#wotc tax credits

Text

What You Don't Know About the ERC Could be Holding You Back

Many people have misconceptions about the Employee Retention Credit (ERC) program and the CARES Act. These misconceptions can lead to missed opportunities for businesses to receive much-needed financial support during these challenging times.

Common Misconceptions

One of the most common misconceptions about the ERC program is that it’s only available to large corporations. In reality, the…

View On WordPress

0 notes

Text

Why don't business owners activate their W.O.T.C. benefits after they see how much they can get?

There are probably several reasons:

1. Lack of awareness: Many small business owners may not be fully aware of the WOTC program, that was launched back in 1942, and its potential benefits, leading them to overlook the opportunity to claim tax credits. To late now, you're reading this!

2. Complexity: The WOTC program can be overwhelming, especially for businesses with large volumes of applicants and new hires. Our proprietary software has scaled that hurdle!

3. Time and effort: Many believe the WOTC program to be time-consuming and may divert attention from other business operations. Not so with our automated software!

4. Automation and compliance: Business owners think they may still need to invest in systems or services to ensure compliance with the program's requirements. Our software needs no other systems or servces to be compliant!

5. Prioritization: Business owners may prioritize other aspects of their operations, such as sales, marketing, or product development, over the administrative tasks associated with claiming tax credits, but this software does 98% of the work!

6. Resource constraints: Small businesses, in particular, may have limited resources to dedicate to tax credit programs, and they might focus on more immediate business needs. The average cost is $5/mo with no contract required! Cheaper than what you pay for coffee in a month!!

To address these challenges, businesses can use our automated solutions to simplify the WOTC process, which can help them forecast potential benefits of up to $9600 per hire and stay current with changing tax credit laws.

2 notes

·

View notes

Text

Working on a TTRPG which is a sequel to my free suggestion book "Not F.A.T.A.L. but Serious!" both a tip of the hat to a notorious sh-t lord RPG from earlier (zero connection) and a favorite American but Manga comic. Was hoping I could put up the uncensored version here but it seems Tumblr still has blue noses even though it's almost like reading the best of Penthouse magazine again.

In essence it'll be erotic TTRPG play with no holds or holes barred. We are F-cking adults playing the games now, but the core properties were owned and dominated by dry corporations making "Product" that had to be G-rated. Now the "Woke" rated is far far worse. So not for kids but you can download the original here and working cover for the upcoming full RPG later.

Serious - click the link (+18), go to the image of the top left and right click "Save as..." PDF document! - I'm privately hosted and NO ADS no SCRIPTS no GARBAGE. Not a full RPG just a book of suggestions that got the woke tourists invading to ruin TTRPGs to scream. That's their agenda, this is mine... I'll play my F*cking games any F*cking way I want them and I want to be able to buy and sell +18 interest.

The rainbow unicorn snowflakes can have Thirsty Sword Lesbians and Zwei-Hander. I'm not holding my gladius to their soy throats with no chins to play MY stuff but I expect something they are incapable of; respect -and that means for someone who has different views than them. If they can't understand that are their snowflake fake sh-t politics worth ANY respect? Jeebuz, I'm quite "Liberal" not a right winger.

Ai + 3D art by me. She's WAY over 18 like 200+ even in fiction, slime minds...!

Heads up - like any real Indie TTRPG I'll use AI art but still keep the few artists who'll do commissions for me employed like Max here. He can do hundreds of pretty damsels in distress and ribaldry in the time it'd take him to paint a swamp or dungeon Midjourney can do in seconds so why waste the time and money?

Let WotC ruin D&D for Blackrock EFT social credit - though I advise writing your Congress + Senate reps for the tax $ they'll scream to turn a failure into profit. The best out is to support the REAL indies that do NOT Bend the Knee to woke whine-buckets.

DEMAND from your TTRPG maker and game at least one element the "Woke" will NOT tolerate. I'm not for real sexism or racism and don't care who you voted for. The world has (and always will) 1,000,001 problems... Censoring comic books, video games, movies and pandering to rainbow unicorn snowflakes from some 'safe space' at a debt factory (College) does NOTHING to help anything on that list. Here are some statements free to include for free speakers, free thinkers versus "Woke" whine buckets:

Oh and speaking of lists...

One of the BEST things on the internet for RPGs "The List".

They just want you to know if your RPG maker is a rainbow unicorn snowflake who cares their woke fake politics vs anything to do with a RPG at all. Agenda vs product. Invaders. Tourists. Most of these people are vile on Twitter and (Zwei-Hander) demand you do NOT play their game unless you agree 100% with them. How in the world their books sit in PILES at major bookstore chains for years no sales but can NOT fail is beyond me - save knowing about 'short-selling' and corporate EFT.

So I advise looking for GREEN on the list, companies that care about their games and players NOT warmed over re-hashed master of the obvious "Woke" sentiment that preaches to its own choir.

3 notes

·

View notes

Text

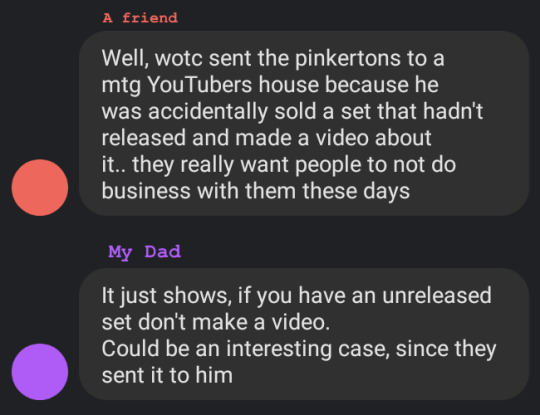

I just want to vent about my dad on a website I know he doesn't use. (He's a Reddit/Facebook man.)

These are two texts from our D&D group's groupchat. In it, Dad reacts to finding out that WotC hired the literal Pinkertons to intimidate someone who got sold the wrong trading cards by criticizing the guy who the Pinkertons intimidated.

This is typical for my dad. When these tales of corporate misdeeds happen, Dad always defends the corporations. If they are not breaking the law, he takes that as evidence that they're in the right. If they are breaking the law, he tries to downplay the severity of the crime. He's a corporate bootlicker, and I don't think he realizes it.

This bootlicking is a bit ironic, since my dad is a "Don't Tread on Me" libertarian. Well, if you asked he'd say he had disagreements with the Libertarian party, but he's never explained exactly what those disagreements are. Which is actually pretty similar to his relationship with the Republican party; Dad will say he holds Democrats and Republicans in equal disdain, but he's complained long and often about Democrats with their gun control and Obamacare and taxes. By contrast, the worst thing he's said about Donald Trump is that he doesn't protect gun rights.

Now, I don't think Dad actually agrees with the alt-right. He's voiced support for minority rights and stuff, even if it's in a milquetoast "We've basically achieved equality, and also the government shouldn't stop businesses from discriminating because the free market will put them out of business" way. But when he talks about politics, he doesn't complain about conservatives. He complains about liberals.

And he talks about politics a lot. My dad might espouse disinterest in the country's political parties, but he has strong opinions about politics. His political discussions, which he made sure to include me and my brother in, are a big part of why I care about politics as much as I do—and to his credit, he encouraged us to think for ourselves instead of just following his politics. I too was a dumbass libertarian for a while, but when I was presented with new evidence, I could change my mind.

But, well. Having a politically-opinionated dad, while being politically-opinionated in the opposite direction is a bit of a problem. And in case you didn't pick up from the way I described my dad defending WotC and also have not noticed any other political post I've made on this blog, I am firmly opposed to capitalism in general and capitalists fucking over employees (or other individuals who annoy them) in specific. So there's a bit of tension there. And I don't know what to do with it.

So far, I've mostly tried to avoid it. That's successful most of the time, but not all the time. Everything is political; even if my dad wasn't the kind of guy who talks with his kids about the president's health care policy or California gun control, politics would come up sooner or later. The friend in the group chat wasn't trying to be political; he just relayed an interesting news story relevant to the group's shared interests. But corporate malfeasance is a political issue, whether you want it to be or not. Politics are gonna come up.

I guess I could argue with him, point out that WotC's actions are morally bankrupt, no matter how legal they are. Question why making a video about some cards that you bought is grounds for getting goons sent to your house. Hell, maybe I should do that, push back against shitty political ideas. But what would the result of that be? I'd get mad, my dad would get mad, neither of us would change our minds, and it's not like the rest of the group would care.

For now, I guess I'm venting my frustrations on Tumblr. I hope that's a healthy outlet.

#family#politics#not sure how to tag this#not sure I want anyone to read this#but it'll be stuck in my head if I just delete it or leave it in my drafts indefinitely or something#so queue it is

2 notes

·

View notes

Text

Tax-Smart Strategies: Navigating Liabilities, Maximizing Savings for Small Businesses

For small business owners in Dubai, tax season often brings a wave of apprehension. However, with the right tools and strategies, navigating taxes can become a manageable task. With specialized bookkeeping services in Dubai and effective tax planning, you can turn this period into an opportunity to maximize deductions, minimize liabilities, and retain more funds for your business's growth. Let's delve into practical tips that will make tax planning in Dubai a seamless and rewarding experience!

Understanding Deductible Expenses:

Expense Tracking Magic:

Keep meticulous records of all business expenses, from office supplies to travel costs. The more organized you are, the easier it is to identify deductible expenses come tax time.

Home Office Advantage:

If you work from home, don't overlook the home office deduction. Measure your workspace's square footage and calculate the percentage used exclusively for business activities to claim this deduction.

Leveraging Tax Credits:

Research & Claim:

Stay updated on available tax credits for small businesses, such as the Small Business Health Care Tax Credit or Research and Development Tax Credit. Every credit claimed is money saved! The R&D tax credit incentivizes businesses to invest in innovation and development. Eligible activities include creating new products, improving existing processes, and conducting scientific research.

Employee Incentives:

Utilize tax credits related to hiring and retaining employees, like the Work Opportunity Tax Credit (WOTC), which rewards businesses for hiring individuals from certain target groups. In addition to hiring incentives, businesses can also leverage tax credits for employee retention programs. Some states offer tax credits for businesses that retain employees for a specified period, encouraging long-term employment relationships.

Strategies for Reducing Tax Liabilities:

Smart Investments:

In Dubai, making smart investments can significantly impact your business's financial health and tax liabilities. One key strategy is to consider investing in equipment or technology that qualifies for Section 179 deductions. This provision allows businesses in Dubai to deduct the full purchase price of qualifying equipment from their gross income, leading to substantial tax savings.

Timing is Key:

Plan the timing of your income and expenses strategically to gain an advantage. For instance, delaying income until the next tax year or prepaying deductible expenses before year-end can impact your tax liabilities positively.

Tax Consultancy Benefits:

Expert Guidance:

Don't underestimate the value of professional tax consultancy services. Experts can help identify tax-saving opportunities specific to your business and ensure compliance with regulations. Contrary to common misconceptions, engaging professional tax consultancy services can be cost-effective in the long run. The tax savings, compliance assurance, and strategic guidance provided often outweigh the consultancy fees, resulting in a positive return on investment.

Stay Updated:

Staying updated with tax laws and regulations is crucial for businesses to navigate the dynamic tax landscape effectively. Tax laws evolve frequently due to legislative changes and economic factors, impacting tax rates, deductions, and compliance requirements. Being informed helps businesses avoid compliance risks, seize tax planning opportunities, and make informed financial decisions aligned with current regulations.

Bookkeeping Services Dubai:

Local Expertise:

If your business operates in Dubai, consider leveraging Accounting services tailored to the region. Professionals familiar with local tax laws can provide specialized advice for maximizing savings.

Compliance Made Easy:

Outsourcing bookkeeping services in Dubai ensures accurate record-keeping and adherence to regulatory requirements, minimizing the risk of costly tax penalties.

Tax planning shouldn't feel daunting. By incorporating these tax-saving strategies, leveraging available deductions and credits, and consulting with experts as needed, small businesses can glide through tax season effortlessly while retaining more funds. Keep in mind that every dollar saved on taxes is a dollar that can be reinvested into your business's development and triumph.

#TaxStrategies#DubaiBusiness#BookkeepingServicesDubai#AccountingServices#BookkeepingServices#TaxConsultancy#DubaiBookkeeping#FTAServices#CompanyFormation#UAEFreeZone#FreeZoneCompanyFormation#vatcompliance#tax consultants in dubai

1 note

·

View note

Text

Payroll and Tax Season: Tips for Smooth Navigation

Tax season can be a daunting time for small business owners, especially when it comes to managing payroll. With numerous regulations, deadlines, and potential pitfalls, it's essential to have a solid plan in place to navigate this period smoothly. Here are some practical tips to help you tackle payroll and taxes with confidence during tax season:

1. Stay Organized: Start by organizing all relevant payroll documents, including employee records, tax forms, and financial statements. Create a dedicated folder or digital file for easy access throughout the tax season.

2. Understand Tax Deadlines: Familiarize yourself with key tax deadlines, including deadlines for filing payroll tax returns, issuing W-2 and 1099 forms, and making quarterly estimated tax payments. Missing deadlines can result in penalties and fines, so mark these dates on your calendar and set reminders to ensure compliance.

3. Keep Accurate Records: Maintaining accurate payroll records is crucial for tax compliance. Keep detailed records of employee wages, hours worked, tax withholdings, and any other relevant information. This will help streamline the tax preparation process and minimize errors.

4. Review Employee Classification: Ensure that your workers are properly classified as employees or independent contractors for tax purposes. Misclassifying workers can lead to costly penalties and legal issues, so review classification criteria carefully and seek professional guidance if needed.

5. Calculate Taxes Correctly: Accurately calculating payroll taxes is essential to avoid underpayment or overpayment. Use reliable payroll software or consult with a tax professional to calculate federal, state, and local taxes, as well as Social Security and Medicare contributions, based on current rates and regulations.

6. Monitor Changes in Tax Laws: Tax laws and regulations are subject to change, so stay informed about any updates that may impact your payroll taxes. Subscribe to reliable tax news sources, consult with a tax advisor, and attend relevant seminars or webinars to stay up-to-date on changes that may affect your business.

7. Utilize Tax Credits and Deductions: Take advantage of available tax credits and deductions to reduce your tax liability. Research tax credits for small businesses, such as the Work Opportunity Tax Credit (WOTC) or the Employee Retention Credit (ERC), and explore deductions for business expenses, retirement contributions, and healthcare costs.

8. Implement a Payroll Compliance Checklist: Create a payroll compliance checklist to ensure that you're meeting all legal requirements and avoiding common pitfalls. Include tasks such as verifying employee information, reconciling payroll records, and filing tax forms accurately and on time.

9. Prepare for Audits: Be proactive in preparing for potential tax audits by maintaining thorough and accurate records, documenting any tax-related transactions or decisions, and responding promptly to any inquiries from tax authorities. Consider seeking assistance from a tax professional to navigate the audit process effectively.

10. Seek Professional Guidance: If you're unsure about any aspect of payroll and tax compliance, don't hesitate to seek professional guidance. Experts offering services of payroll for small businesses in Oklahoma City OK can provide valuable expertise and assistance tailored to your business's specific needs.

0 notes

Text

"Top Tax Planning Strategies for Small Business Owners"

Selecting the Correct Company Structure: Selecting an LLC, S-corporation, partnership, sole proprietorship, or other type of company can have a big tax impact. Because every structure has a unique tax treatment, it's critical to take into account aspects like liability protection, administrative simplicity, and tax benefits.

Maximize Deductions: Make the most of all the available deductions, especially those for business expenses like utilities, travel, office supplies, and equipment. To maximize tax savings and support deductions, maintain thorough records and receipts.

Retirement Plans: Business owners can invest for the future and receive tax benefits by contributing to retirement plans such as 401(k)s, SIMPLE IRAs, and SEP-IRAs. Usually tax deductible, contributions to these schemes can reduce one's taxable income.

Income Deferral: Tax obligations can be managed by carefully timing the recognition and spending of income. To lower taxable income in the current year, think about delaying revenue to the next year or accelerating deductible costs.

Tax Credits: Examine the tax credits that are available to small businesses, including the Small Business Health Care Tax Credit, the Work Opportunity Tax Credit (WOTC), and the Research and Development (R&D) tax credit. If qualifying conditions are satisfied, these credits can drastically lower tax obligations.

Asset: Utilize asset depreciation to your advantage by deducting costs associated with property, automobiles, and other business assets. Reduce taxable income and expedite deductions by utilizing strategies such as Section 179 expensing or bonus depreciation.

Tax Planning Throughout the Year: Tax planning should be a year-round endeavor, not just a once-a-year task. Regularly review financial statements, monitor changes in tax laws, and consult with tax professionals to adapt strategies as needed.

By implementing these tax planning strategies, small business owners can effectively manage their finances, minimize tax burdens, and maximize profitability. Consulting with tax professionals or financial advisors can provide personalized guidance tailored to specific business needs and goals.

Uhlenbrock CPA is among the leading companies in the region, and they are certified tax planners in San Antonio. They offer a wide range of services such as tax services, business services, and more. If you need assistance with financial tasks and effective solutions for your businesses, Uhlenbrock is there to help you out.

#bookkeeping services in san antonio#tax preparation services san antonio#cpa services in san antonio#uhlenbrockcpa#tax services in san antonio

0 notes

Text

How To Make Your Small Business Tax-Efficient?

Making your small business tax-efficient involves strategic planning and proactive decision-making to minimize tax liabilities while maximizing available deductions, credits, and incentives. By implementing effective tax-saving strategies, small businesses can preserve cash flow, increase profitability, and maintain compliance with relevant tax laws and regulations.

In this article, we'll discuss several key strategies to make your small business tax-efficient.

Choose the Right Business Structure: The choice of business entity has significant tax implications for small businesses. Consider whether operating as a sole proprietorship, partnership, corporation, or limited liability company (LLC) is most advantageous for your tax situation. Each entity type is subject to different tax rules, rates, and compliance requirements. Consult with a tax advisor to determine the most tax-efficient structure for your business.

Maximize Deductions and Credits: Take advantage of all available deductions and credits to minimize taxable income and lower your tax bill. Common deductions for small businesses include expenses such as rent, utilities, supplies, advertising, and employee wages. Additionally, explore tax credits for which your business may be eligible, such as the research and development (R&D) tax credit, the work opportunity tax credit (WOTC), and energy efficiency incentives.

Keep Accurate Records: Maintaining accurate financial records is essential for claiming deductions, credits, and other tax benefits. Keep detailed records of all business income, expenses, receipts, invoices, and other financial transactions. Use accounting software or hire a professional bookkeeper to ensure your records are organized and up to date. Accurate recordkeeping not only simplifies tax preparation but also helps you identify opportunities for tax savings.

Track Business Expenses: Deductible business expenses can significantly reduce your taxable income. Keep track of all business-related expenses throughout the year, including office supplies, equipment purchases, travel expenses, professional fees, and vehicle expenses. Use separate business accounts and credit cards to distinguish between personal and business expenses, making it easier to identify deductible items at tax time.

Plan for Depreciation: Depreciation allows businesses to deduct the cost of certain assets over time. Take advantage of accelerated depreciation methods, such as bonus depreciation and Section 179 expensing, to maximize tax deductions for capital investments. Properly managing depreciation schedules can help you recover the cost of assets more quickly and reduce taxable income in the process.

Consider Retirement Plans: Retirement plans offer tax benefits for both business owners and employees. Explore options such as SEP-IRAs, SIMPLE IRAs, and 401(k) plans to save for retirement while reducing taxable income. Contributions to these retirement plans are typically tax-deductible for the business and tax-deferred for employees, making them valuable tax-efficient savings vehicles.

Understand Pass-Through Deductions: If your business operates as a pass-through entity, such as a sole proprietorship, partnership, or S corporation, you may be eligible for the qualified business income (QBI) deduction. This deduction allows eligible businesses to deduct up to 20% of qualified business income from their taxable income. Review the eligibility criteria and limitations of the QBI deduction to maximize tax savings for your business.

Stay Informed About Tax Changes: Tax laws and regulations are subject to change, so staying informed about updates and developments is crucial for small business owners. Keep up to date with changes in tax rates, deductions, credits, and compliance requirements that may affect your business. Consult with a tax advisor or accountant to understand how these changes impact your tax planning strategies and adjust accordingly.

Invest in Tax Planning: Investing in professional tax planning can yield significant long-term benefits for your small business. Work with a qualified tax advisor or accountant to develop a comprehensive tax strategy tailored to your specific circumstances. A tax professional can help you identify opportunities for tax savings, navigate complex tax laws, and ensure compliance with regulations while minimizing tax liabilities.

Explore Tax Deferral and Timing Strategies: Consider deferring income or accelerating deductible expenses to optimize your tax position. For example, delay invoicing clients or accelerate payments to vendors at year-end to shift income and deductions between tax years. By strategically timing your financial transactions, you can minimize current tax liabilities and maximize tax savings over time.

In conclusion, making your small business tax-efficient requires careful planning, diligent recordkeeping, and proactive tax-saving strategies. By choosing the right business structure, maximizing deductions and credits, keeping accurate records, and staying informed about tax changes, you can minimize tax liabilities and maximize tax savings for your small business.

Collaboration with a qualified tax professional offering services of tax planning for business owners in Mayfield Heights OH is essential to develop and implement a tax strategy that aligns with your business goals and objectives.

0 notes

Text

Why YOUR Company Should Prioritize Hiring Military Veterans 🎖️:

Hiring military veterans is not just an act of gratitude 🙏 for their service; it's a strategic advantage 💼 for all companies.

**Transferable Skills and Leadership**:

Veterans are not just trained in combat; they acquire a wide range of skills applicable in many industries, such as logistics 🚚, IT 💻, engineering 🔧, and healthcare 🩺.

Companies like IBM, Liberty Mutual Insurance, and Microsoft have recognized these skills, offering programs to assist veterans in transitioning to civilian roles and leveraging their military experience in fields like cybersecurity 🛡️, data analysis 📊, and project management 📈.

**Adaptability and Teamwork**:

The military trains individuals to adapt quickly to changing situations and to work efficiently within teams 🤝.

This makes veterans ideal for companies undergoing digital transformations 💡 or tackling complex projects 🏗️.

For instance, Northrop Grumman and Amazon have set benchmarks by integrating veterans into their workforce, valuing their mission-focused approach and ability to work under pressure 🕒.

**Financial Incentives**:

There are also financial incentives 💵 for hiring veterans.

The Work Opportunity Tax Credit (WOTC) offers deductions for businesses employing veterans, which can lower the cost of recruitment and onboarding.

**Commitment and Retention**:

Veterans are known for their commitment and high retention rates 📈, reducing turnover costs for companies.

The skills and dedication they bring can significantly enhance a company's performance and culture 🌟.

**Case Studies: Fortune 500 Companies Leading by Example**:

Several Fortune 500 companies have been at the forefront of veteran employment:

1. Enterprise Holdings and City National Bank are noted for their commitment to hiring and training former service members, recognizing the leadership and operational skills they bring 🌐.

2. Subaru of America and Bridgestone Americas offer supportive environments where veterans can thrive and apply their skills effectively 🚗.

**How Many Veterans Do You Employ?**

This Was Brought To You By Our Friend Joey Brown Of Wonder System Marketing 🚀.

TURN YOUR BUSINESS INTO AN AUTOMATIC REVENUE GENERATING MACHINE TODAY.. Go To https://wondersystem.co/

P.S DO NOT MISS TODAY’S Episode Of The www.verticalmomentumpodcast.com With Special Guest Jordan Mendoza Talking Everything New And How To Monetize LinkedIn.

#hireveterans #HireAVeteran #hiring

#resilience#veterans#recovery#podcast#faith#business#mental health#motivation#podcasting#coffee#jobsearch

0 notes

Text

Boost Your Bottom Line: Exploring Tax Reduction Packages for Small Businesses

As a small business owner, navigating the intricate landscape of taxes can be daunting. However, the prospect of reducing your tax burden and increasing your bottom line is undoubtedly appealing. To achieve this goal, consider exploring tax reduction packages tailored for small businesses. These packages offer targeted strategies to optimize your financial position. Here are key components of effective tax reduction packages:

Depreciation and Expensing: Take advantage of tax laws that allow you to depreciate the cost of business assets over time. Additionally, consider expensing assets through Section 179, which permits immediate deductions for qualifying equipment and property purchases.

Tax Credits: Investigate available tax credits for small businesses. This may include credits for research and development, hiring certain types of employees, or providing access to disabled individuals.

Employee Benefits: Implementing tax-advantaged employee benefit programs can benefit both your business and your team. Health savings accounts (HSAs), flexible spending accounts (FSAs), and retirement plans can offer tax advantages for both employers and employees.

Work Opportunity Tax Credit (WOTC): If your business hires individuals from specific target groups facing barriers to employment, you may qualify for the WOTC. This credit encourages employers to hire individuals who may have difficulty finding work.

Energy-Efficient Upgrades: Explore tax incentives for making energy-efficient improvements to your business premises. Many governments offer tax breaks for investments in renewable energy, energy-efficient lighting, HVAC systems, and more.

Research and Development (R&D) Tax Credit: Encourage innovation within your business and potentially qualify for R&D tax credits. This credit is designed to reward businesses that invest in research to develop new products or improve existing ones.

State and Local Incentives: Don't overlook potential tax reduction opportunities at the state and local levels. Many regions offer specific incentives, grants, or tax breaks to encourage business growth and investment.

Consult a Tax Professional: Engaging with a tax professional or accountant who specializes in small business taxation is crucial. They can help you navigate the complex tax landscape, identify eligible deductions, and ensure compliance with changing tax laws.

By actively exploring and implementing these components of tax reduction packages, small business owners can strategically minimize their tax liability. This, in turn, frees up resources that can be reinvested in the business, fostering growth and sustainability. Remember, staying informed and seeking professional advice are essential steps in maximizing the benefits of tax reduction packages for your small business.

0 notes

Text

Understanding Payroll Taxes

Payroll taxes are a critical aspect of managing finances for businesses in Miami and throughout Florida. Whether you're a small business owner or part of a larger corporation, comprehending payroll taxes is essential to ensure compliance and accurate financial management. In this comprehensive guide, we'll delve into the intricacies of payroll taxes and how partnering with top accounting firms in Florida, offering services such as accountant in Miami, bookkeeping in Miami, and catch-up accounting in Miami, can help you navigate this complex financial landscape.

1. What Are Payroll Taxes?

Payroll taxes are the taxes deducted from employees' paychecks by their employers. These taxes fund various government programs and benefits, including Social Security, Medicare, and unemployment insurance.

2. Types of Payroll Taxes

There are several types of payroll taxes, including:

Federal Income Tax Withholding

Social Security Tax

Medicare Tax

Federal Unemployment Tax (FUTA)

State Income Tax (varies by state)

State Unemployment Tax (SUTA) (varies by state)

3. Employer Responsibilities

Employers have several responsibilities related to payroll taxes, including withholding the correct amount of taxes from employees' wages, matching Social Security and Medicare contributions, and reporting and remitting payroll taxes to the appropriate government agencies.

4. Employee Responsibilities

Employees must provide accurate information on their Form W-4 to determine the correct amount of federal income tax to withhold. They are also responsible for ensuring that their Social Security and Medicare taxes are accurately deducted.

5. Reporting and Filing

Employers must accurately report and file payroll tax returns with federal and state authorities. This includes Form 941 for federal taxes and state-specific forms for state taxes.

6. Compliance and Penalties

Ensuring compliance with payroll tax regulations is crucial. Non-compliance can lead to penalties and fines. Top accounting firms in Florida can help businesses stay compliant and avoid costly mistakes.

7. Tax Planning

Effective tax planning can help businesses minimize their payroll tax liabilities while adhering to tax laws. Accountants in Miami can offer expert guidance in this area.

8. Recordkeeping

Maintaining accurate records related to payroll taxes is essential for audits and compliance. Professional bookkeeping in Miami services can help businesses keep track of payroll-related transactions.

9. Payroll Tax Credits

There are various payroll tax credits available to businesses, including the Work Opportunity Tax Credit (WOTC) and the Employee Retention Credit (ERC). These credits can help reduce tax liabilities.

10. Partnering with Experts

Navigating the complexities of payroll taxes requires expertise and attention to detail. Partnering with top accounting firms in Florida that offer accountant in Miami, bookkeeping in Miami, and catch-up accounting in Miami services can ensure that your business manages payroll taxes accurately and efficiently.

In conclusion, understanding payroll taxes is essential for businesses in Miami and Florida. By partnering with experienced professionals and leveraging accounting and bookkeeping services, businesses can navigate payroll tax regulations, minimize tax liabilities, and ensure compliance. Payroll taxes are a critical aspect of financial management, and with the right expertise, businesses can achieve accurate and efficient payroll tax management.

0 notes

Text

The two best reasons a business should take advantage of the Work Opportunity Tax Credit (WOTC) are:

Financial Benefits: The WOTC is a federal tax credit available to employers who hire and retain individuals from certain targeted groups, such as veterans, ex-felons, and individuals receiving government assistance like Temporary Assistance for Needy Families (TANF) or Supplemental Nutrition Assistance Program (SNAP) benefits. The credit amount varies based on the employee's target group, total hours worked, and total qualified wages paid, with a maximum credit of $2,400 per eligible new hire for most target groups, and up to $9,600 for certain qualified veterans. Our propriatary does all of that.

Social Impact: By participating in the WOTC program, businesses contribute to the broader social goal of providing employment opportunities to individuals who have historically faced significant barriers to employment. This not only benefits the employees but also helps to strengthen local communities and the economy.

The WOTC program is voluntary, and there is no limit to the number of eligible individuals a business can hire, nor is there a cap on the amount of credits a business can claim. Employers can claim the tax credit by going to GMG.ME/143862 and answering three simple questions!!

0 notes

Text

Accounting Services in Delhi

SC Bhagat provides one of the best Accounting Services in Delhi, they offer cost-effective and qualitative Accounting Service and Bookkeeping services in Delhi NCR.

Accounting Services in Delhi | Tax Auditor in India | GST Registration in Delhi

Understand Your Business Structure

The choice of business structure has significant tax implications. Whether you operate as a sole proprietorship, partnership, limited liability company (LLC), or corporation, it’s crucial to understand how each structure impacts your tax obligations. Consult with a tax advisor to determine the most tax-efficient structure for your business.

Keep Accurate and Organized Records

Maintaining accurate financial records is essential for effective tax planning. Keep track of income, expenses, receipts, and invoices throughout the year. This will ensure you capture all eligible deductions, credits, and exemptions during tax filing, minimizing the risk of missed opportunities to reduce your tax burden.

Deductible Business Expenses

Take advantage of deductible business expenses to reduce taxable income. Common deductions include rent, utilities, office supplies, marketing expenses, employee salaries, professional fees, and travel expenses directly related to business activities. Familiarize yourself with the current tax laws and consult with a tax professional to maximize your deductible expenses.

Capitalize on Depreciation

For businesses that purchase assets such as equipment, machinery, or vehicles, capitalizing on depreciation can provide substantial tax benefits. Understand the depreciation rules and consider options such as bonus depreciation or Section 179 deductions, which allow you to deduct the cost of qualifying assets in the year of purchase, thereby reducing taxable income.

Utilize Retirement Plans

Contributing to retirement plans not only secures your financial future but also offers tax advantages. Small business owners can consider options like Simplified Employee Pension (SEP) IRAs, solo 401(k) plans, or individual retirement accounts (IRAs). These plans provide opportunities for tax-deferred growth and potential tax deductions on contributions.

Take Advantage of Tax Credits

Tax credits directly reduce the amount of tax owed, making them highly valuable. Explore available tax credits, such as the Small Business Health Care Tax Credit, Research and Development (R&D) Tax Credit, or Work Opportunity Tax Credit (WOTC). Identify which credits apply to your business and ensure you meet the eligibility criteria.

Monitor Estimated Tax Payments

Avoid penalties and interest by staying on top of your estimated tax payments. Small business owners are typically required to make quarterly estimated tax payments based on their expected annual income. Monitor your income throughout the year and adjust your payments accordingly to align with your tax liability.

Seek Professional Assistance

Tax laws are complex and subject to frequent changes. Engaging the services of a qualified tax professional or accountant is highly recommended. A knowledgeable expert can provide valuable advice, help you identify potential tax-saving opportunities, and ensure compliance with relevant regulations.

Conclusion:

As a small business owner, proactive tax planning is essential for financial success. By understanding your business structure, keeping meticulous records, leveraging deductible expenses, capitalizing on depreciation, utilizing retirement plans, taking advantage of tax credits, monitoring estimated tax payments, and seeking professional assistance, you can optimize your tax strategy and maximize savings. Implement these tax planning tips to not only reduce your tax burden but also enhance the overall financial health of your small business.

https://scbc.co/accounting-and-bookkeeping-service-in-india

0 notes

Text

0 notes

Text

Everything Organizations Should Know About the Work Opportunity Tax Credit (WOTC) https://t.co/3Ktu7C0jia

@deandacosta http://dlvr.it/Sp6Cbc

0 notes