#calgaryhomebuyers

Text

Best Pricing and Valuation Strategies for Home Sellers in Canada

Selling a home can be an exciting yet challenging endeavor. One of the critical decisions you’ll make as home sellers in Canada is determining the right price for your property. The price you set can significantly impact your selling experience, affecting the time your property spends on the market and the final profit you make. In this article, we will explore the best pricing and valuation strategies for home sellers in Canada, helping you make informed decisions to maximize your property’s value.

#cash home buyers#firsttimehomebuyer#homebuyers#sell my house for cash#quick home buyers#sell your house fast#sell your home#sell your property#calgary home buyers#sell your house calgary#calgaryhomebuyers

0 notes

Photo

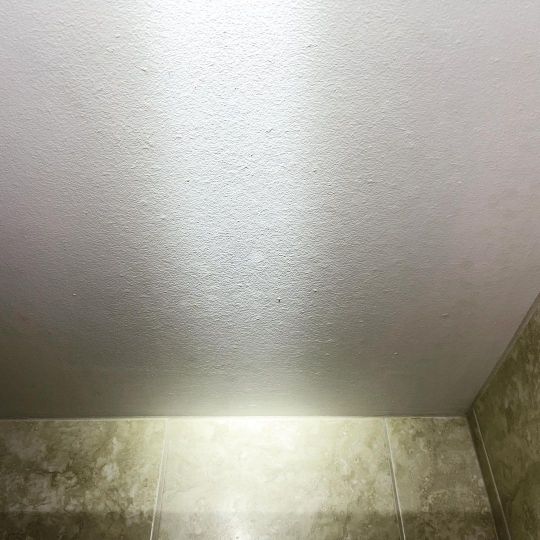

Can you tell if mould was painted over? 🤔 Sometimes yes, if the growth creates damage or bumps 😮 Here we can see visible mould patterns that have been painted over prior to the sale of a property 🦠 Learn more at https://www.ecoabate.com/mould . . . @renovationfind #renovationfindcertified @homestars #homestarsverified #mould #calgary #yyc #mold #moldinspection #moldairtesting #mouldcalgary #calgaryairtesting #calgaryrealestate #calgaryhomebuyers #calgaryrestoration #buildings #construction #cleaning #renovation #waterdamage (at Eco Abate INC) https://www.instagram.com/p/CegfE3urz31/?igshid=NGJjMDIxMWI=

#renovationfindcertified#homestarsverified#mould#calgary#yyc#mold#moldinspection#moldairtesting#mouldcalgary#calgaryairtesting#calgaryrealestate#calgaryhomebuyers#calgaryrestoration#buildings#construction#cleaning#renovation#waterdamage

0 notes

Photo

// What does 𝙃𝙤𝙢𝙚 look like to you?//⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀ Calgary weather is -32°C today and looks even more snowy outside! ❄️ ⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀ Talk of the virus is tiredly everywhere 🦠 ⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀ For us, 𝙃𝙤𝙢𝙚 is the safety of homeownership; the warmth of the fireplace, hearing our kids and pups playing so joyfully in the background and the ability of staying in while these things shall pass. ⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀ Wishing everyone health and healing at this time & hoping this all passes quickly 🌎🙏🏻 ⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀ ⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀⠀ #calgary #calgaryalberta #canada #canadarealestate #winter #calgaryhomebuyers #corona #coronavirus #covid_19 #health #calgaryhealth (at Calgary, Alberta) https://www.instagram.com/p/B9u50IKgk6r/?igshid=i2mircdqrnv4

#calgary#calgaryalberta#canada#canadarealestate#winter#calgaryhomebuyers#corona#coronavirus#covid_19#health#calgaryhealth

1 note

·

View note

Photo

We do have a soft for big decks but that doesn’t mean we don’t like creating spaces with our clients needs in mind 👩👩👦👦 . Drop us a line or give us a call for a free estimate before your spot is taken in 2019! . www.deckrativedesigns.ca Link in bio . . #calgaryalberta #calgary #yyc #yycnow #calgarywoodworkers #calgaryviews #calgarynow #yyctoday #decksofinstagram #deckstaining #calgarylife #calgarybuzz #calgaryhomesforsale #calgaryhome #calgaryhomebuyers (at Calgary, Alberta) https://www.instagram.com/p/B2Uq9R7BggV/?igshid=rhuz7nsd5m8j

#calgaryalberta#calgary#yyc#yycnow#calgarywoodworkers#calgaryviews#calgarynow#yyctoday#decksofinstagram#deckstaining#calgarylife#calgarybuzz#calgaryhomesforsale#calgaryhome#calgaryhomebuyers

1 note

·

View note

Photo

House Prices Rise Back! Average House Prices Rise Back Above $700k as Inventory Falls Removing the high-priced markets of the Greater Toronto and Vancouver areas, the average price stands at $561,585, up 17% year-over-year. There were 57,077 home sales in October, down 11.5% from a year earlier, but up 8.6% on a monthly basis, the largest month-over-month increase since July 2020, CREA noted. Meanwhile, housing inventory continues to be... -- Prices Expected to Keep Rising Until the BoC Hikes Interest Rates While CREA chair Cliff Stevenson noted that one month of data does not make a trend, some observers suggest the rise in prices is likely to continue until the Bank of Canada starts raising interest rates. And that goes for a wide cross-section of the real estate market, including... -- Full Read: https://adiamondmortgage.com/house-prices-rise-back/ #aDiamondMortgage #aDiamondMortgageTDM #thedifferencemortgage #tdmsweepstakes #yycmortgage #yycre #yychome #yychomes #yychomesforsale #yychomebuyers #yycrealestate #calgaryhomes #calgaryrealestate #calgaryhomesforsale #calgaryhomebuyer #calgaryhomebuyers #calgarymortgagebroker #calgarymortgages #yycmortgage #yycmortgages #yycmortgagebroker #yycmortgagebrokers https://www.instagram.com/p/CWW336kBcDm/?utm_medium=tumblr

#adiamondmortgage#adiamondmortgagetdm#thedifferencemortgage#tdmsweepstakes#yycmortgage#yycre#yychome#yychomes#yychomesforsale#yychomebuyers#yycrealestate#calgaryhomes#calgaryrealestate#calgaryhomesforsale#calgaryhomebuyer#calgaryhomebuyers#calgarymortgagebroker#calgarymortgages#yycmortgages#yycmortgagebroker#yycmortgagebrokers

0 notes

Photo

Think or know you have bad credit? Read our latest blog where we cover the steps you’ll need to take to get a mortgage with bad credit, what you need to know about your credit score, what you need to qualify for a home loan, and what you can do to quickly improve your credit score! https://www.repcalgaryhomes.ca/blog/how-to-buy-a-house-with-bad-credit.html Not sure where you land and are thinking about getting a mortgage? Connect with one of our trusted mortgage partners over at @spiremortgage and see how much home you can afford. #repyyc #badcredit #mortgages #realestate #yyc #calgaryhomebuyers (at Calgary, Alberta) https://www.instagram.com/p/COUU3uzFRe1/?igshid=1ubr8lhoixz4p

0 notes

Photo

Nice job we done for LukusDevelopments. Looking forward to seeing what they have in store for the 2021 season. #yyc #calgaryconcrete #calgaryhomebuyers #calgaryalberta #yyccontractors #canada🇨🇦 #canadian #concrete #yycrenos #calgaryliving #winterstyle #scorboro (at Scarboro) https://www.instagram.com/p/CIFDPseh5xj/?igshid=1kqn2wbg4bj95

#yyc#calgaryconcrete#calgaryhomebuyers#calgaryalberta#yyccontractors#canada🇨🇦#canadian#concrete#yycrenos#calgaryliving#winterstyle#scorboro

0 notes

Text

How to sell your house fast for cash in Calgary, Alberta?

How to sell your house fast for cash in Calgary, Alberta? (maxxcashhomebuyers.com)

Selling a house is a significant decision, and when you need to sell your house fast for cash in Calgary, Alberta, it can be even more daunting. Whether you’re facing a financial crunch, relocating, or simply want a quick and hassle-free sale, this article will guide you through the process.

#cash home buyers#firsttimehomebuyer#homebuyers#sell my house for cash#quick home buyers#sell your house fast#sell your home#sell your property#sell your house calgary#calgaryhomebuyers

0 notes

Photo

Housing Affordability Worsens Housing Affordability Worsens, Time Needed to Save for a Down Payment Increases The three housing markets that saw the greatest deterioration in affordability in the quarter were Vancouver, Victoria and Toronto. “Looking at data for November, mortgage interest rates have moved up nearly 25 basis points with the potential for further increases as monetary policy normalization intensifies,” the report noted. “We estimate that a hypothetical 100-bps increase in rates represents approximately a 12% reduction in... Read Full: https://adiamondmortgage.com/housing-affordability-worsens/ #aDiamondMortgage #aDiamondMortgageTDM #thedifferencemortgage #tdmsweepstakes #yycmortgage #yycre #yychome #yychomes #yychomesforsale #yychomebuyers #yycrealestate #calgaryhomes #calgaryrealestate #calgaryhomesforsale #calgaryhomebuyer #calgaryhomebuyers #calgarymortgagebroker #calgarymortgages #yycmortgage #yycmortgages #yycmortgagebroker #yycmortgagebrokers https://www.instagram.com/p/CWKQUjEpESa/?utm_medium=tumblr

#adiamondmortgage#adiamondmortgagetdm#thedifferencemortgage#tdmsweepstakes#yycmortgage#yycre#yychome#yychomes#yychomesforsale#yychomebuyers#yycrealestate#calgaryhomes#calgaryrealestate#calgaryhomesforsale#calgaryhomebuyer#calgaryhomebuyers#calgarymortgagebroker#calgarymortgages#yycmortgages#yycmortgagebroker#yycmortgagebrokers

0 notes

Photo

Rate Hikes Predictions Scotiabank economist predicts eight rate hikes in next two years Bank of Canada will likely raise its benchmark interest rate four times in the second half of next year and another four times in 2023... Read Full: https://adiamondmortgage.com/rate-hikes-predictions/ #aDiamondMortgage #aDiamondMortgageTDM #thedifferencemortgage #tdmsweepstakes #yycmortgage #yycre #yychome #yychomes #yychomesforsale #yychomebuyers #yycrealestate #calgaryhomes #calgaryrealestate #calgaryhomesforsale #calgaryhomebuyer #calgaryhomebuyers #calgarymortgagebroker #calgarymortgages #yycmortgage #yycmortgages #yycmortgagebroker #yycmortgagebrokers https://www.instagram.com/p/CWKJcuQr07w/?utm_medium=tumblr

#adiamondmortgage#adiamondmortgagetdm#thedifferencemortgage#tdmsweepstakes#yycmortgage#yycre#yychome#yychomes#yychomesforsale#yychomebuyers#yycrealestate#calgaryhomes#calgaryrealestate#calgaryhomesforsale#calgaryhomebuyer#calgaryhomebuyers#calgarymortgagebroker#calgarymortgages#yycmortgages#yycmortgagebroker#yycmortgagebrokers

0 notes

Photo

Fine-tune finances for a mortgage How to fine-tune your finances for a mortgage The CMHC also changed the rules to allow buyers a higher ratio of expenses relative to their income. It said a borrower’s gross debt-service ratio – the share of monthly household income used to pay the mortgage and other housing costs – can go up to 39 per cent instead of 35 per cent, while the total debt-service ratio – the percentage of monthly household income that covers housing costs and any other debts – can go up to 44 per cent instead of 42 per cent. A preapproval will also determine if a borrower qualifies based on the stress test and debt-servicing ratios, since it involves the lender reviewing personal and financial information, including income and down payment and credit history. Read Full: https://adiamondmortgage.com/fine-tune-finances-for-a-mortgage/ #aDiamondMortgage #aDiamondMortgageTDM #thedifferencemortgage #tdmsweepstakes #yycmortgage #yyc #yycre #yychome #yychomes #yycluxuryhomes #yychomesforsale #yychomebuyers #yycrealestate #calgaryhomes #calgaryrealestate #calgaryhomesforsale #calgarycondos #calgaryhomebuyer #calgaryhomebuyers #calgarymortgagebroker https://www.instagram.com/p/CWCe4JtgSnd/?utm_medium=tumblr

#adiamondmortgage#adiamondmortgagetdm#thedifferencemortgage#tdmsweepstakes#yycmortgage#yyc#yycre#yychome#yychomes#yycluxuryhomes#yychomesforsale#yychomebuyers#yycrealestate#calgaryhomes#calgaryrealestate#calgaryhomesforsale#calgarycondos#calgaryhomebuyer#calgaryhomebuyers#calgarymortgagebroker

0 notes

Photo

Home Sales “Cooling Off” Period B.C. B.C. Government Plans “Cooling Off” Period for Home Sales “Especially in periods of heightened activity in the housing market, it’s crucial that we have effective measures in place so that people have the peace of mind that they’ve made the right choice,” Robinson said. Seven-day cooling-off periods are already in place for... Read Full: https://adiamondmortgage.com/home-sales-cooling-off-period-b-c/ #aDiamondMortgage #aDiamondMortgageTDM #thedifferencemortgage #tdmsweepstakes #yycmortgage #yyc #yycre #yychome #yychomes #yycluxuryhomes #yychomesforsale #yychomebuyers #yycrealestate #calgaryhomes #calgaryrealestate #calgaryhomesforsale #calgarycondos #calgaryhomebuyer #calgaryhomebuyers #calgarymortgagebroker https://www.instagram.com/p/CV8iqnjt4vq/?utm_medium=tumblr

#adiamondmortgage#adiamondmortgagetdm#thedifferencemortgage#tdmsweepstakes#yycmortgage#yyc#yycre#yychome#yychomes#yycluxuryhomes#yychomesforsale#yychomebuyers#yycrealestate#calgaryhomes#calgaryrealestate#calgaryhomesforsale#calgarycondos#calgaryhomebuyer#calgaryhomebuyers#calgarymortgagebroker

0 notes

Photo

Home Sales Remain Strong in Big Cities Home Sales Remain Strong in Big Cities as Demand Outstrips Supply In Vancouver, the supply of homes for sale dipped to a three-year low, while in the Greater Toronto Area the number of new listings was down by about a third. “Both the ownership and rental markets have recovered from the relatively short–term effects of the pandemic, but competition for ownership and rental properties is once again tight,” said John DiMichele, CEO of the Toronto Regional Real Estate Board (TRREB). Here’s a look at October readings from some of the country’s key real estate boards: Read Full: https://adiamondmortgage.com/home-sales-remain-strong-in-big-cities/ #aDiamondMortgage #aDiamondMortgageTDM #thedifferencemortgage #tdmsweepstakes #yycmortgage #yyc #yycre #yychome #yychomes #yycluxuryhomes #yychomesforsale #yychomebuyers #yycrealestate #calgaryhomes #calgaryrealestate #calgaryhomesforsale #calgarycondos #calgaryhomebuyer #calgaryhomebuyers #calgarymortgagebroker https://www.instagram.com/p/CV8WbJHBNhA/?utm_medium=tumblr

#adiamondmortgage#adiamondmortgagetdm#thedifferencemortgage#tdmsweepstakes#yycmortgage#yyc#yycre#yychome#yychomes#yycluxuryhomes#yychomesforsale#yychomebuyers#yycrealestate#calgaryhomes#calgaryrealestate#calgaryhomesforsale#calgarycondos#calgaryhomebuyer#calgaryhomebuyers#calgarymortgagebroker

0 notes

Photo

Mortgage Pre-Approval Can Protect You How a Mortgage Pre-Approval Can Protect You from Rising Rates Not only does a mortgage pre-approval give you the lender’s estimate of your borrowing power, but it also offers you an interest rate hold for up to 120 days in many cases. In times of steady or declining rates, you barely pay attention to your pre-approval rate. But these days, this rate hold can be a total game-changer. What are the Benefits of a Mortgage Pre-Approval? You have protection—or insurance—against higher rates during your pre-approval period (for many lenders, this can be up to 120 days). Let everyone else pay more than you, because your rate hold gave you every advantage with no disadvantages. If rates had fallen instead, you would still be a free agent and could benefit from those lower rates. So, with a pre-approval you can have your cake and eat it too. You know your borrowing power. This is so essential when buying a home..., Read full: https://adiamondmortgage.com/mortgage-pre-approval-can-protect-you/ #aDiamondMortgage #aDiamondMortgageTDM #thedifferencemortgage #tdmsweepstakes #yycmortgage #yycre #yychome #yychomes #yychomesforsale #yychomebuyers #yycrealestate #calgaryhomes #calgaryrealestate #calgaryhomesforsale #calgaryhomebuyer #calgaryhomebuyers #calgarymortgagebroker #calgarymortgages #yycmortgage #yycmortgages #yycmortgagebroker #yycmortgagebrokers https://www.instagram.com/p/CV8OaEpLgyY/?utm_medium=tumblr

#adiamondmortgage#adiamondmortgagetdm#thedifferencemortgage#tdmsweepstakes#yycmortgage#yycre#yychome#yychomes#yychomesforsale#yychomebuyers#yycrealestate#calgaryhomes#calgaryrealestate#calgaryhomesforsale#calgaryhomebuyer#calgaryhomebuyers#calgarymortgagebroker#calgarymortgages#yycmortgages#yycmortgagebroker#yycmortgagebrokers

0 notes

Photo

Housing Market Vulnerable – CMHC Canada’s housing market overheated, highly vulnerable – CMHC Apotent combination of factors including home price growth acceleration continued overvaluation, and stagnant labour incomes has introduced a high degree of vulnerability in the Canadian housing market, according to Canada Mortgage and Housing Corporation. “High vulnerability at the national level is largely a reflection of problematic conditions in several local housing markets across Ontario and Eastern Canada,” CMHC said in the latest edition of its quarterly Housing Market Assessment. The Crown Corporation said that historically low-interest rates, government fiscal support programs, and the mass inoculation against COVID-19 have given Canadians improved employment prospects, purchasing power, and disposable income levels in the first half of 2021. https://adiamondmortgage.com/housing-market-vulnerable-cmhc/ #aDiamondMortgage #thedifferencemortgage #tdmsweepstakes #yycmortgage #yycre #yychome #yychomes #yychomesforsale #yychomebuyers #yycrealestate #calgaryhomes #calgaryrealestate #calgaryhomesforsale #calgaryhomebuyer #calgaryhomebuyers #calgarymortgagebroker #calgarymortgages #yycmortgage #yycmortgages #yycmortgagebroker #yycmortgagebrokers https://www.instagram.com/p/CUa9DRKD4dN/?utm_medium=tumblr

#adiamondmortgage#thedifferencemortgage#tdmsweepstakes#yycmortgage#yycre#yychome#yychomes#yychomesforsale#yychomebuyers#yycrealestate#calgaryhomes#calgaryrealestate#calgaryhomesforsale#calgaryhomebuyer#calgaryhomebuyers#calgarymortgagebroker#calgarymortgages#yycmortgages#yycmortgagebroker#yycmortgagebrokers

0 notes

Photo

Court Refuses Mortgage Penalty Canada: Court Refuses To Enforce Mortgage Prepayment Penalty Many Canadian mortgages have a prepayment term that imposes a penalty if the mortgage advance is repaid by the borrower before the maturity date. The general purpose of such a term is to provide compensation to the lender for the unanticipated time required to find another borrower of the funds, in contrast to the maturity date where the lender expects to take steps to prepare to reinvest the funds. The specific penalty imposed by a prepayment term, if any, depends on the wording of the mortgage contract between the parties. A recent Ontario Superior Court of Justice decision, 2598508 Ontario Inc. v. 2394049 Ontario Inc. o/a Goodman Green Solutions, 2021 ONSC 5293 (CanLII) involved a dispute over the interpretation of a prepayment clause in a mortgage, which stated: provided that upon giving at least one month’s written notice, the Borrower, when not in default hereunder and having never been in default, shall have the right to prepay the whole or any part of the principal outstanding plus interest accrued, all applicable fee(s), costs, and other sum which may be due as herein set out (the “Mortgage Due”) on any monthly payment date. https://adiamondmortgage.com/court-refuses-mortgage-penalty/ #aDiamondMortgage #thedifferencemortgage #tdmsweepstakes #yycmortgage #yyc #yycre #yychome #yychomes #yycluxuryhomes #yychomesforsale #yychomebuyers #yycrealestate #calgaryhomes #calgaryrealestate #calgaryhomesforsale #calgarycondos #calgaryhomebuyer #calgaryhomebuyers #calgarymortgagebroker https://www.instagram.com/p/CUa6DU7hRiJ/?utm_medium=tumblr

#adiamondmortgage#thedifferencemortgage#tdmsweepstakes#yycmortgage#yyc#yycre#yychome#yychomes#yycluxuryhomes#yychomesforsale#yychomebuyers#yycrealestate#calgaryhomes#calgaryrealestate#calgaryhomesforsale#calgarycondos#calgaryhomebuyer#calgaryhomebuyers#calgarymortgagebroker

0 notes