#tax the wealthy

Text

Republicans have, for decades, been cutting social services, including mental health and substance use services, while giving tax breaks to billionaires and corporations without raising the minimum wage. Republicans created the homelessness crisis.

Now they want to criminalize the people who have suffered most from their policies. The only way this can make sense is if Republicans do not care at all how their policies hurt people as long as they get paid.

#homelessness#housing is a human right#housing first#vote blue#end citizens united#vote democrat#tax the wealthy#vote biden#tax the billionaires#billionaires should not exist#vote blue to save democracy#democracy#social democracy#tax the rich#vote blue 2024#tax the 1%#democrats#democratic socialism#democrats now socialism later#tax corporations#biden/harris 2024#vote biden/harris

17 notes

·

View notes

Text

Today’s Tax Day. I’m sorry friends.

ok come over here and let’s be pissed about it together,

lookit👁️👇🏽 dat

youtube

sobscribe to my crime. thanks.

#haha im in danger#tax day#tax season#tax the rich#tax the church#tax the billionaires#tax the 1%#tax time#tax the wealthy#send help#i have no clue#i have no self control#i have no shame#i have no regrets#mental health#mental illness#mentally exhausted#late stage capitalism#Youtube

606 notes

·

View notes

Text

#us politics#twitter#tweet#sen. bernie sanders#vermont#2023#tax the 1%#tax the billionaires#tax the wealthy#taxes#workers unite#working class#working class solidarity

1K notes

·

View notes

Text

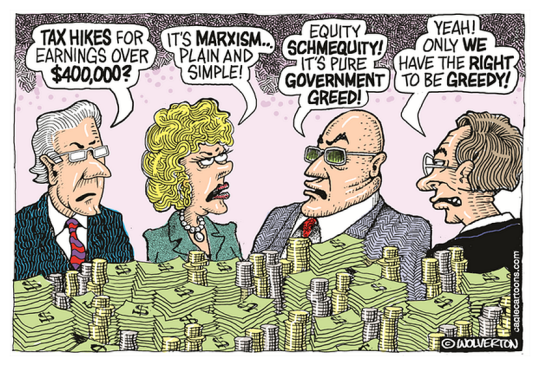

#socialism#anti communism#marxism#anti capitalism#communism#leftism#left wing#anarchist#communist#anarchy#late stage capitalism#capitalism#social issues#social commentary#fuck capitalism#tax the rich#tax the wealthy#tax the church#tax the billionaires#tax the 1%#eat the rich#eat the fucking rich

547 notes

·

View notes

Text

On Wednesday, Senate Health, Education, Labor and Pensions (HELP) Chair Bernie Sanders (I-Vermont) and Rep. Pramila Jayapal (D-Washington) reintroduced a proposal to make higher education free at public schools for most Americans — and pay for it by taxing Wall Street.

The College for All Act of 2023 would massively change the higher education landscape in the U.S., taking a step toward Sanders’s long-standing goal of making public college free for all. It would make community college and public vocational schools tuition-free for all students, while making any public college and university free for students from single-parent households making less than $125,000 or couples making less than $250,000 — or, the vast majority of families in the U.S.

The bill would increase federal funding to make tuition free for most students at universities that serve non-white groups, such as Historically Black Colleges and Universities (HBCUs). It would also double the maximum award to Pell Grant recipients at public or nonprofit private colleges from $7,395 to $14,790.

If passed, the lawmakers say their bill would be the biggest expansion of access to higher education since 1965, when President Lyndon B. Johnson signed the Higher Education Act, a bill that would massively increase access to college in the ensuing decades. The proposal would not only increase college access, but also help to tackle the student debt crisis.

“Today, this country tells young people to get the best education they can, and then saddles them for decades with crushing student loan debt. To my mind, that does not make any sense whatsoever,” Sanders said. “In the 21st century, a free public education system that goes from kindergarten through high school is no longer good enough. The time is long overdue to make public colleges and universities tuition-free and debt-free for working families.”

Debt activists expressed support for the bill. “This is the only real solution to the student debt crisis: eliminate tuition and debt by fully funding public colleges and universities,” the Debt Collective wrote on Wednesday. “It’s time for your member of Congress to put up or shut up. Solve the root cause and eliminate tuition and debt.”

These initiatives would be paid for by several new taxes on Wall Street, found in a separate bill reintroduced by Sanders and Rep. Barbara Lee (D-California) on Wednesday. The Tax on Wall Street Speculation would enact a 0.5% tax on stock trades, a 0.1% tax on bonds and a 0.005% tax on trades on derivatives and other types of assets.

The tax would primarily affect the most frequent, and often the wealthiest, traders and would be less than a typical fee for pension management for working class investors, the lawmakers say. It would raise up to $220 billion in the first year of enactment, and over $2.4 trillion over a decade. The proposal has the support of dozens of progressive organizations as well as a large swath of economists.

“Let us never forget: Back in 2008, middle class taxpayers bailed out Wall Street speculators whose greed, recklessness and illegal behavior caused millions of Americans to lose their jobs, homes, life savings, and ability to send their kids to college,” said Sanders. “Now that giant financial institutions are back to making record-breaking profits while millions of Americans struggle to pay rent and feed their families, it is Wall Street’s turn to rebuild the middle class by paying a modest financial transactions tax.”

#us politics#news#truthout#sen. bernie sanders#progressives#progressivism#Democrats#senate health education labor and pensions committee#College for All Act of 2023#tax Wall Street#tax the rich#tax the 1%#tax the wealthy#college for all#student debt#student loan debt#tuition-free college#Historically Black Colleges and Universities#pell grants#Higher Education Act#Rep. Barbara Lee#rep. pramila jayapal#2023

466 notes

·

View notes

Text

143 notes

·

View notes

Text

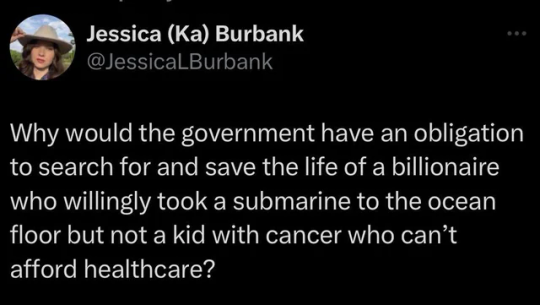

Billionaires don’t fear for their lives enough. That’s a legit issue.

#hunt the rich for sport#eat the rich#burn the rich#billionaires#tax the wealthy#tax the rich#tax the billionaires#tax the 1%#tax billionaires#fuck elon#elongated muskrat#elon musty#elon musk#redistribute wealth#wealth inequality#wage inequality#wealth gap#late stage capitalism#capitalism

402 notes

·

View notes

Text

253 notes

·

View notes

Text

I saved and sharing this in case I win lotto :P

74 notes

·

View notes

Text

#quotes#mary elizabeth lease#wall street#1890#income inequality#corporations#tax the wealthy#tax the 1%#tax the rich

31 notes

·

View notes

Text

my gran called to complain about my coworker who hasn't been pulling her weight. She likes to complain about every person in my life not doing right by me which gets really annoying when it's my friends. Anyway, I give her an update on the coworker situation which is essentially this: It's not about me. The kid is struggling. She's living in poverty with an abusive parent who she can't get away from because of the housing crisis, she's forced to commute for hours every day in a truck she's gonna be paying off until she wrecks it, and when she gets to work she can't do the work because of personal health issues and being pregnant but she can't quit the job because she needs healthcare. That took the steam out of my grandma's Karen rant. Now she could see how heartless it would be to say the kid deserved to be fired. She's anti-abortion so she can't suggest that. Gee it's almost like it would be great, I said, if we had things like affordable housing, universal healthcare, and some kind of government program that gave people who couldn't find safe & accessible work a living wage (with no shame or demeaning conditions) so that this young girl wouldn't be forced to suffer like this— and for what? She is running herself ragged caring for luxury status symbol animals on behalf of a company who's CEO has a net worth in the millions. Who's really not pulling their weight?

#eat the rich#tax the wealthy#poverty#housing crisis#us politics#life of a texan peasant#it makes me so mad#things gran says

34 notes

·

View notes

Text

Some rich people understand that wealth inequality is bad for democrcy, bad for the planet and bad for the vast majority of people.

#abigail dinsey#vote blue#vote democrat#vote biden#tax the rich#democracy#social democracy#tax the billionaires#billionaires should not exist#democratic socialism#democrats now socialism later#tax the 1%#vote blue 2024#tax the wealthy#democrats#vote blue to save democracy#wealth inequality

59 notes

·

View notes

Text

3 notes

·

View notes

Text

#us politics#twitter#tweet#2022#anti capitalism#anti capitalist#fuck capitalism#simping for capitalism#eat the fucking rich#eat the rich#tax the wealthy#tax the 1%#working class#worker's rights#working class solidarity#rent control#living wage#wages

886 notes

·

View notes

Text

#socialism#anti capitalism#marxism#communism#leftism#anti communism#eat the rich#eat the fucking rich#tax the 1%#tax the church#tax the rich#tax the wealthy#tax the billionaires#late stage capitalism#capitalism#social issues#social commentary#fuck capitalism

455 notes

·

View notes

Text

Public-school students in Massachusetts are set to get free lunch and breakfast thanks to a new 4% tax on people's earnings above $1 million.

Massachusetts in 2022 voted for a constitutional amendment to tax high earners. It went into effect at the beginning of 2023.

State House News Service, an independent news wire, reported that $1 billion of the state's record $56.2 billion fiscal budget for 2024 will be funded by its new 4% tax.

Gov. Maura Healey signed the budget on Wednesday, making Massachusetts the eighth state to adopt a plan for free school lunch since the expiration of federal free school lunches that had emerged during the COVID-19 pandemic.

The outlet reported that a portion of the $1 billion expected to be gathered from the new income tax would be used to provide all public-school students in Massachusetts with free breakfast and lunch, if they want it.

WCVB reported that state lawmakers agreed to allocate $523 million of anticipated revenue from the new tax on education and set aside $477 million for transportation.

In February, President Joe Biden urged lawmakers to pass his billionaires' tax proposal, which would impose a minimum 20% tax on households with a net worth of more than $100 million.

Unlike Massachusetts' new tax, which is on income, the proposed billionaire's tax is aimed at wealth.

Jared Bernstein, a member of the White House Council of Economic Advisers, told CNBC the proposal would target "big corporations and the wealthiest Americans," while protecting people who made less than $400,000 a year from tax increases.

Biden also signed the Inflation Reduction Act into law in February, which included a 15% minimum tax on corporations earning more than $1 billion.

#us politics#news#business insider#2023#massachusetts#tax the rich#tax the 1%#tax the billionaires#tax the wealthy#billionaire's tax#biden administration#president joe biden#free school meals#State House News Service#Gov. Maura Healey#Jared Bernstein#White House Council of Economic Advisers#cnbc

77 notes

·

View notes