#like 20 cents per egg thats how much they are worth to me

Text

my toxic trait is picking up random hobbies on a whim like today i went shopping for a cardigan but found No cardigan i liked and so i naturally decided that i can just knit one even tho the only thing i have ever knit was a 8” by 3” rectangle in 5th grade that just looked so pathetic-

#digital art is truly one of the cheapest hobbies#hobbies i do not recommend with my entire soul: baking#fk baking i have beef with baking baking is a fking SCAM#i denounce ur sugar cookie recipe and ur stupid apple tartes!!!#actually i really love both#but eggs are so expensive now it just cant be worth it#btw who allowed egg prices to go back up#bruh i dont want to pay more than#like 20 cents per egg thats how much they are worth to me#oh but the sanity of the chickens u know what i didnt make the farming industry they should figure that out and i should still be allowed#to eat eggs#also like short of driving to a farm urself and verifying the free rangeness u just cant trust the labels#free range could refer to the holy pasture fields#or it could mean like a 0.2 sqft pissing block outside the pen#im tired of making posts about gj let me vent about eggs for one night geez#delete later

161 notes

·

View notes

Text

18 favorite financial rules of thumb (and some useful money guidelines)

Shares 392

After twelve years of reading and writing about money, Ive come to love financial rules of thumb.

Financial rules of thumb provide helpful shortcuts for making quick calculations and decisions. You dont always have time (or want to take the time) to create elaborate spreadsheets when choosing a course of action. In these cases, its nice to have some rough guidelines you can rely on.

Youve probably heard of the rule of 72, for example. This shortcut says that if you divide 72 by a particular rate of return, youll get the number of years itll take to double your money. If your savings account yields 4%, say, it will take about 18 years for your nest egg to increase by 100%. But if you were able to earn 12% on your investment, that money would double in six years.

Like all rules of thumb, the rule of 72 isnt precise. It doesnt give an exact answer but a ballpark figure. Financial rules of thumb dont always hold true. But theyre true enough for us to make loose plans based on them.

I have some engineer friends whod get tense at this sort of sloppy guesswork, but most of the rest of us are happy to trade a bit of precision for speed. Thats what rules of thumb are all about!

The trick, of course, is knowing which rules of thumb to use. Most are handy, but some common guidelines do more harm than good.

Rules Gone Wild

In the past, youve probably seen my rant about some of my most-hated financial rules of thumb. Lets look at three things I think conventional wisdom gets wrong (and what I believe are better alternatives).

How much should you save for retirement?

For instance, I get frustrated when I hear financial advisers push the idea that you should base your retirement savings on 70% of your income. Instead of estimating your retirement needs from your income, it makes far more sense to base them on spending. Your spending reflects your lifestyle; your income doesnt.

I think a better rule of thumb for determining retirement needs is this: When estimating how much youll need to save for retirement, assume youll spend as much in the future as you do now. Use 100% of your current expenses to calculate your retirement spending. (And if you want to build in a safety margin, base your future needs on 110% of your current spending.)

How much should you spend on a house?

As I mentioned last week, another rule of thumb that makes me cranky is this common guideline espoused by all sectors of the homebuying industry: Buy as much home as you can afford. No no no no no! Of all financial rules of thumb, this is probably the worst. Its certainly one of the most prevalent. This is how folks end up house poor, chained to a mortgage they resent.

Lenders quantify this guideline by saying your housing payments should be nor more than 28% or 33% or 41% of your income. But, as David Bach wrote in The Automatic Millionaire Homeowner, You should generally assume that the amount the bank or mortgage company is willing to loan you is more than you should borrow. A better rule of thumb? Spend as little on housing as possible. Spending less than 25% of your net income is best less than 20% is even better.

How much life insurance should you carry?

A third rule that bugs me is the one for determining how much life insurance you should buy. Different experts give different answers. Some say your policy should cover five times your annual income. Others say ten times. And Suze Orman recommends 20 times annual income needs.

The truth is that not everyone needs life insurance. Like all insurance, its designed to prevent financial catastrophes. You only need it if other people like a spouse or children would face financial hardship when you die. If you dont have kids, if your spouse has a good income, or you have substantial savings, then life insurance isnt a necessity.

Even if you do need life insurance, you probably dont need to carry as much as your insurance agent is willing to sell you. To find out the amount thats right for you, check out the Life Insurance Needs Calculator from the non-profit Life Happens organization. (How much life insurance should I carry? According to this calculator, I shouldnt have any at all. And I dont.)

Useful Financial Rules of Thumb

Financial rules of thumb usually arent this bad. In fact, most are useful. Here are eighteen of my favorites.

When estimating income, $1 an hour in wage is equivalent to $2000 per year in pre-tax earnings. The reverse is also true: $2000 per year in salary is equal to $1 an hour in hourly wage. (This rule works because the average worker spends roughly 2000 hours per year on the job.)How wealthy should you be? According to the authors of The Millionaire Next Door, the following wealth formula can tell you if youre on target: Divide your age by ten, then multiply by your annual gross income. Your net worth should be equal to this number (less any inheritances). So, if youre 40 and make $50,000 per year, your net worth should be $200,000. If you have less than half the expected amount, youre an under-accumulator of wealth. If you have twice the target, youre a prodigious accumulator of wealth. (Note that the authors are well aware that this formula doesnt work well for young people; its meant to be used by folks nearing retirement age.)On average, each dollar an American spends represents about $2.50 of after-tax value in ten years or $10 in thirty years. (If you live outside the U.S., the consequences of spending that dollar are probably even greater.) This is due to two reasons: taxes and compounding. When you buy something, you spend after-tax dollars. On average, Americans have to earn $1.33 to have $1.00 left over.Inflation is the silent killer of wealth. In the U.S., inflation has averaged 3.18% over the past hundred years. A lot of folks figure a 3% inflation rate when making money calculations. I think its safer to assume 3.5% or even 4% average inflation in the future.Historically, U.S. stocks have earned long-term real returns (meaning inflation-adjusted returns) of about 7%. Bonds have long-term real returns of around 2.5%. Gold and real estate have long-term real returns of close to 1%.If you withdraw about four percent of your savings each year, your wealth snowball will maintain its value against inflation. During market downturns, you might have to withdraw as little as three percent. If times are flush, you might allow yourself five percent. But four percent is generally safe. (For more on safe withdrawal rates, check out this article from the Mad Fientist.)Based on the previous rule of thumb, theres a quick way to check whether early retirement is within your reach. Multiply your current annual expenses by 25. If the result is less than your savings, youve achieved financial independence you can retire early. If the product is greater than your savings, you still have work to do. (If youre conservative or have low risk tolerance, multiply your annual expenses by 30. If youre aggressive and/or willing to take on greater risk, multiple by 20.)Building on the above, Mr. Money Mustaches shockingly simple math behind early retirement gives us a useful rule of thumb for determining how long youll need to save before youre financially independent. Figure out your current saving rate (or profit margin, if you prefer). Subtract this number from 60. Roughly speaking and assuming youve started from a zero net worth thats how long youll need to work before your nest egg is big enough to support you in retirement. (Note that this rule breaks down at saving rates over 40%. If you save a lot, subtract from 70.)Joe from Stacking Benjamins likes what he calls the penny approximation: Assuming a safe withdraw rate of roughly four percent, every $100 you save gives you one penny per day in perpetuity. Once you stack enough Benjamins you have enough pennies to sustain you forever. If you change your own brake pads and save $200, thats two cents a day for the rest of your life because you avoided paying a mechanic.

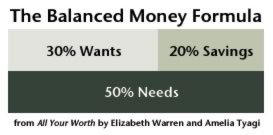

I hate detailed budgets because they bog people down. Instead, Im a fan of budget frameworks that focus more on the Big Picture. My favorite budget framework is the Balanced Money Formula: Spend no more than 50% of your after-tax income on Needs, put at least 20% into savings (including debt reduction), and spend the rest (around 30%) on Wants. This is a great beginner budget, but its also useful for transitioning to the mindset of Financial Independence. If you decide early retirement is a goal, then part of your Wants spending becomes additional savings.If you own your home, its wise to set aside money for maintenance and repairs. Each year, contribute 1% of your homes current value to a separate account. If you dont spend the money, keep it there for future remodeling and improvements.Is it better to buy or to rent? The price-to-rent ratio is a useful rule of thumb for making this decision. Find two similar places, one for sale and one for rent. Divide the sale price of the one by the annual rent for the other. The result is the P/R ratio. Say you find a $200,000 house for sale in a nice neighborhood, and a similar home for rent on the next block for $1000 per month, which is $12,000 per year. Dividing $200,000 by $12,000, you get a P/R ratio of 16.7. If the P/R ratio is low, its better to buy. If the price-to-rent ratio is over 15, its probably better to rent.How much does it cost to raise a child? As a rule of thumb, budget $10,000 per child per year. Thats not quite a quarter of a million dollars per kid, but its close.If you get a windfall, use 1% to treat yourself. (Or maybe 2%, tops.) Put the rest in a safe place and ignore it for six months. After youve had time to think about it, then take action. So, if you inherit $100,000 from Aunt Marge, only allow yourself a $1000 splurge. Stash the remaining $99,000 someplace you wont be tempted to spend it.To approximate a new vehicles five-year cost of ownership (in monthly terms), double the price tage and divide by 60. Looking at a brand-new Mini Cooper ? Double that $30,000 sticker price to get $60,000, then divide by 60. Is it really worth $1000 per month to get rid of your crummy Ford Focus?The standard rule of thumb is to save at least 10% of your income. I think a better goal is to aim for 20% and more is better. Financial guru Liz Weston says that if youre young, you should follow this guideline: Save 10% for basics, 15% for comfort, 20% to escape.Nobody agrees how much you should set aside for an emergency fund. Even the experts offer advice ranging from $1000 up to 12 months of expenses. (The most common suggestions range from three to six months of expenses.) One clever rule of thumb to determine how much you should have set aside: Your emergency fund should cover X months of expenses, where X is the current unemployment rate. In other words, because the U.S. unemployment is about 4% right now, you should aim to have enough money in the bank to cover four months of expenses.According to Consumer Reports, wen youre faced with the repair of an appliance (such as a refrigerator or washing machine), you should buy a new one if the appliance is more than eight years old (or if the repair would cost more than half what it would take to buy a replacement).

Its important to remember that rules of thumb arent set in stone. Theyre guidelines. Theyre meant to help you make quick evaluations, not actual life-changing decisions. Financial rules of thumb are a starting point. Start with them, then adjust for your individual goals and situation.

Other Useful Financial Guidelines

Strictly speaking, rules of thumb deal with numbers. Still, there are a lot of non-numeric guidelines that I think are useful to know. If youve done any reading about personal finance, for example, youve probably heard the admonition, Pay yourself first. While not strictly a rule of thumb, this guideline is very similar.

Here are some other useful financial guidelines:

The more you learn, the more you earn. In the U.S., education has a greater impact on work-life earnings than any other demographic factor. Your age, race, gender, and location all influence what you earn, but nothing matters more than what you know.Bank a raise. When you get a salary bump, dont increase your spending. Stay the course and put the added income into savings.Always take the employer match on the 401(k).Never touch your retirement savings except for retirement.Never co-sign on a loan. (Ever.)Avoid paying interest on anything that loses value. Its okay to finance a home or a college education but avoid taking out a loan on a car.Speaking of cars: When you buy a vehicle, buy used or buy new and plan to drive it for at least ten years. (Do both and youll save even more!)Dont mess with the IRS. When it comes to taxes, dont try to cheat. Pay what you owe. Claim all the deductions you deserve, but dont try to stretch things.In general, save an emergency fund first; pay off high-interest debt second; and begin investing (at the same time you pay down remaining debt) last.It almost always makes more sense (and cents) to repair your old car than to buy a new one.If youre not willing to pay cash for it, then it doesnt make sense to buy it on credit. (I have a friend whose guiding principle is: If I wouldnt buy five, why would I buy one? Similar idea taken to an extreme.)Save for your own retirement before saving for your childrens college education. They can get loans for school. You cant get loans for retirement.

Now its your turn. What rules of thumb did I miss? Do you disagree with any of those I suggested? What are some of your favorite rules of thumb?

Shares 392

https://www.getrichslowly.org/financial-rules-of-thumb/

0 notes

Text

18 favorite financial rules of thumb (and some useful money guidelines)

Shares 352

After twelve years of reading and writing about money, Ive come to love financial rules of thumb.

Financial rules of thumb provide helpful shortcuts for making quick calculations and decisions. You dont always have time (or want to take the time) to create elaborate spreadsheets when choosing a course of action. In these cases, its nice to have some rough guidelines you can rely on.

Youve probably heard of the rule of 72, for example. This shortcut says that if you divide 72 by a particular rate of return, youll get the number of years itll take to double your money. If your savings account yields 4%, say, it will take about 18 years for your nest egg to increase by 100%. But if you were able to earn 12% on your investment, that money would double in six years.

Like all rules of thumb, the rule of 72 isnt precise. It doesnt give an exact answer but a ballpark figure. Financial rules of thumb dont always hold true. But theyre true enough for us to make loose plans based on them.

I have some engineer friends whod get tense at this sort of sloppy guesswork, but most of the rest of us are happy to trade a bit of precision for speed. Thats what rules of thumb are all about!

The trick, of course, is knowing which rules of thumb to use. Most are handy, but some common guidelines do more harm than good.

Rules Gone Wild

In the past, youve probably seen my rant about some of my most-hated financial rules of thumb. Lets look at three things I think conventional wisdom gets wrong (and what I believe are better alternatives).

How much should you save for retirement?

For instance, I get frustrated when I hear financial advisers push the idea that you should base your retirement savings on 70% of your income. Instead of estimating your retirement needs from your income, it makes far more sense to base them on spending. Your spending reflects your lifestyle; your income doesnt.

I think a better rule of thumb for determining retirement needs is this: When estimating how much youll need to save for retirement, assume youll spend as much in the future as you do now. Use 100% of your current expenses to calculate your retirement spending. (And if you want to build in a safety margin, base your future needs on 110% of your current spending.)

How much should you spend on a house?

As I mentioned last week, another rule of thumb that makes me cranky is this common guideline espoused by all sectors of the homebuying industry: Buy as much home as you can afford. No no no no no! Of all financial rules of thumb, this is probably the worst. Its certainly one of the most prevalent. This is how folks end up house poor, chained to a mortgage they resent.

Lenders quantify this guideline by saying your housing payments should be nor more than 28% or 33% or 41% of your income. But, as David Bach wrote in The Automatic Millionaire Homeowner, You should generally assume that the amount the bank or mortgage company is willing to loan you is more than you should borrow. A better rule of thumb? Spend as little on housing as possible. Spending less than 25% of your net income is best less than 20% is even better.

How much life insurance should you carry?

A third rule that bugs me is the one for determining how much life insurance you should buy. Different experts give different answers. Some say your policy should cover five times your annual income. Others say ten times. And Suze Orman recommends 20 times annual income needs.

The truth is that not everyone needs life insurance. Like all insurance, its designed to prevent financial catastrophes. You only need it if other people like a spouse or children would face financial hardship when you die. If you dont have kids, if your spouse has a good income, or you have substantial savings, then life insurance isnt a necessity.

Even if you do need life insurance, you probably dont need to carry as much as your insurance agent is willing to sell you. To find out the amount thats right for you, check out the Life Insurance Needs Calculator from the non-profit Life Happens organization. (How much life insurance should I carry? According to this calculator, I shouldnt have any at all. And I dont.)

Useful Financial Rules of Thumb

Financial rules of thumb usually arent this bad. In fact, most are useful. Here are eighteen of my favorites.

When estimating income, $1 an hour in wage is equivalent to $2000 per year in pre-tax earnings. The reverse is also true: $2000 per year in salary is equal to $1 an hour in hourly wage. (This rule works because the average worker spends roughly 2000 hours per year on the job.)How wealthy should you be? According to the authors of The Millionaire Next Door, the following wealth formula can tell you if youre on target: Divide your age by ten, then multiply by your annual gross income. Your net worth should be equal to this number (less any inheritances). So, if youre 40 and make $50,000 per year, your net worth should be $200,000. If you have less than half the expected amount, youre an under-accumulator of wealth. If you have twice the target, youre a prodigious accumulator of wealth. (Note that the authors are well aware that this formula doesnt work well for young people; its meant to be used by folks nearing retirement age.)On average, each dollar an American spends represents about $2.50 of after-tax value in ten years or $10 in thirty years. (If you live outside the U.S., the consequences of spending that dollar are probably even greater.) This is due to two reasons: taxes and compounding. When you buy something, you spend after-tax dollars. On average, Americans have to earn $1.33 to have $1.00 left over.Inflation is the silent killer of wealth. In the U.S., inflation has averaged 3.18% over the past hundred years. A lot of folks figure a 3% inflation rate when making money calculations. I think its safer to assume 3.5% or even 4% average inflation in the future.Historically, U.S. stocks have earned long-term real returns (meaning inflation-adjusted returns) of about 7%. Bonds have long-term real returns of around 2.5%. Gold and real estate have long-term real returns of close to 1%.If you withdraw about four percent of your savings each year, your wealth snowball will maintain its value against inflation. During market downturns, you might have to withdraw as little as three percent. If times are flush, you might allow yourself five percent. But four percent is generally safe. (For more on safe withdrawal rates, check out this article from the Mad Fientist.)Based on the previous rule of thumb, theres a quick way to check whether early retirement is within your reach. Multiply your current annual expenses by 25. If the result is less than your savings, youve achieved financial independence you can retire early. If the product is greater than your savings, you still have work to do. (If youre conservative or have low risk tolerance, multiply your annual expenses by 30. If youre aggressive and/or willing to take on greater risk, multiple by 20.)Building on the above, Mr. Money Mustaches shockingly simple math behind early retirement gives us a useful rule of thumb for determining how long youll need to save before youre financially independent. Figure out your current saving rate (or profit margin, if you prefer). Subtract this number from 60. Roughly speaking and assuming youve started from a zero net worth thats how long youll need to work before your nest egg is big enough to support you in retirement. (Note that this rule breaks down at saving rates over 40%. If you save a lot, subtract from 70.)Joe from Stacking Benjamins likes what he calls the penny approximation: Assuming a safe withdraw rate of roughly four percent, every $100 you save gives you one penny per day in perpetuity. Once you stack enough Benjamins you have enough pennies to sustain you forever. If you change your own brake pads and save $200, thats two cents a day for the rest of your life because you avoided paying a mechanic.

I hate detailed budgets because they bog people down. Instead, Im a fan of budget frameworks that focus more on the Big Picture. My favorite budget framework is the Balanced Money Formula: Spend no more than 50% of your after-tax income on Needs, put at least 20% into savings (including debt reduction), and spend the rest (around 30%) on Wants. This is a great beginner budget, but its also useful for transitioning to the mindset of Financial Independence. If you decide early retirement is a goal, then part of your Wants spending becomes additional savings.If you own your home, its wise to set aside money for maintenance and repairs. Each year, contribute 1% of your homes current value to a separate account. If you dont spend the money, keep it there for future remodeling and improvements.Is it better to buy or to rent? The price-to-rent ratio is a useful rule of thumb for making this decision. Find two similar places, one for sale and one for rent. Divide the sale price of the one by the annual rent for the other. The result is the P/R ratio. Say you find a $200,000 house for sale in a nice neighborhood, and a similar home for rent on the next block for $1000 per month, which is $12,000 per year. Dividing $200,000 by $12,000, you get a P/R ratio of 16.7. If the P/R ratio is low, its better to buy. If the price-to-rent ratio is over 15, its probably better to rent.How much does it cost to raise a child? As a rule of thumb, budget $10,000 per child per year. Thats not quite a quarter of a million dollars per kid, but its close.If you get a windfall, use 1% to treat yourself. (Or maybe 2%, tops.) Put the rest in a safe place and ignore it for six months. After youve had time to think about it, then take action. So, if you inherit $100,000 from Aunt Marge, only allow yourself a $1000 splurge. Stash the remaining $99,000 someplace you wont be tempted to spend it.To approximate a new vehicles five-year cost of ownership (in monthly terms), double the price tage and divide by 60. Looking at a brand-new Mini Cooper ? Double that $30,000 sticker price to get $60,000, then divide by 60. Is it really worth $1000 per month to get rid of your crummy Ford Focus?The standard rule of thumb is to save at least 10% of your income. I think a better goal is to aim for 20% and more is better. Financial guru Liz Weston says that if youre young, you should follow this guideline: Save 10% for basics, 15% for comfort, 20% to escape.Nobody agrees how much you should set aside for an emergency fund. Even the experts offer advice ranging from $1000 up to 12 months of expenses. (The most common suggestions range from three to six months of expenses.) One clever rule of thumb to determine how much you should have set aside: Your emergency fund should cover X months of expenses, where X is the current unemployment rate. In other words, because the U.S. unemployment is about 4% right now, you should aim to have enough money in the bank to cover four months of expenses.According to Consumer Reports, wen youre faced with the repair of an appliance (such as a refrigerator or washing machine), you should buy a new one if the appliance is more than eight years old (or if the repair would cost more than half what it would take to buy a replacement).

Its important to remember that rules of thumb arent set in stone. Theyre guidelines. Theyre meant to help you make quick evaluations, not actual life-changing decisions. Financial rules of thumb are a starting point. Start with them, then adjust for your individual goals and situation.

Other Useful Financial Guidelines

Strictly speaking, rules of thumb deal with numbers. Still, there are a lot of non-numeric guidelines that I think are useful to know. If youve done any reading about personal finance, for example, youve probably heard the admonition, Pay yourself first. While not strictly a rule of thumb, this guideline is very similar.

Here are some other useful financial guidelines:

The more you learn, the more you earn. In the U.S., education has a greater impact on work-life earnings than any other demographic factor. Your age, race, gender, and location all influence what you earn, but nothing matters more than what you know.Bank a raise. When you get a salary bump, dont increase your spending. Stay the course and put the added income into savings.Always take the employer match on the 401(k).Never touch your retirement savings except for retirement.Never co-sign on a loan. (Ever.)Avoid paying interest on anything that loses value. Its okay to finance a home or a college education but avoid taking out a loan on a car.Speaking of cars: When you buy a vehicle, buy used or buy new and plan to drive it for at least ten years. (Do both and youll save even more!)Dont mess with the IRS. When it comes to taxes, dont try to cheat. Pay what you owe. Claim all the deductions you deserve, but dont try to stretch things.In general, save an emergency fund first; pay off high-interest debt second; and begin investing (at the same time you pay down remaining debt) last.It almost always makes more sense (and cents) to repair your old car than to buy a new one.If youre not willing to pay cash for it, then it doesnt make sense to buy it on credit. (I have a friend whose guiding principle is: If I wouldnt buy five, why would I buy one? Similar idea taken to an extreme.)Save for your own retirement before saving for your childrens college education. They can get loans for school. You cant get loans for retirement.

Now its your turn. What rules of thumb did I miss? Do you disagree with any of those I suggested? What are some of your favorite rules of thumb?

Shares 352

https://www.getrichslowly.org/financial-rules-of-thumb/

0 notes