#debts paid

Text

you're in the habit of denying yourself things.

if someone asked you directly, you would say that you love a little treat. you like iced coffee and getting the cookie. you drink juice out of a fancy cup sometimes, and often do use your candles until they gutter out helplessly.

but you hesitate about buying the 20 dollar hand mixer because, like. you could just use your arms. you weren't raised rich. you don't get to just spend the 20 dollars (remember when that could cover lunch?), at least - you don't spend that without agonizing over it first, trying to figure out the cost-benefits like you are defending yourself in front of a jury. yes, this rice cooker could seriously help you. but you do know how to make stovetop rice and it really isn't that hard. how many pies or brownies would you actually make, in order to make that hand mixer worthwhile?

what's wild is that if the money was for a friend, it would already be spent. you'd fork over 40 without blinking an eye, just to make them happy. the difference is that it's for you, so you need to justify it.

and it sneaks in. you ration yourself without meaning to - you don't finish the pint of ice cream, even though you want to. the next time you go to the store, you say ah, i really shouldn't, and then you walk away. you save little bits of your precious things - just in case. sometimes you even go so far as putting that one thing in your shopping cart. and then just leaving it there, because maybe-one-day, but not right now, there's other stuff going on.

you do self-care, of course. but you don't do it more than like, 3 days in a row. after that it just feels a little bit over-the-edge. like. you can't live in decadence, the economy is so bad right now, kid.

so you don't buy the rice cooker. you can-and-will spend the time over the stove. you can withstand the little sorrows. denial and discipline are practically synonyms. and you're not spoiled.

it's just - it's not always a rice cooker. sometimes it is a person or a job or a hug. sometimes it is asking for help. sometimes it is the summer and your college degree. sometimes it is looking down at scabbed knees and feeling a strange kind of falling, like you can't even recognize the girl you used to be. sometimes it is your handprint looking unsteady.

sometimes it is tuesday, and you didn't get fired, and you want to celebrate. but what is it you like, even? you search around your little heart and come up empty. you're so used to denying that all your desires draw a blank.

oh fuck. see, this is the perfect opportunity. if you had a mixer, you'd make a cake.

#warm up#this isn't good#writeblr#this is complicated by the fact i can't stand up too long or i fuckken pass out and <3 hit my damn head <3#but i did take a deep breath and buy myself the stupid rice cooker#and!!! a very cheap sushi kit!!! i have been wanting to try making sushi for literally YEARS#the kit was only like 15 dollars!!!! and i haven't purchased it bc?!!??!?!?!?!!?#..... i didn't get the mixer tho that felt. like a lot. like too much.#on my list is a kitchenaid. one day when i get a check and i have paid off my student debt#and medical debt#i will put that first little bit of cash#into a kitchenaid 5qt stand mixer (with attachments)#i really do just go into their refurbished section and stare lustily at each option#but yeah i feel guilty about the rice cooker even tho i know for a fact this damn thing is gonna be a lifesaver#oh shit also fuck i forgot to mention . poached eggs

30K notes

·

View notes

Text

Paying consumer debts is basically optional in the United States

The vast majority of America's debt collection targets $500-2,000 credit card debts. It is a filthy business, operated by lawless firms who hire unskilled workers drawn from the same economic background as their targets, who routinely and grotesquely flout the law, but only when it comes to the people with the least ability to pay.

America has fairly robust laws to protect debtors from sleazy debt-collection practices, notably the Fair Debt Collection Practices Act (FDCPA), which has been on the books since 1978. The FDCPA puts strict limits on the conduct of debt collectors, and offers real remedies to debtors when they are abused.

But for FDPCA provisions to be honored, they must be understood. The people who collect these debts are almost entirely untrained. The people they collected the debts from are likewise in the dark. The only specialized expertise debt-collection firms concern themselves with are a series of gotcha tricks and semi-automated legal shenanigans that let them take money they don't deserve from people who can't afford to pay it.

There's no better person to explain this dynamic than Patrick McKenzie, a finance and technology expert whose Bits About Money newsletter is absolutely essential reading. No one breaks down the internal operations of the finance sector like McKenzie. His latest edition, "Credit card debt collection," is a fantastic read:

https://www.bitsaboutmoney.com/archive/the-waste-stream-of-consumer-finance/

McKenzie describes how a debt collector who mistook him for a different PJ McKenzie and tried to shake him down for a couple hundred bucks, and how this launched him into a life as a volunteer advocate for debtors who were less equipped to defend themselves from collectors than he was.

McKenzie's conclusion is that "paying consumer debts is basically optional in the United States." If you stand on your rights (which requires that you know your rights), then you will quickly discover that debt collectors don't have – and can't get – the documentation needed to collect on whatever debts they think you owe (even if you really owe them).

The credit card companies are fully aware of this, and bank (literally) on the fact that "the vast majority of consumers, including those with the socioeconomic wherewithal to walk away from their debts, feel themselves morally bound and pay as agreed."

If you find yourself on the business end of a debt collector's harassment campaign, you can generally make it end simply by "carefully sending a series of letters invoking [your] rights under the FDCPA." The debt collector who receives these letters will have bought your debt at five cents on the dollar, and will simply write it off.

By contrast, the mere act of paying anything marks you out as substantially more likely to pay than nearly everyone else on their hit-list. Paying anything doesn't trigger forbearance, it invites a flood of harassing calls and letters, because you've demonstrated that you can be coerced into paying.

But while learning FDCPA rules isn't overly difficult, it's also beyond the wherewithal of the most distressed debtors (and people falsely accused of being debtors). McKenzie recounts that many of the people he helped were living under chaotic circumstances that put seemingly simple things "like writing letters and counting to 30 days" beyond their needs.

This means that the people best able to defend themselves against illegal shakedowns are less likely to be targeted. Instead, debt collectors husband their resources so they can use them "to do abusive and frequently illegal shakedowns of the people the legislation was meant to benefit."

Here's how this debt market works. If you become delinquent in meeting your credit card payments ("delinquent" has a flexible meaning that varies with each issuer), then your debt will be sold to a collector. It is packaged in part of a large spreadsheet – a CSV file – and likely sold to one of 10 large firms that control 75% of the industry.

The "mom and pops" who have the other quarter of the industry might also get your debt, but it's more likely that they'll buy it as a kind of tailings from one of the big guys, who package up the debts they couldn't collect on and sell them at even deeper discounts.

The people who make the calls are often barely better off than the people they're calling. They're minimally trained and required to work at a breakneck pace. Employee turnover is 75-100% annually: imagine the worst call center job in the world, and then make it worse, and make "success" into a moral injury, and you've got the debt-collector rank-and-file.

To improve the yield on this awful process, debt collection companies start by purging these spreadsheets of likely duds: dead people, people with very low credit-scores, and people who appear on a list of debtors who know their rights and are likely to stand on them (that's right, merely insisting on your rights can ensure that the entire debt-collection industry leaves you alone, forever).

The FDPCA gives you rights: for example, you have the right to verify the debt and see the contract you signed when you took it on. The debt collector who calls you almost certainly does not have that contract and can't get it. Your original lender might, but they stopped caring about your debt the minute they sold it to a debt-collector. Their own IT systems are baling-wire-and-spit Rube Goldberg machines that glue together the wheezing computers of all the companies they've bought over the last 25 years. Retrieving your paperwork is a nontrivial task, and the lender doesn't have any reason to perform it.

Debt collectors are bottom feeders. They are buying delinquent debts at 5 cents on the dollar and hoping to recover 8 percent of them; at 7 percent, they're losing money. They aren't "large, nationally scaled, hypercompetent operators" – they're shoestring operations that can only be viable if they hire unskilled workers and fail to train them.

They are subject to automatic damages for illegal behavior, but they still break the law all the time. As McKenzie writes, a debt collector will "commit three federal torts in a few minutes of talking to a debtor then follow up with a confirmation of the same in writing." A statement like "if you don’t pay me I will sue you and then Immigration will take notice of that and yank your green card" makes the requisite three violations: a false threat of legal action, a false statement of affiliation with a federal agency, and "a false alleged consequence for debt nonpayment not provided for in law."

If you know this, you can likely end the process right there. If you don't, buckle in. The one area that debt collectors invest heavily in is the automation that allows them to engage in high-intensity harassment. They use "predictive dialers" to make multiple calls at once, only connecting the collector to the calls that pick up. They will call you repeatedly. They'll call your family, something they're legally prohibited from doing except to get your contact info, but they'll do it anyway, betting that you'll scrape up $250 to keep them from harassing your mother.

These dialing systems are far better organized than any of the company's record keeping about what you owe. A company may sell your debt on and fail to keep track of it, with the effect that multiple collectors will call you about the same debt, and even paying off one of them will not stop the other.

Talking to these people is a bad idea, because the one area where collectors get sophisticated training is in emptying your bank account. If you consent to a "payment plan," they will use your account and routing info to start whacking your bank account, and your bank will let them do it, because the one part of your conversation they reliably record is this payment plan rigamarole. Sending a check won't help – they'll use the account info on the front of your check to undertake "demand debits" from your account, and backstop it with that recorded call.

Any agreement on your part to get on a payment plan transforms the old, low-value debt you incurred with your credit card into a brand new, high value debt that you owe to the bill collector. There's a good chance they'll sell this debt to another collector and take the lump sum – and then the new collector will commence a fresh round of harassment.

McKenzie says you should never talk to a debt collector. Make them put everything in writing. They are almost certain to lie to you and violate your rights, and a written record will help you prove it later. What's more, debt collection agencies just don't have the capacity or competence to engage in written correspondence. Tell them to put it in writing and there's a good chance they'll just give up and move on, hunting softer targets.

One other thing debt collectors due is robo-sue their targets, bulk-filing boilerplate suits against debtors, real and imaginary. If you don't show up for court (which is what usually happens), they'll get a default judgment, and with it, the legal right to raid your bank account and your paycheck. That, in turn, is an asset that, once again, the debt collector can sell to an even scummier bottom-feeder, pocketing a lump sum.

McKenzie doesn't know what will fix this. But Michael Hudson, a renowned scholar of the debt practices of antiquity, has some ideas. Hudson has written eloquently and persuasively about the longstanding practice of jubilee, in which all debts were periodically wiped clean (say, whenever a new king took the throne, or once per generation):

https://pluralistic.net/2020/03/24/grandparents-optional-party/#jubilee

Hudson's core maxim is that "debt's that can't be paid won't be paid." The productive economy will have need for credit to secure the inputs to their processes. Farmers need to borrow every year for labor, seed and fertilizer. If all goes according to plan, the producer pays off the lender after the production is done and the goods are sold.

But even the most competent producer will eventually find themselves unable to pay. The best-prepared farmer can't save every harvest from blight, hailstorms or fire. When the producer can't pay the creditor, they go a little deeper into debt. That debt accumulates, getting worse with interest and with each bad beat.

Run this process long enough and the entire productive economy will be captive to lenders, who will be able to direct production for follies and fripperies. Farmers stop producing the food the people need so they can devote their land to ornamental flowers for creditors' tables. Left to themselves, credit markets produce hereditary castes of lenders and debtors, with lenders exercising ever-more power over debtors.

This is socially destabilizing; you can feel it in McKenzie's eloquent, barely controlled rage at the hopeless structural knot that produces the abusive and predatory debt industry. Hudson's claim is that the rulers of antiquity knew this – and that we forgot it. Jubilee was key to producing long term political stability. Take away Jubilee and civilizations collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Debts that can't be paid won't be paid. Debt collectors know this. It's irrefutable. The point of debt markets isn't to ensure that debts are discharged – it's to ensure that every penny the hereditary debtor class has is transferred to the creditor class, at the hands of their fellow debtors.

In her 2021 Paris Review article "America's Dead Souls," Molly McGhee gives a haunting, wrenching account of the debts her parents incurred and the harassment they endured:

https://www.theparisreview.org/blog/2021/05/17/americas-dead-souls/

After I published on it, many readers wrote in disbelief, insisting that the debt collection practices McGhee described were illegal:

https://pluralistic.net/2021/05/19/zombie-debt/#damnation

And they are illegal. But debt collection is a trade founded on lawlessness, and its core competence is to identify and target people who can't invoke the law in their own defense.

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” today (Aug 12) at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

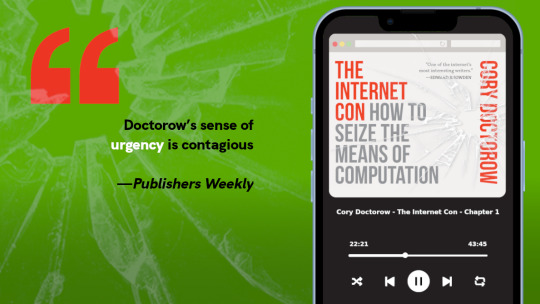

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

#pluralistic#jubilee#debts that cant be paid wont be paid#Patrick McKenzie#patio11#bits about money#debt#debt collection#do not pay#bottom feeders#Fair Debt Collection Practices Act#fdcpa#finance#armbreakers

11K notes

·

View notes

Quote

"Justice Elena Kagan memorably castigated him for treating 'judging as scorekeeping,' whining about 'how unfair it is' when he loses, and repeating the same bad arguments 'at a higher volume.' Justice Sonia Sotomayor has repeatedly accused him of outright dishonesty by misrepresenting precedent and dangling false promises. In a fed-up dissent in just her first term, Justice Ketanji Brown Jackson compared a Kavanaugh majority opinion to the children’s book If You Give a Mouse a Cookie. [Samul] Alito’s rebuttal to Kavanaugh’s dissent in Sackett v. EPAconsisted of exactly one sentence: Kavanaugh’s argument, Alito wrote, 'cannot be taken seriously.'"

Justices are 'losing patience': Brett Kavanaugh skewered as a 'lightweight' in brutal analysis

Hold up.

This guy?

“The consequences will extend long past my nomination. The consequences will be with us for decades. This grotesque character assassination will dissuade confident and good people of all political persuasions from serving our country, and as we all know, in the political system of the early 2000s, what goes around comes around.”

This piece of shit?

The guy who spent his entire life as a right wing activist judge, who was part of the Brooks Brothers “riot”, snarled and barked and insulted the Senate Judiciary Committee during his farcical confirmation hearing, who lied repeatedly about his history of sexual assault, his gambling debts, and threatened to explicitly hurt people who he views as antagonistic to him ... turns out to be an intellectual lightweight in the mold of Thomas? He doesn’t give a flying fuck about law or justice or precedent, he just wants to hurt people he doesn’t like under the color of law?

Wow. None of us saw that coming.

#fuck brett kavanaugh#who paid off brett kavanaugh's gambling debts#impeach brett kavanaugh#scotus#uspol

1K notes

·

View notes

Text

irt poverty/homelessness + alcohol use (esp with @butchfeygela‘s tags on my post)- people really underestimate the function that substance use/alcohol use can have for someone who is unhoused. being unhoused is boring, cold, painful, + lonely. substances can allow the 8 hours panhandling to get the $45 you need for a motel to fly by. alcohol reduces your perception of the cold + can knock you out whben you can’t sleep. substances can help you cope with the physical deterioration from malnutrition, constant stress, + sleeping outside. substances can provide social connection with others who you would otherwise not enjoy or help you cope with being alone.

not only that but- many unhoused people are stuck in a seemingly inescapable position. the pathway to financial stability or even housing is difficult or even impossible. in the wake of that hopelessness, the downsides of substance use start to seem insignificant. arrest? you’re getting arrested anyway for sleeping outside, peeing outside, standing in the wrong place, etc. physical danger? you’re already beat the fuck up, anyway, right? loss of relationships? you’ve lost most people already. inability to keep a job? nobody will hire you + you can’t stay employed, anyway, because you have no car + no shower.

perhaps for you or me, the cons of heroin use or binge drinking nightly greatly outweigh the pros. that isn’t the case for everyone. if we are really serious about ending overdose/addiction, we need to start looking at giving people lives worth recovering into instead of shaming them for their own hopelessness.

#i had a long talk with my dad once about how#my brother sank into so much financial despair#that he was never going to be able to find#a livable job or housing (eviction record#plus bad credit plus#arrest record ofc#he was going to be forced into poverty for the rest of his life#the only job prospects he had were menial shit jobs#he once worked at one of those chicken butchering places#it was the only place that paid him a living wage but he got fired for relapsing#his only options were to go to school part time + try to pass with his dyslexia which made him essentially unable to read#then work a horrible shitty job the rest of the time#while paying atlanta's outrageous rent prices#plus who is he gonna room with?? all his friends are opioid users!#while he paid back all the debt he accrued from going to rehab#then MAYBE after like 6 years of school he could get a decent job#but his credit would be in flames for years his eviction record there for years#his arrest record + lack of driver's license limiting his employment..#sorry but i would have probably given up at that point too#not to mention his interpersonal + familial relationships up in flames + the shame#of the things he did while using hanging over his head#the only family member who didn't think he was an irredeemable fuckup (me) living a thousand miles away + about as broke as him#substance use#harm reduction

305 notes

·

View notes

Text

Shopping trip

#one piece#art#my art#fanart#one piece fanart#zoro#roronoa zoro#nami#hc that zoro paid back some of his debts by carrying all that nami bought#they're besties

783 notes

·

View notes

Text

Swerve signed the contract in blood so therefore Hangman's curse will not affect him. In this essay I will-

#hangman is still the only one to hold that belt and not be riddled with injuries or have a lackluster reign#and after he lost it his curse claimed everyone who held it because they are not true to this game#swerve is true to this he's a real sicko and has paid his debt in blood to have a successful reign#never fail to make shit about hangman because everything is always about hangman#(and btw y'all are seeing this because elle is sleeping and i can't torment her)#hangman adam page#swerve strickland

33 notes

·

View notes

Text

What if Alicent was able to get the upper hand and take Lucerys eye that night, then what?

#I don't think Viserys would punish Alicent#I think Alicent would immediately regret it#how would it change lucemond#aemond and lucerys would be “equal”#there's no debt to be paid#alicent hightower#aemond targaryen#lucerys velaryon#aemond x lucerys#lucemond#house of the dragon

37 notes

·

View notes

Photo

OSCAR KENNEDY as Lord John Grey

2017 • Outlander • S3·EP3 • dir. Brendan Maher

#outlander#perioddramaedit#lord john grey#oscar kennedy#deleted scene#queer media#lgbtedit#lgbtq+#gay#lgbt#gay couple#kiss#period drama#romancegifs#all debts paid#lgbtgifs#gaygifs#queergifs#couple#intimacy#affection#longing#desire#amor#passion#romantic#queer

243 notes

·

View notes

Text

Be sexy. Be silly. Be you.

#4 of my mutuals tagged me for selfies - i have paid my debt#beautiful babes#lawdddddd#me#assets#she's a goddess#she's 30licious#i smell gooood

345 notes

·

View notes

Text

https://x.com/NewBlackMan/status/1702891802833904057?s=20

er 15, 2023September 15, 2023

Georgetown University and the Jesuits have pledged $27 million in money and land donations to the descendants of 19th-century enslaved people who were sold to fund the highly prestigious institution.

According to CNN, the Descendants Truth & Reconciliation Foundation confirmed the gifts of $10 million from Georgetown and an additional $17 million from the Jesuits in the form of financial retribution and plantation land.

“These contributions from Georgetown University and the Jesuits are a clear indication of the role Jesuits and other institutions of higher education can play in supporting our mission to heal the wounds of racism in the United States, as well as a call to action for all of the Catholic Church to take meaningful steps to address the harm done through centuries of slaveholding,” Monique Trusclair Maddox, CEO of the Descendants Truth & Reconciliation Foundation and chair of its board of directors, said.

The donations hope to be a crucial step in rectifying the injustice enacted upon 272 enslaved men, women, and children sold from Jesuit plantations to settle Georgetown’s debts in 1838.

The long-term plan of Georgetown is to pledge over $1 billion through the Descendants Truth & Reconciliation Foundation. According to CNN, the Jesuits made a $100 million commitment to the efforts in 2021. The foundation will use the funds to invest in the lifelong education of descendants, endow programs invested in anti-racism advocacy, and provide support to elderly descendants throughout their lives.

“It is an honor for our University to have the opportunity to contribute to their efforts. The difficult truths of our past guide us in the urgent work of seeking and supporting reconciliation in our present and future,” Georgetown President John J. DeGioia said.

In recent years, the university and the Jesuits have issued public apologies for the atrocities enacted upon the enslaved by the institution’s founding body.

#$27M Reparations To Be Paid To Descendants Of Enslaved People Sold To Fund Georgetown University#georgetown#freedmen#reparations#survivors of georgetown university slavery debt#jesuits

56 notes

·

View notes

Text

Just to be clear, my feeling on Farfadox is that he deprived us of 3 dream streams by killing Dream, therefore the debt must be paid before he is free of sin. I will count today as One.

#sif speaks#just to be clear this is light hearted/a joke#but for any random farfadox fans that find this#you need to understand that 3 dream streams#at 2022 rates#is like 4-6 months worth of content#you don't understand what we've been through#That Is Why The Debt Must Be Paid#in all seriousness farfadox seems hilarious and I'm glad he and Dream are hitting it off#dreamwastaken#farfadox#squidcraft 2 heaven

150 notes

·

View notes

Text

When you hear "fintech," think "unlicensed bank"

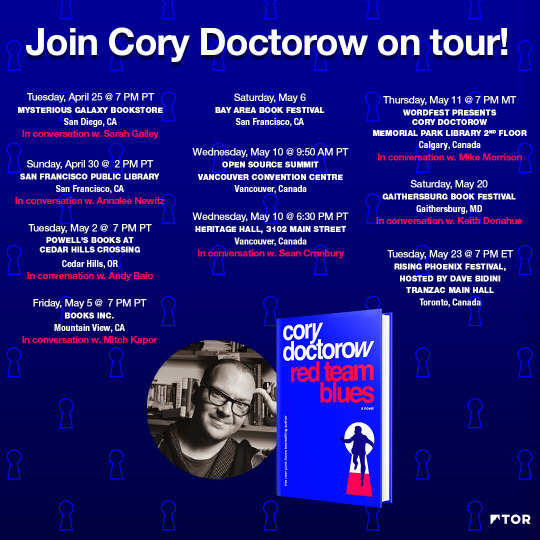

Tomorrow (May 2) I’ll be in Portland at the Cedar Hills Powell’s with Andy Baio for my new novel, Red Team Blues.

In theory, patents are for novel, useful inventions that aren’t obvious “to a skilled practitioner of the art.” But as computers ate our society, grifters began to receive patents for “doing something we’ve done for centuries…with a computer.” “With a computer”: those three words had the power to cloud patent examiners’ minds.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Patent trolls — who secure “with a computer” patents and then extract ransoms from people doing normal things on threat of a lawsuit — are an underappreciated form of “tech exceptionalism.” Normally, “tech exceptionalism” refers to bros who wave away things like privacy invasions by arguing that “with a computer” makes it all different.

These tech exceptionalists are the legit face of tech exceptionalism, the Forbes 30 Under 30 set. They’re grifters, but they’re celebrated grifters. There’s a whole bottom-feeding sludge of tech exceptionalists that don’t get the same kind of attention, like patent trolls.

Oh, and the fintech industry.

As Riley Quinn says, “when you hear ‘fintech,’ think: ‘unlicensed bank.’” The majority of fintech “innovation” consists of adding “with a computer” to highly regulated activities and declaring them to be unregulated (and, in the case of crypto, unregulatable).

There are a lot of heavily regulated financial activities, like dealing in securities (something the crypto industry is definitely doing and claims it isn’t). Most people don’t buy or sell securities regularly — indeed, most Americans own little or no stocks.

But you know what regulated financial activity a lot of Americans participate in?

Going into debt.

As wages stagnate and the price of housing, medical care, childcare, transportation and education soar, Americans fund their consumption with debt. Trillions of dollars’ worth of debt. Many of us are privileged to borrow money by walking into a bank and asking for a loan, but millions of Americans are denied that genteel experience.

Instead, working Americans increasingly rely on payday lenders and other usurers who charge sky-high interest rates, on top of penalties and fees, trapping borrowers in an endless cycle of indebtedness. This is an historical sign of a civilization in decline: productive workers require loans to engage in useful activities. Normally, the activity pans out — the crop comes in, say — and the debt is repaid.

But eventually, you’ll get a bad beat. The crop fails, the workshop burns down, a pandemic shuts down production. Instead of paying off your debt, you have to roll it over. Now, you’re in an even worse situation, and the next time you catch a bad break, you go further into debt. Over time, all production comes under the control of creditors.

The historical answer to this is jubilee: a regular wiping-away of all debt. While this was often dressed up in moral language, there was an absolutely practical rationale for it. Without jubilee, eventually, all the farmers stop growing food so that they can grow ornamental flowers for their creditors’ tables. Then, as starvation sets in, civilization collapses:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

As the debt historian Michael Hudson says, “Debts that can’t be paid, won’t be paid.” Without jubilee, indebtedness becomes a chronic and inescapable condition. As more and more creditors attach their claims to debtors’ assets, they have to compete with one another to terrorize the debtor into paying them off, first. One creditor might threaten to garnish your paycheck. Another, to repossess your car. Another, to evict you from your home. Another, to break your arm. Debts that can’t be paid, won’t be paid — but when you have a choice between a broken arm and stealing from your kid’s college fund or the cash-register, maybe the debt can be paid…a little. Of course, digital tools offer all kinds of exciting new tools for arm-breakers — immobilizing your car, say, or deleting the apps on your phone, starting with the ones you use most often:

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

Under Trump, payday lenders romped through America. A lobbyist for the payday lenders became a top Trump lawyer:

https://theintercept.com/2017/11/27/white-house-memo-justifying-cfpb-takeover-was-written-by-payday-lender-attorney/

This lobbyist then oversaw Trump’s appointment of a Consumer Finance Protection Bureau boss who deregulated payday lenders, opening the door to triple digit interest rates:

https://www.latimes.com/business/lazarus/la-fi-lazarus-cfpb-payday-lenders-20180119-story.html

To justify this, the payday loan industry found corruptible academics and paid them to write papers defending payday loans as “inclusive.” These papers were secretly co-authored by payday loan industry lobbyists:

https://www.washingtonpost.com/business/2019/02/25/how-payday-lending-industry-insider-tilted-academic-research-its-favor/

Of course, Trump doesn’t read academic papers, so the payday lenders also moved their annual conference to a Trump resort, writing the President a check for $1m:

https://www.propublica.org/article/trump-inc-podcast-payday-lenders-spent-1-million-at-a-trump-resort-and-cashed-in

Biden plugged many of the cracks that Trump created in the firewalls that guard against predatory lenders. Most significantly, he moved Rohit Chopra from the FTC to the CFPB, where, as director, he has overseen a determined effort to rein in the sector. As the CFPB re-establishes regulation, the fintech industry has moved in to add “with a computer” to many regulated activities and so declare them beyond regulation.

One fintech “innovation” is the creation of a “direct to consumer Earned Wage Access” product. Earned Wage Access is just a fancy term for a program some employers offer whereby workers can get paid ahead of payday for the hours they’ve already worked. The direct-to-consumer EWA offers loans without verifying that the borrower has money coming in. Companies like Earnin claim that their faux EWA services are free, but in practice, everyone who uses the service pays for the “Lightning Speed” upsell.

Of course they do. Earnin charges sky-high interest rates and twists borrowers’ arms into leaving a “tip” for the service (yes, they expect you to tip your loan-shark!). Anyone desperate enough to pay triple-digit interest rates and tip the service for originating their loan is desperate and needs to the money now:

https://prospect.org/power/05-01-2023-fintech-ewa-payday-loan-scam/

EWA annual interest rates sit around 300%. The average EWA borrower uses the service two or three times every month. EWA CEOs and lobbyists claim that they’re banking the unbanked — but the reality is that they’re acting as sticky-fingered brokers between banks and young, poor workers, marking up traditional bank services.

This fact is rarely mentioned when EWA companies lobby state legislatures seeking to be exempted from usury rules that are supposed to curb predatory lenders. In Vermont, Earnin wants an exemption from the state’s 18% interest rate cap — remember, the true APR for EWA loans is about 300%.

In Texas, payday lenders are classed as loan brokers, not loan originators and are thus able to avoid the state’s usury caps. EWAs are lobbying the Texas legislature for further exemptions from state money-transmitter and usury limit laws, principally on the strength of the “it’s different: we do it with a computer” logic.

But as Jarod Facundo writes for The American Prospect, quoting Monica Burks from the Center for Responsible Lending, a loan is a loan even if it’s with a computer: “The industry is trying to create a new definition for what a loan is in order to exempt themselves from existing consumer protection laws… When you offer someone a portion of money on the promise that they will repay it, and often that repayment will be accompanied with fees or charges or interest, that’s what a loan is.”

Catch me on tour with Red Team Blues in Mountain View, Berkeley, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A stately, columnated bank building, bedecked in garish payday lender signs.]

Image:

Andre Carrotflower (modified)

https://commons.wikimedia.org/wiki/File:30_North_%28former_Pontiac_Commercial_%26_Savings_Bank_Building%29,_Pontiac,_Michigan_-_entrance_and_Chief_Pontiac_relief_sculpture_-_20201213.jpg

CC BY-SA 4.0

https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#cfpb#earned wage access#digital armbreakers#loansharks#payday lenders#tech exceptionalism#jubilee#debt#fintech#usury#michael hudson#graeber#debts that can't be paid wont be paid

670 notes

·

View notes

Photo

#bank run#build back better#bt news#congress#bank bailouts#student debt#student loans#student loan crisis#cancel student loans#cancel student debt#student debt forgiveness#student debt relief#paid family leave#infrastructure#universal childcare#instagram

105 notes

·

View notes

Text

In terms of the anime, I like to believe that Meta Knight paid for the cost of the Halberd by completely illegal means. He absolutely tapped into Dedede’s bank account, and for every single payment that was meant to be forwarded to Nightmare Enterprises, for every single monster that the King tried to pay off, Meta Knight silently wired it into his own account instead.

#meta knight#Kirby#kirby right back at ya#the halberd (kirby)#the king genuinely thinks he paid for those monsters and it’s why he refuses any NME debt collectors#don’t be mistaken tho#he is still a cheepstake king

86 notes

·

View notes

Text

last dnd character of the night—this is Acanthus of the Western Isles, a scholar by trade and Giant Ass Shark Person by birth currently working to pay of an enormous debt by partaking in a late pirate captain's death defying treasure hunt

i liked to draw him in ms paint during the sessions like this w

#miodoodledavinci#acanthus was. certainly something KSJFHKSGFKJH#he was difficult to play because he was a homebrew class and a high intelligence character#but honestly i think it worked out in the end w#he got to pay off his debt at least w#OH though it was fun#he spent 90% of the game thinking one of his fellow party members was a plant sent by the loan sharks he was in debt to#to keep an eye on him and make sure he paid his dues#meanwhile the guy in question was Literally just bluffing to someone when he said he was in the know with People with money#and just thought acanthus was being really nice because they were friends <333333#that was honestly really fun w#the coolest emerald division

49 notes

·

View notes

Text

i made my first student loan payments😶 everyone be proud😶

#hey guys so im happy to announce i will be in debt for the rest of the foreseeable future👍🏼#one down five million more to go#excited to make this better by getting paid shit for the next 15 years of my life while i get a phd#anyway . why does no one else i know have student loans

20 notes

·

View notes