#BankOnUs Credit Cards Online Market Revenue

Text

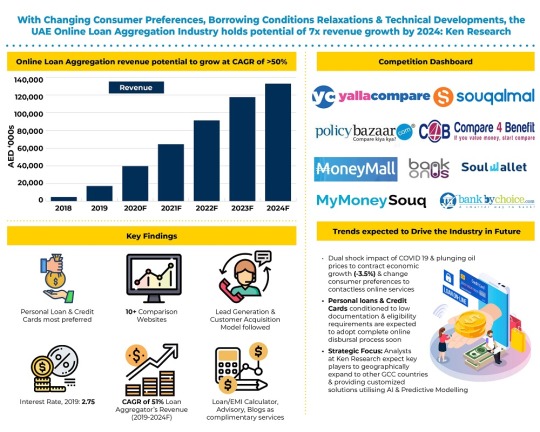

UAE Online Loan Aggregation Industry Holds Potential 7x Revenue Growth By 2024. Will UAE Online Loan Aggregation Industry Stand On This Projected Figure? Ken Research

REQUEST FOR SAMPLE REPORT

Buy Now

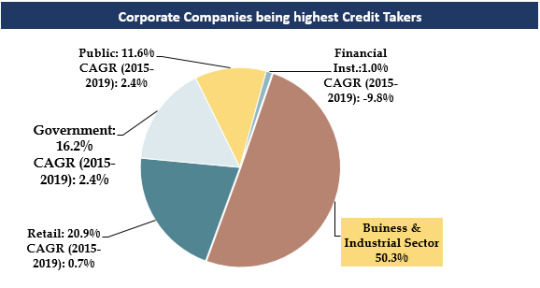

1. With rich, diverse & unparalleled infrastructure, the UAE Loan Industry driven by high corporate loan demand.

Trends and Developments in UAE Online Loan Aggregator Industry

Lending majorly dominated by national banks with wide distribution network, occupying >90% of all banks credit disbursal.

With major investment in hydrocarbon projects & other infrastructure projects, credit demand by government has been rising & expected to further rise in future as well.

Traditional methods of lending (Friends/family) are still preferred choice for availing loans by people with below avg credit history.

Banks are undertaking consolidation activities thereby reducing number of branches, cash offices & promoting digital banking services.

2. Technological Evolution in UAE Banking Services.

To Know More about this report, download a Free Sample Report

Adoption of Blockchain technology in enhancing “Know- Your-Customer” processes, useful in client onboarding, cross border transfers, payments & compliance reporting.

Tasharuk Platform: Launched by UBF to fight against cyber-attacks on banks. Platform enables cyber threat information sharing, identify threats & enhance defense systems.

Incorporating Artificial Intelligence in data analytics, combatting fraudulent activities & compliance improvement, further increasing focus on customer dealing & decision-making processes.

Increased penetration of virtual banking channels including Mobile (>85%), Online Banking (>90%), Branch/Call center (>90%) and ATMs (~100%).

Noticeable shift among customers to online medium for undertaking non-cash transactions of balance enquiries, fund transfers etc.

3. Housing Loan, one of the fastest growing retail loan segments.

Visit This link:- Request for Custom Report

In 2019, average house price in Dubai decreased by ~12% reaching to ~AED 2.58 Mn, thereby, shifting from investor led market to owner-occupied market.

While borrower’s previously preferred fixed interest rates but with Fed Reserve Predictions (2019), noticeable trend was observed for variable rate schemes.

Customers rising preferences for loan providers/aggregators offering other benefits like property management services & post-handover assistance services.

Dubai is dominated by expat population (11 times of Emirati population), who are observed to be preferring indirect channels due to high documentation & eligibility requirements.

Current lending process in The UAE is partially offline; however; with advancements & relaxations in regulations could help in making the process online.

For more insights on the market intelligence, refer to the link below:-

UAE Online Loan Aggregator Market

#BankOnUs Credit Cards Online Market Revenue#Car Loan Market UAE#Commercial Loan Market UAE#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Cards Market UAE#Credit Outstanding in the UAE#Fee rate Loan disbursement UAE#Investments UAE Online Loan Aggregator Startups#Leading players of Loan Aggregator Market#Major Companies Loan Aggregator Market#Major Loan Providers in UAE#Number of Car Loans UAE#Number of Credit Card Users UAE#Number of House Loans UAE#Number of Loans Disbursed UAE#Number of Online Loan Market End Users#Number of Online Loans Disbursed UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Distribution Loan UAE#Online Loan Aggregator Industry UAE#Outstanding Loans UAE#Personal Loan Market UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#Souqalmal UAE Personal Loan Revenue#Top 5 Online Loan Aggregator Startups UAE Top companies UAE Car Rental Market#Top Players Loan Aggregator Market#UAE Cash Loans Online Loan Market

0 notes

Photo

Future of UAE Online Loan Aggregator Market: Ken Research Buy Now COVID 19 Crisis Creating Opportunity in Credit Market As Coronavirus hit the world in 2020, whilst some countries took a slow approach to comprehend & dealing with the situation, UAE was one of the very few countries taking pivotal steps to minimize both health & economic risks in the country.

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Brokers in UAE#Online Brokers vs Online Aggregators UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loans Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis

0 notes

Photo

How are Online Aggregators gaining momentum in UAE? – Ken Research Buy Now Traditionally banks provided limited transparency on loan pricing & charges, making customers call up/visit bank branches just to attain basic loan pricing information.

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Broker vs Online Aggregators UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loan Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis#UAE Online Loan Aggregator Market Forecast

0 notes

Photo

UAE Online Loan Aggregators Industry Outlook to 2024: Ken Research Buy Now The publication titled ‘UAE Online Loan Aggregators Industry Outlook to 2024 - Driven by Shifting to Contactless Services & Easy Online Loan Facilitation’

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Brokers in UAE#Online Brokers vs Online Aggregators UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loans Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis

0 notes

Text

How Online Loan Aggregators contributing to Retail Loan Penetration in UAE? – Ken Research

How Online Loan Aggregators contributing to Retail Loan Penetration in UAE? – Ken Research

Buy Now

The banking industry in UAE is a highly fragmented space with a presence of ~60 national & international banks in the country. Post-2016 oil crisis, suffering from high NPAs banks in UAE tended to be more cautious when lending particularly to corporate & individuals thereby increasing rejection rates. Even now, banks generally avoid lending to ex-pats (sometimes putting additional…

View On WordPress

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loan Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis#UAE Online Loan Aggregator Market Forecast

0 notes

Text

UAE Online Loan Aggregator Market Outlook: Ken Research

UAE Online Loan Aggregator Market Outlook: Ken Research

Buy Now

Socio-Economic Outlook Of UAE

With a population of 9.68 Mn as of 2019, ~70% of the borrowing population belongs to the age group of 30-50 years. A major proportion of the population resides in urban areas including Dubai, Abu Dhabi & Sharjah thereby driving the demand for financial products in the country.

High Job opportunities attract the ex-pat population to the UAE. >80% population is…

View On WordPress

#BankOnUs Credit Cards Online Market Revenue#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Outstanding in the UAE in AED#Fee rate Loan disbursement UAE#Future of UAE Online Loan Aggregator Market#Future Outlook of Retail Lending & Online Loan Aggregators#Impact of COVID 19 on UAE Loan Industry#Major Loan Providers in UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Loan Aggregator Industry UAE#Online Loan Aggregator Market UAE#Online Loan Industry in UAE#Online Loans Market in UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#PolicyBazaar UAE Personal Loan Revenue#Revenue Loan Aggregators UAE#Souqalmal UAE Personal Loan Revenue#UAE Cash Loans Online Loan Market#UAE Credit Cards Online Market#UAE Fintech Market#UAE Online Aggregator Services Market#UAE Online Car Loan Market#UAE Online Distribution Loan UAE#UAE Online Loan Aggregator Industry#UAE Online Loan Aggregator Industry Research Report#UAE Online Loan Aggregator Market#UAE Online Loan Aggregator Market Analysis

0 notes