#PPP Loans

Text

Private equity plunderers want to buy Simon & Schuster

Going to Defcon this weekend? I'm giving a keynote, "An Audacious Plan to Halt the Internet's Enshittification and Throw it Into Reverse," on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

Last November, publishing got some excellent news: the planned merger of Penguin Random House (the largest publisher in the history of human civilization) with its immediate competitor Simon & Schuster would not be permitted, thanks to the DOJ's deftly argued case against the deal:

https://pluralistic.net/2022/11/07/random-penguins/#if-you-wanted-to-get-there-i-wouldnt-start-from-here

When I was a baby writer, there were dozens of large NY publishers. Today, there are five - and it was almost four. A publishing sector with five giant companies is bad news for writers (as Stephen King said at the trial, the idea that PRH and S&S would bid against each other for books was as absurd as the idea that he and his wife would bid against each other for their next family home).

But it's also bad news for publishing workers, a historically exploited and undervalued workforce whose labor conditions have only declined as the number of employers in the sector dwindled, leading to mass resignations:

https://lithub.com/unlivable-and-untenable-molly-mcghee-on-the-punishing-life-of-junior-publishing-employees/

It should go without saying that workers in sectors with few employers get worse deals from their bosses (see, e.g., the writers' strike and actors' strike). And yup, right on time, PRH, a wildly profitable publisher, fired a bunch of its most senior (and therefore hardest to push around) workers:

https://www.nytimes.com/2023/07/18/books/penguin-random-house-layoffs-buyouts.html

But publishing's contraction into a five-company cartel didn't occur in a vacuum. It was a normal response to monopolization elsewhere in its supply chain. First it was bookselling collapsing into two major chains. Then it was distribution going from 300 companies to three. Today, it's Amazon, a monopolist with unlimited access to the capital markets and a track record of treating publishers "the way a cheetah would pursue a sickly gazelle":

https://pluralistic.net/2023/07/31/seize-the-means-of-computation/#the-internet-con

Monopolies are like Pringles (owned by the consumer packaged goods monopolist Procter & Gamble): you can't have just one. As soon as you get a monopoly in one part of the supply chain, every other part of that chain has to monopolize in self-defense.

Think of healthcare. Consolidation in pharma lead to price-gouging, where hospitals were suddenly paying 1,000% more for routine drugs. Hospitals formed regional monopolies and boycotted pharma companies unless they lowered their prices - and then turned around and screwed insurers, jacking up the price of care. Health insurers gobbled each other up in an orgy of mergers and fought the hospitals.

Now the health care system is composed of a series of gigantic, abusive monopolists - pharma, hospitals, medical equipment, pharmacy benefit managers, insurers - and they all conspire to wreck the lives of only two parts of the system who can't fight back: patients and health care workers. Patients pay more for worse care, and medical workers get paid less for worse working conditions.

So while there was no question that a PRH takeover of Simon & Schuster would be bad for writers and readers, it was also clear that S&S - and indeed, all of the Big Five publishers - would be under pressure from the monopolies in their own supply chain. What's more, it was clear that S&S couldn't remain tethered to Paramount, its current owner.

Last week, Paramount announced that it was going to flip S&S to KKR, one of the world's most notorious private equity companies. KKR has a long, long track record of ghastly behavior, and its portfolio currently includes other publishing industry firms, including one rotten monopolist, raising similar concerns to the ones that scuttled the PRH takeover last year:

https://www.nytimes.com/2023/08/07/books/booksupdate/paramount-simon-and-schuster-kkr-sale.html

Let's review a little of KKR's track record, shall we? Most spectacularly, they are known for buying and destroying Toys R Us in a deal that saw them extract $200m from the company, leaving it bankrupt, with lifetime employees getting $0 in severance even as its executives paid themselves tens of millions in "performance bonuses":

https://memex.craphound.com/2018/06/03/private-equity-bosses-took-200m-out-of-toys-r-us-and-crashed-the-company-lifetime-employees-got-0-in-severance/

The pillaging of Toys R Us isn't the worst thing KKR did, but it was the most brazen. KKR lit a beloved national chain on fire and then walked away, hands in pockets, whistling. They didn't even bother to clear their former employees' sensitive personnel records out of the unlocked filing cabinets before they scarpered:

https://memex.craphound.com/2018/09/23/exploring-the-ruins-of-a-toys-r-us-discovering-a-trove-of-sensitive-employee-data/

But as flashy as the Toys R Us caper was, it wasn't the worst. Private equity funds specialize in buying up businesses, loading them with debts, paying themselves, and then leaving them to collapse. They're sometimes called vulture capitalists, but they're really vampire capitalists:

https://www.motherjones.com/politics/2022/05/private-equity-buyout-kkr-houdaille/

Given a choice, PE companies don't want to prey on sick businesses - they preferentially drain off value from thriving ones, preferably ones that we must use, which is why PE - and KKR in particular - loves to buy health care companies.

Heard of the "surprise billing epidemic"? That's where you go to a hospital that's covered by your insurer, only to discover - after the fact - that the emergency room is operated by a separate, PE-backed company that charges you thousands for junk fees. KKR and Blackstone invented this scam, then funneled millions into fighting the No Surprises Act, which more-or-less killed it:

https://pluralistic.net/2020/04/21/all-in-it-together/#doctor-patient-unity

KKR took one of the nation's largest healthcare providers, Envision, hostage to surprise billing, making it dependent on these fraudulent payments. When Congress finally acted to end this scam, KKR was able to take to the nation's editorial pages and damn Congress for recklessly endangering all the patients who relied on it:

https://pluralistic.net/2022/03/14/unhealthy-finances/#steins-law

Like any smart vampire, KKR doesn't drain its victim in one go. They find all kinds of ways to stretch out the blood supply. During the pandemic, KKR was front of the line to get massive bailouts for its health-care holdings, even as it fired health-care workers, increasing the workload and decreasing the pay of the survivors of its indiscriminate cuts:

https://pluralistic.net/2020/04/11/socialized-losses/#socialized-losses

It's not just emergency rooms. KKR bought and looted homes for people with disabilities, slashed wages, cut staff, and then feigned surprise at the deaths, abuse and misery that followed:

https://www.buzzfeednews.com/article/kendalltaggart/kkr-brightspring-disability-private-equity-abuse

Workers' wages went down to $8/hour, and they were given 36 hour shifts, and then KKR threatened to have any worker who walked off the job criminally charged with patient abandonment:

https://pluralistic.net/2023/06/02/plunderers/#farben

For KKR, people with disabilities and patients make great victims - disempowered and atomized, unable to fight back. No surprise, then, that so many of KKR's scams target poor people - another group that struggles to get justice when wronged. KKR took over Dollar General in 2007 and embarked on a nationwide expansion campaign, using abusive preferential distributor contracts and targeting community-owned grocers to trap poor people into buying the most heavily processed, least nutritious, most profitable food available:

https://pluralistic.net/2023/03/27/walmarts-jackals/#cheater-sizes

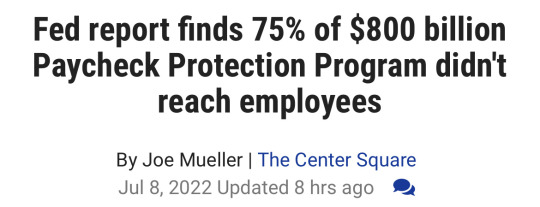

94.5% of the Paycheck Protection Program - designed to help small businesses keep their workers payrolled during lockdown - went to giant businesses, fraudulently siphoned off by companies like Longview Power, 40% owned by KKR:

https://pluralistic.net/2020/04/20/great-danes/#ppp

KKR also helped engineer a loophole in the Trump tax cuts, convincing Justin Muzinich to carve out taxes for C-Corporations, which let KKR save billions in taxes:

https://pluralistic.net/2020/06/02/broken-windows/#Justin-Muzinich

KKR sinks its fangs in every part of the economy, thanks to the vast fortunes it amassed from its investors, ripped off from its customers, and fraudulently obtained from the public purse. After the pandemic, KKR scooped up hundreds of companies at firesale prices:

https://pluralistic.net/2020/03/30/medtronic-stole-your-ventilator/#blackstone-kkr

Ironically, the investors in KKR funds are also its victims - especially giant public pension funds, whom KKR has systematically defrauded for years:

https://pluralistic.net/2020/07/22/stimpank/#kentucky

And now KKR has come for Simon & Schuster. The buyout was trumpeted to the press as a done deal, but it's far from a fait accompli. Before the deal can close, the FTC will have to bless it. That blessing is far from a foregone conclusion. KKR also owns Overdrive, the monopoly supplier of e-lending software to libraries.

Overdrive has a host of predatory practices, loathed by both libraries and publishers (indeed, much of the publishing sector's outrage at library e-lending is really displaced anger at Overdrive). There's a plausible case that the merger of one of the Big Five publishers with the e-lending monopoly will present competition issues every bit as deal-breaking as the PRH/S&S merger posed.

(Image: Sefa Tekin/Pexels, modified)

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/08/vampire-capitalism/#kkr

#kkr#simon and schuster#publishing#penguin random house#ppp loans#looters#plunderers#vampire capitalism#vulture capitalism#debt#private equity#pe#harmful dominance#monopoly#trustbusters#incentives matter#labor#writing#publishing workers#recorded books#overdrive#glam#libraries#toys r us#pluralistic

187 notes

·

View notes

Text

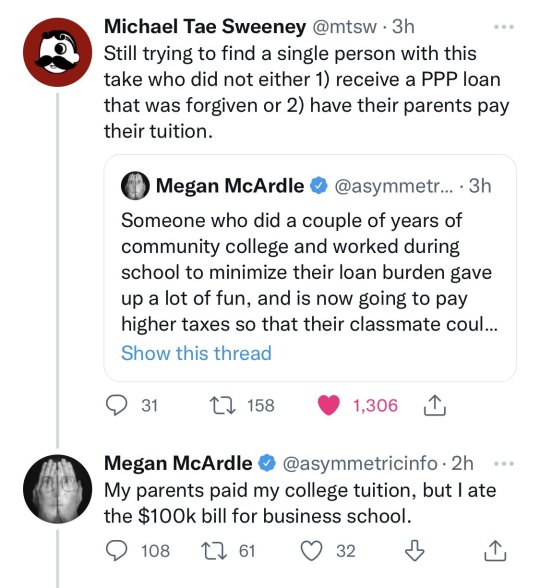

*fake shock*

844 notes

·

View notes

Text

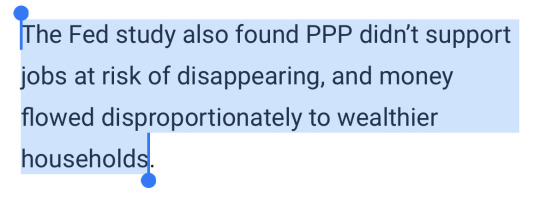

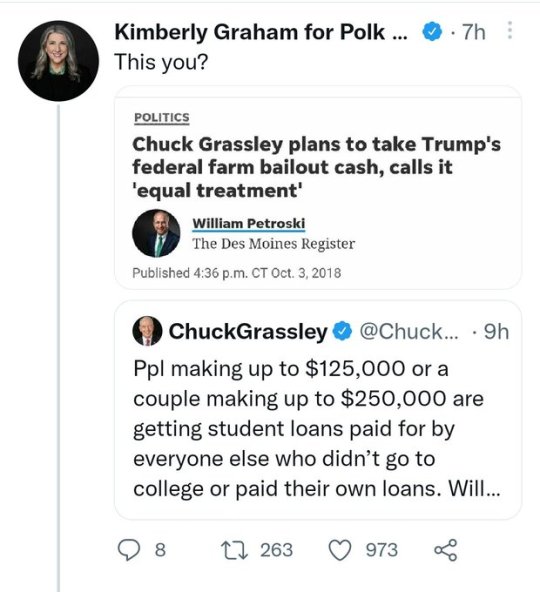

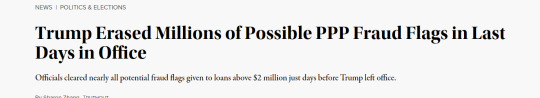

#student loans#ppp loans#us military spending#us war monger#defund the military and fund our communities#defund the police fund our communities

1K notes

·

View notes

Text

“Ok for me, but not for thee”

- Very rich people of the GOP

21 notes

·

View notes

Text

#us politics#2022#tiktok#dark brandon#biden administration#president joe biden#student loans#cancel student debt#student debt forgiveness#student debt#debt forgiveness#ppp#ppp loans#payment protection program#corporate bailouts#videos

422 notes

·

View notes

Photo

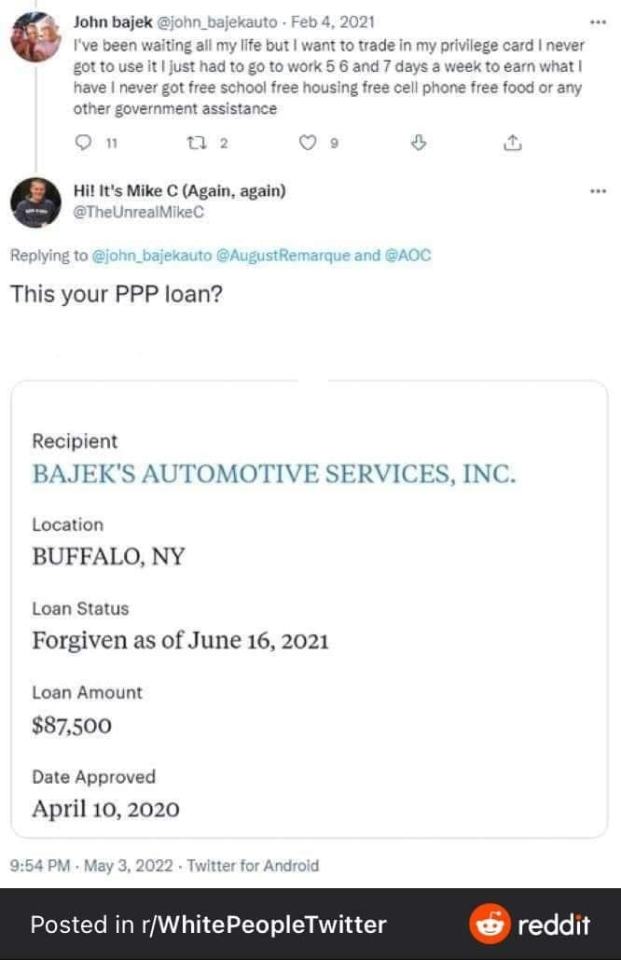

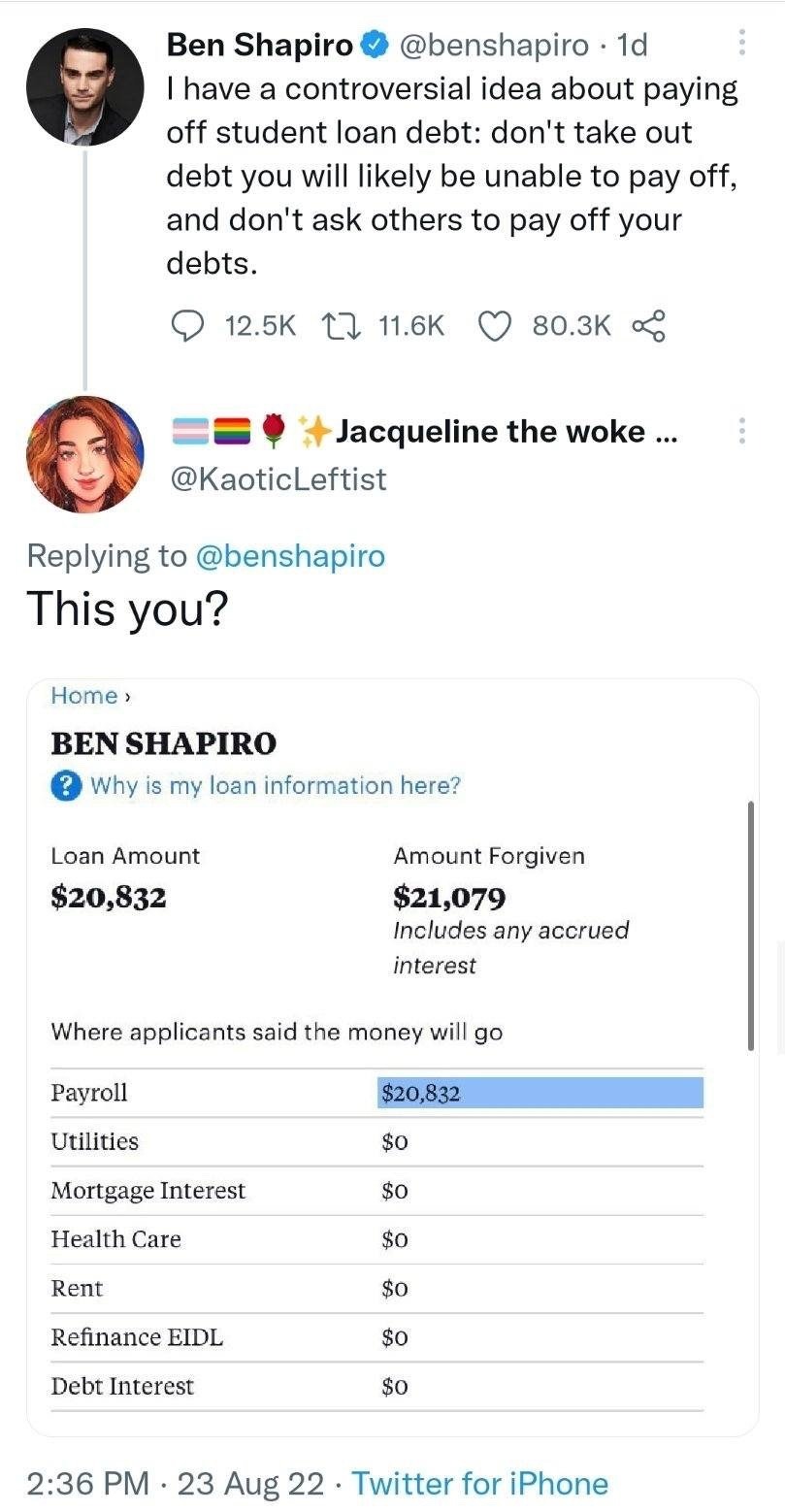

this you?

a whole thread

https://twitter.com/trayne_wreck/status/1562587880026808321

#tweet#tweets#student loan crisis#student loans#cancel student loans#student debt#PPP loans#this you?#twitter

288 notes

·

View notes

Text

Three years after receiving a $700 million pandemic-era lifeline from the federal government, the struggling freight trucking company Yellow is filing for bankruptcy.

After monthslong negotiations between Yellow’s management and the Teamsters union broke down, the company shut its operations late last month, and said on Sunday that it was seeking bankruptcy protection so it could wind down its business in an “orderly” way.

“It is with profound disappointment that Yellow announces that it is closing after nearly 100 years in business,” the company’s chief executive, Darren Hawkins, said in a statement. Yellow filed a so-called Chapter 11 petition in U.S. Bankruptcy Court in Delaware.

The downfall of the 99-year-old company will lead to the loss of about 30,000 jobs and could have ripple effects across the nation’s supply chains. It also underscores the risks associated with government bailouts that are awarded during moments of economic panic.

Yellow, which formerly went by the name YRC Worldwide, received the $700 million loan during the summer of 2020 as the pandemic was paralyzing the U.S. economy. The loan was awarded as part of the $2.2 trillion pandemic-relief legislation that Congress passed that year, and Yellow received it on the grounds that its business was critical to national security because it shipped supplies to military bases. Government watchdogs have scrutinized the loan because of the company’s financial turmoil and close ties to the Trump administration, which awarded the loan.

Since then, Yellow changed its name and embarked on a restructuring plan to help revive its flagging business by consolidating its regional networks of trucking services under one brand. As of the end of March, Yellow’s outstanding debt was $1.5 billion, including about $730 million that it owed to the federal government. Yellow has paid approximately $66 million in interest on the loan, but it has repaid just $230 of the principal owed on the loan, which comes due next year.

The fate of the loan is not yet clear. The federal government assumed a 30% equity stake in Yellow in exchange for the loan. It could end up assuming or trying to sell off much of the company’s fleet of trucks and terminals. Yellow aims to sell “all or substantially all” of its assets, according to court documents. Mr. Hawkins said the company intended to pay back the government loan “in full.”

The White House declined to comment.

Yellow estimated that it has more than 100,000 creditors and more than $1 billion in liabilities, per court documents. Some of its largest unsecured creditors include Amazon, with a claim of more than $2 million, and Home Depot, which is owed nearly $1.7 million.

Yellow is the third-largest small-freight trucking company in a part of the industry known as “less than truckload” shipping. The industry has been under pressure over the last year from rising interest rates and higher fuel costs, while customers have been reluctant to accept higher prices.

Those forces collided with an ugly labor fight this year between Yellow and the Teamsters union over wages and other benefits. Those talks collapsed last month and union officials soon after warned workers that the company was shutting down.

After its bankruptcy filing, company officials placed much of the blame on the union, saying its members caused “irreparable harm” by halting its restructuring plan. Yellow employed about 23,000 union employees.

“We faced nine months of union intransigence, bullying and deliberately destructive tactics,” Mr. Hawkins said. The Teamsters union “was able to halt our business plan, literally driving our company out of business, despite every effort to work with them,” he added.

In late June, the company filed a lawsuit against the union, asserting it had caused more than $137 million in damages by blocking the restructuring plan.

The Teamsters union said that Yellow’s executives unjustly blamed the union for the demise of the company, which had been “plagued with financial trouble for nearly two decades,” officials said in a statement.

“Teamster families sacrificed billions of dollars in wages, benefits and retirement security to rescue Yellow,” said Sean O’Brien, the union’s general president. “The company blew through a $700 million government bailout.” Calling Yellow’s top executives “dysfunctional” and “greedy,” he blamed them for failing to “take responsibility for squandering all that cash.”

The bankruptcy could create temporary disruptions for companies that relied on Yellow and might prompt more consolidation in the industry. It could also lead to temporarily higher prices as businesses find new carriers for their freight.

“Those inflationary prices will certainly hurt the shippers and hurt the consumer to a certain extent,” said Tom Nightingale, chief executive of AFS Logistics, who suggested that prices would probably normalize within a few months.

In late July, Yellow began permanently laying off workers and ceased most of its operations in the United States and Canada, according to court documents. Yellow has retained a “core group” of about 1,650 employees to maintain limited operations and provide administrative work as it winds down. Yellow said it expected to pay about $3.4 million per week in employee wages to operate during bankruptcy, which “may decrease over time.” None of the remaining employees are union members, the company said.

The company also sought the authority to pay an estimated $22 million in compensation and benefit costs for current and former employees, including roughly $8.7 million in unpaid wages as of the date of filing.

Yellow had readily accessible funds of about $39 million when it filed for bankruptcy, which it said would be insufficient to cover its wind-down efforts, and it expected to receive special financing to help support the sale process and payment of wages.

Jack Atkins, a transportation analyst at the financial services firm Stephens, said that Yellow’s troubles had been mounting for years. In the wake of the financial crisis, Yellow engaged in a spree of acquisitions that it failed to successfully integrate, Mr. Atkins said. The demands of repaying that debt made it difficult for Yellow to reinvest in the company, allowing rivals to become more profitable.

“Yellow was struggling to keep its head above water and survive,” Mr. Atkins said. “It was harder and harder to be profitable enough to support the wage increases they needed.”

David P. Leibowitz, a Chicago bankruptcy lawyer who represents several trucking companies, said Yellow had found itself in a “perfect storm, and they have not managed that perfect storm very well.”

The company’s financial problems fueled concerns. It lost more than $100 million in 2019 and was being sued by the Justice Department over claims that it defrauded the federal government during a seven-year period. Last year it agreed to pay $6.85 million to settle the lawsuit.

Congressional oversight committees have scrutinized the company’s relationships with the Trump administration. President Donald J. Trump tapped Mr. Hawkins to serve on a coronavirus economic task force, and Yellow had financial backing from Apollo Global Management, a private equity firm with close ties to Trump administration officials.

Democrats on the House Select Subcommittee on the Coronavirus Crisis wrote in a report last year that top Trump administration officials had awarded Yellow the money over the objections of career officials at the Defense Department. The report noted that Yellow had been in close touch with Trump administration officials throughout the loan process and had discussed how the company employed Teamsters as its drivers.

In December 2020, Steven T. Mnuchin, then the Treasury secretary, defended the loan, arguing that had the company been shuttered, thousands of jobs would have been at risk and the military’s supply chain could have been disrupted. He predicted that the federal government would eventually turn a profit from the deal.

“Yellow had longstanding financial problems before the pandemic, was not essential to national security and thus should never have received a $700 million taxpayer bailout from the Treasury Department,” Representative French Hill, Republican of Arkansas and a member of the Congressional Oversight Commission, said in a statement. “Years of poor financial management at Yellow has resulted in hard-working people losing their jobs.”

#us politics#news#the new york times#2023#donald trump#conservatives#republicans#trump administration#yellow corporation#teamsters union#unions#union workers#workers union#bankruptcy#chapter 11#Darren Hawkins#U.S. Bankruptcy Court#coronavirus relief#ppp loans#department of treasury#government bailouts#Sean O’Brien#House Select Subcommittee on the Coronavirus Crisis#steve mnuchin#department of defense#rep. French Hill#Apollo Global Management

15 notes

·

View notes

Photo

#class war#class warfare#classism#bootstraps#rugged individualism#ppp loans#john bajek#bajek's automotive services

191 notes

·

View notes

Text

114 notes

·

View notes

Text

I BELIEVE I LIVE IN A DYSTOPIA, WHAT CAN I DO ABOUT IT?

I promise I’ll read everything this post ever gets.

Between oceangate-gate and the supreme court’s recent loan un-forgiveness and ppp loan forgiveness, it feels like the unchecked corruption has reached an inflection point. Can I, can WE do anything about that?

8 notes

·

View notes

Link

FISCAL CONSERVATIVES! . HERE’S AN IDEA LETS INVESTIGATE THE WHOLE COVID RELIEF HANDOUTS TO THE RICH AND TRUMP ALLIES?

15 notes

·

View notes

Text

“The lawmaker fraudulently took more than $150,000 in Small Business Administration COVID relief loans between December 2020 and March 2021, the Department of Justice alleged. The loans were meant for what the DOJ referred to as two “dormant business entities.””

[He took out loans for two businesses he ‘owned’ claiming nearly a million in income together along with 6 employees. They had 0 employees and $0 in income.]

In response, Harding said: ““I ask that you keep me and my family in your prayers as we work for a fair and just resolution. Thank you, and may God bless you.””

I have as many prayers for him as Lauren Boehbert’s fake ass had for the LGBTQ community after the shooting at Club Q, as each and every one of those politicians that condemns shootings but takes NRA money and won’t budge on gun reform.

Fuck this man and his lies, theft of the American people’s money, and his homophobia.

19 notes

·

View notes

Text

33 notes

·

View notes

Text

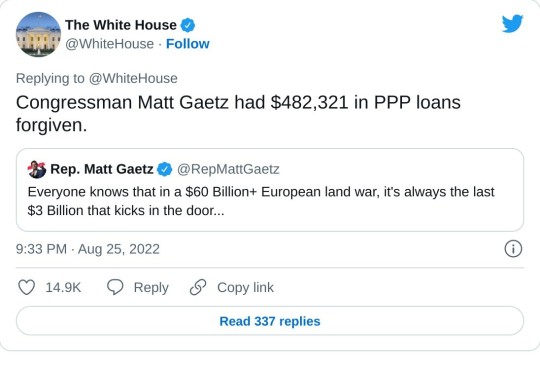

#us politics#memes#shitpost#biden administration#president joe biden#sen. bernie sanders#ppp#ppp loans#paycheck protection program#debt forgiveness#student debt forgiveness#student debt#cancel student debt#student loans#the white house#twitter#tweet#rep. marjorie taylor greene#Rep. Vern Buchanan#rep. markwayne mullin#rep. kevin hern#rep. mike kelly#rep. matt gaetz#2022

437 notes

·

View notes

Text

Not sure why these already @rich people are getting taxpayers money 💴 to do @talk…$how$ and aren’t @obligated to pay USA 🇺🇸 back ✍️

#t pain#philanthropy#stock market#financial education#microsoft#politics#constitution#shades#ppp loans#government#college#education#president#credit#black and white#macroeconomics#minimum wage#production#ai#green#kinky boots#commercial real estate#pope francis#retail#mini dress#shaking hands#battery#bartering#applied sciences

7 notes

·

View notes