors. These double-entry fabrications conceal rot in giant, structurally important firms until they implode spectacularly and suddenly, leaving workers, suppliers, customers and investors in a state of utter higgeldy-piggeldy:

https://pluralistic.net/2022/11/29/great-andersens-ghost/#mene-mene-bezzle

In helping corporations defraud institutional investors, auditors are facilitating mass scale millionaire-on-billionaire violence, and while that may seem like the kind of fight where you're happy to see either party lose, there are inevitably a lot of noncombatants in the blast radius. Since the Enron collapse, the entire accounting sector has turned to quicksand, which is a big deal, given that it's what industrial capitalism's foundations are anchored to. There's a reason my last novel was a thriller about forensic accounting and Big Tech:

https://us.macmillan.com/books/9781250865847/red-team-blues

But accounting isn't the only bedrock that's been reduced to slurry here in capitalism's end-times. The insurance sector is meant to be an unshakably rational enterprise, imposing discipline on the rest of the economy. Sure, your company can do something stupid and reckless, but the insurance bill will be stonking, sufficient to consume the expected additional profits.

But the crash of 2008 made it clear that the largest insurance companies in the world were capable of the same wishful thinking, motivated reasoning, and short-termism that they were supposed to prevent in every other business. Without AIG – one of the largest insurers in the world – there would have been no Great Financial Crisis. The company knowingly underwrote hundreds of billions of dollars in junk bonds dressed up as AAA debt, and required a $180b bailout.

Still, many of us have nursed an ember of hope that the insurance sector would spur Big Finance and its pocket governments into taking the climate emergency seriously. When rising seas and wildfires and zoonotic plagues and famines and rolling refugee crises make cities, businesses, and homes uninsurable risks, then insurers will stop writing policies and the doom will become undeniable. Money talks, bullshit walks.

But while insurers have begun to withdraw from the most climate-endangered places (or crank up premiums), the net effect is to decrease climate resilience and increase risk, creating a "climate risk doom loop" that Advait Arun lays out brilliantly for Phenomenal World:

https://www.phenomenalworld.org/analysis/the-doom-loop/

Part of the problem is political: as people move into high-risk areas (flood-prone coastal cities, fire-threatened urban-wildlife interfaces), politicians are pulling out all the stops to keep insurers from disinvesting in these high-risk zones. They're loosening insurance regs, subsidizing policies, and imposing "disaster risk fees" on everyone in the region.

But the insurance companies themselves are simply not responding aggressively enough to the rising risk. Climate risk is correlated, after all: when everyone in a region is at flood risk, then everyone will be making a claim on the insurance company when the waters come. The insurance trick of spreading risk only works if the risks to everyone in that spread aren't correlated.

Perversely, insurance companies are heavily invested in fossil fuel companies, these being reliable money-spinners where an insurer can park and grow your premiums, on the assumption that most of the people in the risk pool won't file claims at the same time. But those same fossil-fuel assets produce the very correlated risk that could bring down the whole system.

The system is in trouble. US claims from "natural disasters" are topping $100b/year – up from $4.6b in 2000. Home insurance premiums are up (21%!), but it's not enough, especially in drowning Florida and Texas (which is also both roasting and freezing):

https://grist.org/economics/as-climate-risks-mount-the-insurance-safety-net-is-collapsing/

Insurers who put premiums up to cover this new risk run into a paradox: the higher premiums get, the more risk-tolerant customers get. When flood insurance is cheap, lots of homeowners will stump up for it and create a big, uncorrelated risk-pool. When premiums skyrocket, the only people who buy flood policies are homeowners who are dead certain their house is gonna get flooded out and soon. Now you have a risk pool consisting solely of highly correlated, high risk homes. The technical term for this in the insurance trade is: "bad."

But it gets worse: people who decide not to buy policies as prices go up may be doing their own "motivated reasoning" and "mispricing their risk." That is, they may decide, "If I can't afford to move, and I can't afford to sell my house because it's in a flood-zone, and I can't afford insurance, I guess that means I'm going to live here and be uninsured and hope for the best."

This is also bad. The amount of uninsured losses from US climate disaster "dwarfs" insured losses:

https://www.reuters.com/business/environment/hurricanes-floods-bring-120-billion-insurance-losses-2022-2023-01-09/

Here's the doom-loop in a nutshell:

As carbon emissions continue to accumulate, more people are put at risk of climate disaster, while the damages from those disasters intensifies. Vulnerability will drive disinvestment, which in turn exacerbates vulnerability.

Also: the browner and poorer you are, the worse you have it: you are impacted "first and worst":

https://www.climaterealityproject.org/frontline-fenceline-communities

As Arun writes, "Tinkering with insurance markets will not solve their real issues—we must patch the gaping holes in the financial system itself." We have to end the loop that sees the poorest places least insured, and the loss of insurance leading to abandonment by people with money and agency, which zeroes out the budget for climate remediation and resiliency where it is most needed.

The insurance sector is part of the finance industry, and it is disinvesting in climate-endagered places and instead doubling down on its bets on fossil fuels. We can't rely on the insurance sector to discipline other industries by generating "price signals" about the true underlying climate risk. And insurance doesn't just invest in fossil fuels – they're also a major buyer of municipal and state bonds, which means they're part of the "bond vigilante" investors whose decisions constrain the ability of cities to raise and spend money for climate remediation.

When American cities, territories and regions can't float bonds, they historically get taken over and handed to an unelected "control board" who represents distant creditors, not citizens. This is especially true when the people who live in those places are Black or brown – think Puerto Rico or Detroit or Flint. These control board administrators make creditors whole by tearing the people apart.

This is the real doom loop: insurers pull out of poor places threatened by climate disasters. They invest in the fossil fuels that worsen those disasters. They join with bond vigilantes to force disinvestment from infrastructure maintenance and resiliency in those places. Then, the next climate disaster creates more uninsured losses. Lather, rinse, repeat.

Finance and insurance are betting heavily on climate risk modeling – not to avert this crisis, but to ensure that their finances remain intact though it. What's more, it won't work. As climate effects get bigger, they get less predictable – and harder to avoid. The point of insurance is spreading risk, not reducing it. We shouldn't and can't rely on insurance creating price-signals to reduce our climate risk.

But the climate doom-loop can be put in reverse – not by market spending, but by public spending. As Arun writes, we need to create "a global investment architecture that is safe for spending":

https://tanjasail.wordpress.com/2023/10/06/a-world-safe-for-spending/

Public investment in emissions reduction and resiliency can offset climate risk, by reducing future global warming and by making places better prepared to endure the weather and other events that are locked in by past emissions. A just transition will "loosen liquidity constraints on investment in communities made vulnerable by the financial system."

Austerity is a bad investment strategy. Failure to maintain and improve infrastructure doesn't just shift costs into the future, it increases those costs far in excess of any rational discount based on the time value of money. Public institutions should discipline markets, not the other way around. Don't give Wall Street a veto over our climate spending. A National Investment Authority could subordinate markets to human thriving:

https://democracyjournal.org/arguments/industrial-policy-requires-public-not-just-private-equity/

Insurance need not be pitted against human survival. Saving the cities and regions whose bonds are held by insurance companies is good for those companies: "Breaking the climate risk doom loop is the best disaster insurance policy money can buy."

I found Arun's work to be especially bracing because of the book I'm touring now, The Lost Cause, a solarpunk novel set in a world in which vast public investment is being made to address the climate emergency that is everywhere and all at once:

https://us.macmillan.com/books/9781250865939/the-lost-cause

There is something profoundly hopeful about the belief that we can do something about these foreseeable disasters – rather than remaining frozen in place until the disaster is upon us and it's too late. As Rebecca Solnit says, inhabiting this place in your imagination is "Completely delightful. Neither utopian nor dystopian, it portrays life in SoCal in a future woven from our successes (Green New Deal!), failures (climate chaos anyway), and unresolved conflicts (old MAGA dudes). I loved it."

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/28/re-re-reinsurance/#useless-price-signals

#pluralistic#doom loop#insurance#insuretech#climate#climate risk#climate emergency#the lost cause#market forces#risk management#price signals#control boards#decarbonization#bond vigilantes#climate resilience

262 notes

·

View notes

Text

67 notes

·

View notes

Text

Cindy Picos was dropped by her home insurer last month. The reason: aerial photos of her roof, which her insurer refused to let her see.

“I thought they had the wrong house,” said Picos, who lives in northern California. “Our roof is in fine shape.”

Her insurer said its images showed her roof had “lived its life expectancy.” Picos paid for an independent inspection that found the roof had another 10 years of life. Her insurer declined to reconsider its decision.

Across the U.S., insurance companies are using aerial images of homes as a tool to ditch properties seen as higher risk.

Nearly every building in the country is being photographed, often without the owner’s knowledge. Companies are deploying drones, manned airplanes and high-altitude balloons to take images of properties. No place is shielded: The industry-funded Geospatial Insurance Consortium has an airplane imagery program it says covers 99% of the U.S. population.

The array of photos is being sorted by computer models to spy out underwriting no-nos, such as damaged roof shingles, yard debris, overhanging tree branches and undeclared swimming pools or trampolines. The red-flagged images are providing insurers with ammunition for nonrenewal notices nationwide.

���We’ve seen a dramatic increase across the country in reports from consumers who’ve been dropped by their insurers on the basis of an aerial image,” said Amy Bach, executive director of consumer group United Policyholders.

The increasingly sophisticated use of flyby photos comes as home insurers nationwide scramble to “derisk” their property portfolios, dropping less-than-perfect homes in an effort to recover from big underwriting losses.

(continue reading)

54 notes

·

View notes

Text

I had a meeting with the national insurance company about my disability money.

AND I GOT “SHE/HER”ED

she had my ID and I was boy-moding and her instincts were still to use “she/her”

#:3#196#egg irl#traaa#rule#:3 hehe#r/196#traaaaaaannnnnnnnnns#transgender#transgirl#transfemme#transfem#insurance#legally disabled#disability#disabled#mentally disabled

76 notes

·

View notes

Text

When you’re burnt out from working 80 hours a week and on the edge of losing your damn mind from sleep deprivation but then someone gives you a small snack or you have time to sit down and drink a cup of water:

Today I had the chance to drink a whole cup of water between OR cases and I almost cried of happiness. When the highlight of your day is that you had the chance to pee once, something is wrong.

Residents like me work 80 hours a week (sometimes more) for what calculates out to be less than minimum wage because this is how residencies are structured and because we are the last line between patients and unsafe care. You didn’t hire enough nurses? Have the resident remove/place foleys and NG tubes. You didn’t hire enough transport staff? Have the resident transport patients. I can’t in good conscience let my patients have less than the standard of care, but it becomes unsustainable when you don’t have enough staff. To top this all off, my hospital CEO got a raise of millions of dollars this year, but my raise to next year doesn’t even keep up with inflation. People justify this treatment of residents by saying that oh well we will be rich when we’re attendings, as if having a higher salary in the future justifies this kind of exploitation. I know residents right now who are struggling to afford healthcare for their children, who struggle to find affordable housing within the area we are required to live because of home call. There is simply no justification for the amount of work we do compared with our pay (or the hours we work period).

Maybe this is just a long way of saying please be kind to residents in the hospital. We work really hard within a really broken system and care a lot about our patients.

#medical school#residency#medstudent#medschool#medicine#medicalstudent#medical student#healthcare#resident doctors#physician#covid 19#covid19#doctor#surgery#burnout#insurance#health insurance

297 notes

·

View notes