#MMT

Text

#you just had to be there#mmt I will start sobbing and crying#the vibes this movie have euuughgghhdhdhdhh I love the Beatles#the Beatles#magical mystery tour#mmt#george harrison#paul mccartney#john lennon#ringo starr

740 notes

·

View notes

Text

sgt pepper, rooftop concert, and wizard george harrisons

#george harrison#the beatles fanart#the beatles#sgt pepper#sgt peppers lonely hearts club band#get back#rooftop concert#mmt

202 notes

·

View notes

Text

THE BEATLES in the YOUR MOTHER SHOULD KNOW music video, 1967

#someone stop him <3#the beatles#mine#paul mccartney#ringo starr#john lennon#george harrison#magical mystery tour#mmt#beatles

916 notes

·

View notes

Text

Social Security is class war, not intergenerational conflict

Today, Tor.com published my latest short story, "The Canadian Miracle," set in the world of my forthcoming (Nov 14) novel, The Lost Cause. I am serializing this one on my podcast! Here's part one.

The very instant the Social Security Act was passed in 1935, American conservatives (in both parties) began lobbying to destroy it. After all, a reserve army of forelock-tugging plebs and family retainers won't voluntarily assemble themselves – they need to be goaded into it by the threat of slowly starving to death in their dotage.

They're at it again (again). The oligarch-thinktank industrial complex has unleashed a torrent of scare stories about Social Security's imminent insolvency, rehearsing the same shopworn doom predictions that they've been repeating since the Nixonite billionaire cabinet member Peter G Peterson created a "foundation" to peddle his disinformation in 2008:

https://en.wikipedia.org/wiki/I.O.U.S.A.

Peterson's go-to tactic is convincing young people that all the Social Security money they're paying into the system will be gobbled up by already-wealthy old people, leaving nothing behind for them. Conservatives have been peddling this ditty since the 1930s, and they're still at it – in the pages of the New York Times, no less:

https://www.nytimes.com/2023/10/26/opinion/social-security-medicare-aging.html

The Times has become a veritable mouthpiece for this nonsense, publishing misleading and nonsensical charts and data to support the idea that millennials are losing a generational war to boomers, who will leave the cupboard bare:

https://www.nytimes.com/2023/10/27/opinion/aging-medicare-social-security.html

As Robert Kuttner writes for The American Prospect, this latest rhetorical assault on Social Security is timed to coincide with the ascension of the GOP House's new Speaker, Mike Johnson, who makes no secret of his intention to destroy Social Security:

https://prospect.org/economy/2023-10-31-debunking-latest-attack-social-security/

The GOP says it wants to destroy Social Security for two reasons: first, to promote "choice" by letting us provide for our own retirement by flushing even more of our savings into the rigged casino that is the stock market; and second, because America doesn't have enough dollars to feed and house the elderly.

But for the New York Times' audience, they've figured out how to launder this far-right nonsense through the language of social justice. Rather than condemning the impecunious olds for their moral failing to lay the correct bets in the stock market, Social Security's opponents paint the elderly as a gerontocratic elite, flush with cash that rightfully belongs to the young.

To support this conclusion, they throw around statistics about how house-rich the Boomers are, and how much consumption they can afford. But as Kuttner points out, the Boomers' real-estate wealth comes not from aggressive house-flipping, but from merely owning a place to live. America's housing bubble means that younger people can't afford this basic human necessity, but the answer to that isn't making old people homeless – it's providing a lot more housing, and banning housing speculation:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

It's true that older people are doing a lot of consumption spending – but the bulk of that spending isn't on cruises to Alaska to see the melting glaciers, it's on health care. Old people aren't luxuriating in their joint replacements and coronary bypasses. Calling this "consumption" is deliberately misleading.

But as Kuttner points out, there's another, more important point to be made about inequality in America – the most significant wealth gap in America is between workers and owners, not young people and old people. The "average" Boomer's net worth factors in the wealth of Warren Buffett and Donald Trump. Older renters are more rent-burdened and precarious than younger renters, and most older Americans have little to no retirement savings:

https://www.forbes.com/sites/teresaghilarducci/2023/10/28/the-new-york-times-greedy-geezer-myth/

Less than one percent of Social Security benefits go to millionaires – that's because the one percent constitute one percent of the population. It's right there in the name. The one percent are politically and economically important, but that's because they are low in numbers. Giving Social Security benefits to everyone over 65 will not result in a significant outlay to the ultra-wealthy, because there aren't many ultra-wealthy people in America. The problem of inequality isn't the expanding pool of rich people, it's the explosion of wealth for a contracting pool of rich people.

If conservatives were serious about limiting the grip of these "undeserving" Social Security recipients on our economy and its politics, they'd advocate for interitance taxes (which effectively don't exist in America), not the abolition of Social Security. The problem of wealth in America is that it is establishing permanent dynasties which are incompatible with social mobility. In other words, we have created a new hereditary aristocracy – and its corollary, a new hereditary peasantry:

https://pluralistic.net/2021/06/19/dynastic-wealth/#caste

Hereditary aristocracies are poisonous for lots of reasons, but one of the most pressing problems they present is political destabilization. American belief in democracy, the rule of law, and a national identity is q function of Americans' perception of fairness. If you think that your kids can't ever have a better life than you, if you think that the cops will lock you up for a crime for which a rich person would escape justice, then why obey the law? Why vote? Why not cheat and steal? Why not burn it all down?

The wealthy put a lot of energy into distracting us from this question. Just lately, they've cooked up a gigantic panic over a nonexistent wave of retail theft:

https://www.techdirt.com/2023/10/31/the-retail-theft-surge-that-isnt-report-says-crime-is-being-exaggerated-to-cover-up-other-retail-issues/

Meanwhile, the very real, non-imaginary, accelerating, multi-billion-dollar plague of wage theft is conspicuously missing from the public discourse, despite a total that dwarfs all retail theft in America by an order of magnitude:

https://fair.org/home/wage-theft-is-built-into-the-business-models-of-many-industries/

America does have a property crime crisis, but it's a crisis of wage-theft, not shoplifting. Likewise, America does have a retirement crisis: it's a crisis of inequality, not intergenerational conflict.

Social Security has been under sustained assault since its inception, and that's in large part due to a massive blunder on the part of FDR. Roosevelt believed that people would be more protective of Social Security if they thought it was funded by their taxes: "we bought it, it's ours." But – as FDR well knew – that's not how government spending works.

The US government can't run out of US dollars. The US government doesn't get its dollars for spending from your taxes. The US government spends money into existence and taxes it out of existence:

https://pluralistic.net/2020/12/14/situation-normal/#mmt

A moment's thought will reveal that it has to be this way. The US government (and its fiscal agents, chartered banks) are the only source of dollars. How can the US tax dollars away from earners unless it has first spent those dollars into the economy?

The point of taxation isn't to fund programs, it's to reduce the private sector's spending power so that there are things for sale to the public sector. If we only spent money into the economy but didn't take any out of the economy, the private sector would have so many dollars to spend that any time the government tried to buy something, there'd be a bidding war that would result in massive price spikes.

When a government runs a "balanced budget," that means that it has taxed as much out of the economy as it put into the economy at the start of the year. When a government runs a "surplus," that means it's left less money in the economy at the end of the year than there was at the beginning of the year. This is fine if the economy has contracted overall, but if the economy stayed constant or grew, that means there are fewer dollars chasing more goods and services, which leads to deflation and all kinds of toxic outcomes, like borrowing more bank-created money, which makes the finance sector richer and the real economy poorer.

Of course, most governments run "deficits" – which is another way of saying that they leave more dollars in the economy at the end of the year than there was at the start of the year, or, put another way, a deficit probably means that your economy got bigger, so it needed more dollars.

None of this means that governments can spend without limit. But it does mean that governments can buy anything that's for sale in their own currency. There are a lot of goods for sale in US dollars, both goods that are produced domestically and goods from abroad (this is why it's such a big deal that most of the world's oil is priced in dollars).

Governments do have to worry about getting into bidding wars with the private sector. To do that, governments come up with ways of reducing the private sector's spending power. One way to do that is taxes – just taking money away from us at the end of the year and annihilating it. Another way is to ration goods – think of WWII, or the direct economic interventions during the covid lockdowns. A third way is to sell bonds, which is just a roundabout way of getting us to promise not to spend some of our dollars for a while, in return for a smaller number of dollars in interest payments:

https://pluralistic.net/2021/04/08/howard-dino/#payfors

FDR knew all of this, but he still told the American people that their taxes were funding Social Security, thinking that this would protect the program. This backfired terribly. Today, Democrats have embraced the myth that taxes fund spending and join with their Republican counterparts in insisting that all spending must be accompanied by either taxes or cuts (AKA "payfors").

These Democrats voluntarily put their own policymaking powers in chains, refusing to take any action on behalf of the American people unless they can sell a tax increase or a budget cut. They insist that we can't have nice things until we make billionaires poor – which is the same as saying that we can't have nice things, period.

There are damned good reasons to make billionaires poor. The legitimacy of the American system is incompatible with the perception that wealth and power are fixed by birth, and that the rich and powerful don't have to play by the rules.

The capture of America's institutions – legislatures, courts, regulators – by the rich and powerful is a ghastly situation, and to reverse it, we'll need all the help we can get. Every hour that Americans spend worrying about their how they'll pay their rent, their medical bills, or their student loans is an hour lost to the fight against oligarchy and corruption.

In other words, it's not true that we can't have nice things until we get rid of billionaires – rather, we can't get rid of billionaires until we have nice things.

This is the premise of my next novel, The Lost Cause, which comes out on November 14; it's set in a world where care and solidarity have unleashed millions of people on the project of maintaining the habitability of our planet amidst the polycrisis:

https://us.macmillan.com/books/9781250865939/the-lost-cause

It's a fundamentally hopeful book, and it's already won praise from Naomi Klein, Rebecca Solnit, Bill McKibben and Kim Stanley Robinson. I wrote it while thinking through and researching these issues. Conservatives want us to think that we can't do better than this, that – to quote Margaret Thatcher – "there is no alternative." Replacing that narrative is critical to the kinds of mass mobilizations that our very survival depends on.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/intergenerational-warfare/#five-pound-blocks-of-cheese

This Saturday (Nov 4), I'm keynoting the Hackaday Supercon in Pasadena, CA.

#pluralistic#class war#inheritance tax#death tax#mmt#modern monetary theory#intergenerational war#intergenerational wealth transfers#social security#ss

351 notes

·

View notes

Note

Any thoughts/opinions on the idea of Universal Basic Income?

So I come out of MMT-adjacent circles that tend to focus on Job Guarantees over Universal Basic Income(s).

There is a certain amount of rivalry and bad blood between these two camps, as they see their projects as competing for the same policy "space" as solutions to poverty and unemployment. For example, back when I was on twitter I got into quite a few arguments with Matt Bruenig, who is a UBI advocate and quite hostile to Job Guarantees, and I was not the only MMTer/job guarantee advocate who mixed it up with Bruening and his supporters.

For my own part, I am not opposed to incomes policies in general. Certainly, I think we saw from COVID-era initiatives around Unemployment Insurance and the Child Tax Credit that incomes policies can be tremendously effective in stabilizing consumer demand, preventing eviction and homelessness, and especially in cutting poverty rates. Likewise, I think there is now pretty solid empirical evidence that the concerns about employment effects that were the bane of UBIs and Negative Income Tax (NIT) proposals from the 1970s onwards are baseless.

That being said, I think there are other critiques of UBI from the left that were raised by Hyman Minsky in the late 1960s and 1970s that (instead of focusing on employment effects and the ideological question of "dependency") center on the fiscal capacity of the state, the problem of inflation, and the inability of UBIs to solve the problem of lost labor-time, which remain open questions.

This is why I am skeptical of the more Georgist approach to UBI as panacea. To my mind, incomes policies are a partial solution to some socioeconomic problems that have some side effects; they need to be buttressed by complementary policies (including job guarantees) that can do things UBIs can't, while also dealing with UBI's side effects. In some sense, it shouldn't be very surprising that a belt-and-braces strategy is best, because that was the intended vision for a comprehensive New Deal order proposed by the National Resources Planning Board in 1942.

#public policy#economic policy#social policy#universal basic income#negative income tax#job guarantee#job guarantees#my day job#mmt#political economy#ubi#people must live by work#policy history

80 notes

·

View notes

Photo

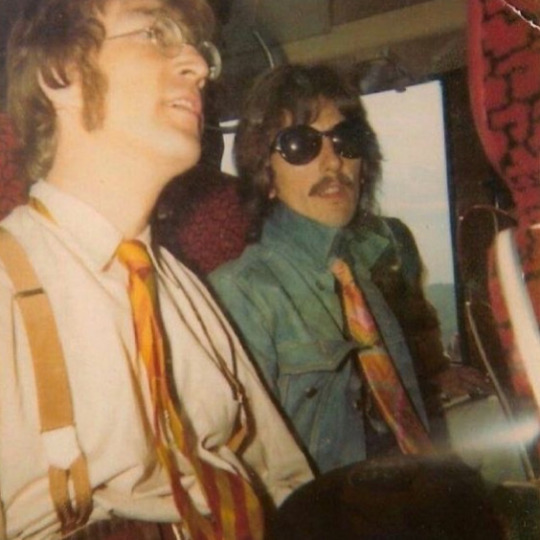

George Harrison and John Lennon filming Magical Mystery Tour, 11th September 1967.

224 notes

·

View notes

Text

John Lennon on his way to the recording of “All You Need is Love” at Abbey Road, 26 June 1967 (x)

271 notes

·

View notes

Text

Just a little thing, i thought it'd be funny :)

#sans#sans au#undertale#art#killer sans#dust sans#killertale#dusttale#murder sans#murder time trio#mmt#horror sans#dragon#horrortale#bad sanses

37 notes

·

View notes

Text

hare krishna

#george harrison#xartx#the beatles#mmt#magical mystery tour#art#fanart#beatles fanart#painting#my art

195 notes

·

View notes

Text

Album - ATEEZ Volume 1: "Treasure Ep. Fin: All to Action"

Anniversary Edition Yunho Album Photocards/Purchase Benefits

- Album Adult Ver. 》 MyMusicTaste Postcard

- Japan Preorder Postcard 》 Album Child Ver.

scanned by me. please give credit to brigidandair or Jasmyr if you use them!

#ateez#에이티즈#yunho#jeong yunho#kpop collection#photocard collection#photocard#ateez photocard#정윤호#윤호#treasure era#treasure ep fin: all to action#ateez anniversary#에이티즈 윤호#my scans#my sunshine#yo ho ults#mymusictaste#mmt photocard#mmt

15 notes

·

View notes

Text

roll up 4 tha mystery tour !

#the beatles#the beatles fanart#paul mccartney#paul mccartney fanart#mmt#magical mystery tour#beatles art#beatles#dont look too closely#please

201 notes

·

View notes

Text

More pride month art! MTT

#sans#sans aus#sans au#undertale au#ibispaint art#dust sans#murder sans#horror sans#killer sans#non binary#non binary pride#pansexaul#gay pride#bisexaul#bisexual pride#polyamourous#poly pride#demisexual#asexual#mmt#murder time trio

36 notes

·

View notes

Note

I know the other people you mentioned, but who is Kelton?

Stephanie Kelton is a professor, economist, and one of the chief proponents of Modern Monetary Theory. In her book The Deficit Myth, she argues that the primary method of thinking about deficits at the macro-level is wrong. This theory has become very popular among progressive policy makers and forms a significant underpinning of their economic policy proposals, such as the Federal Job Guarantee, while the theory is considered to be fringe nonsense by economists, more of an article of faith that proscribes its adherents to positions of privileged policy advisors rather than a concrete theory that can be modeled. Per the Banque of France: "Overall, it appears that MMT is based on an outdated approach to economics and that the meaning of MMT is a more that of a political manifesto than of a genuine economic theory."

MMT has been rather notorious for its refusal to create testable models, a neglect in monetary policy over fiscal policy, and an insistence on always being right, which is intellectually exhilarating among its proponents for its conspiracy-minded claims, but frustrating for the scientifically-minded who prefer data and hard evidence. One of the chief shortcomings among the MMT crowd is that fiscal policy crowds out monetary policy, largely due to the relatively constant inflationary rates for decades previous to the point where those not knowledgeable in economic history forget about it.

Fortunately, Kelton has exposed her lack of knowledge on macroeconomics and monetary policy when it comes to the 2020's inflation spiral. Kelton famously predicted back in 8 April 2021 (so before the Russian war in Ukraine placed inflationary pressures on food and fuel), stated that "Have you considered the possibility that raising rates might move inflation higher?" This was useful, because it was something that was empirical, something that could be tested and measured. Again in a stroke of good fortune, we did receive data - Erdogan had pursued Fisherist policies that were in line with what Kelton was predicting. If she was right, then we would have seen inflation in Turkey drop in response to Erdogan's policies. The opposite happened - inflation skyrocketed in comparison to other regional markets; Turkey's inflation rate was well in excess of other economies, peaking over 80% in 2022. So Kelton was completely wrong in this regard. While one bad prediction shouldn't invalidate everything, the consistently poor performance of MMT in an ideal world would leave this theory relegated to the dustbin.

It didn't happen, of course, but I never expected it to. The scientific method is anathema to public policy discourse.

Thanks for the question, Anon.

SomethingLikeALawyer, Hand of the King

8 notes

·

View notes

Text

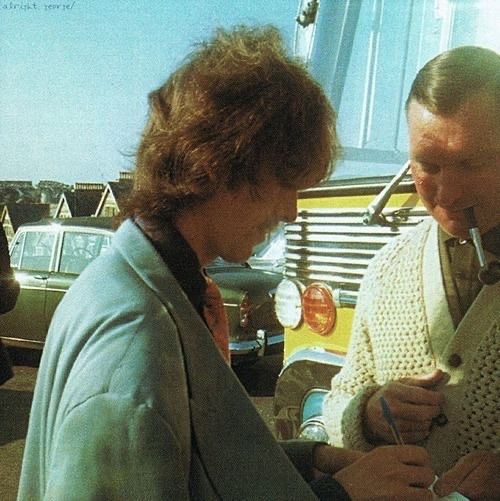

JOHN LENNON and PAUL MCCARTNEY in MAGICAL MYSTERY TOUR

#*in the aaaarms of the angel*#the beatles#mine#john lennon#paul mccartney#magical mystery tour#mmt#jp#mclennon

702 notes

·

View notes

Note

Is there really any difference between the government spending money into circulation rather than lending to private banks?

How would the former allow the government to capture seigniorage rents?

Well, MMT would argue they are essentially the same thing, except that in the latter the government is outsourcing the spending decision-making to the finance sector. They do differ in that lending provides additional liquidity to banks and other financial institutions, and gives the government some income from interest.

As to how "the former allow the government to capture seigniorage rents," essentially the government makes money from the difference between the cost of producing the money and the value of the money. Moreover, when the government spends money into circulation as opposed to lending it into circulation, it also gets the stuff it's spending the money on (and usually at a discount), whether that's goods or services (or labor in general).

17 notes

·

View notes

Photo

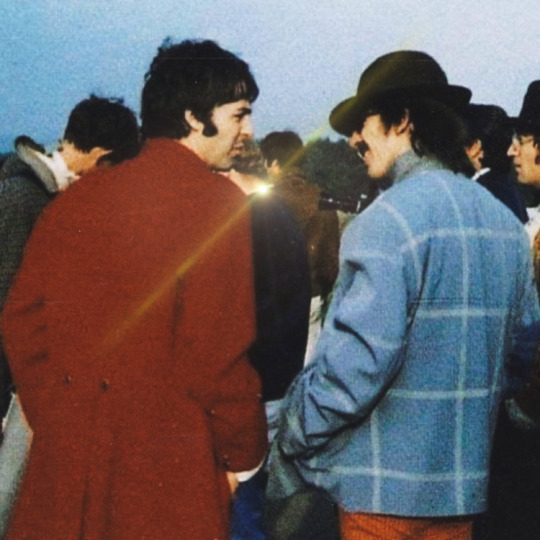

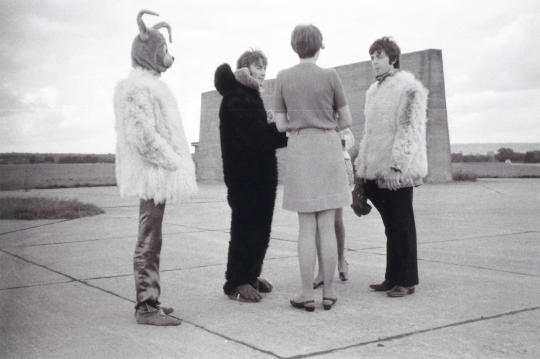

George Harrison, John Lennon and Paul McCartney filming Magical Mystery Tour at the airbase at West Malling, 19th-24th September, 1967.

265 notes

·

View notes