#turn record profits and fuel inflation... theres no helping it... we have to make

Text

Oh while I'm on U.S. economics, I have another thing that bugs the hell out of me: the hiking of mortgage interest rates.

For those who don't know, mortgage interest rates dropped low during the pandemic. Which is not all sunshine since it resulted in many bidding wars and a ton of way-over-asking offers in competitive areas, but it put home-ownership way more within reach for a lot of people.

Then the fed started to pee their pants over inflation, and hiked their rates up, prompting mortgage companies to follow.

Here's a chart of mortgage interest rates over the last 4 years

It hit a trough at 2.65% on average in early January 2021, and then you see it hiked itself way back up, now chilling at 6.27%

For context on how different these are: let's use an example of a $400,000 home - someone pays 20% down ($80,000) in cash, and finances the remaining 80% ($320,000).

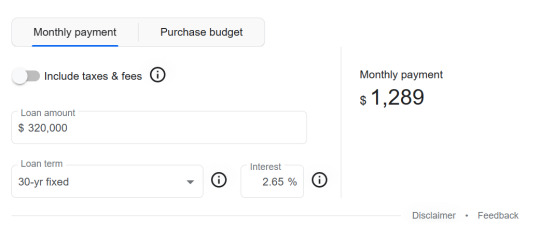

Monthly payments at 2.65%:

This results in paying back, in total, $464,040. You'll notice that's well over the initial $320,000, and that's because of the interest paid over those 30 years.

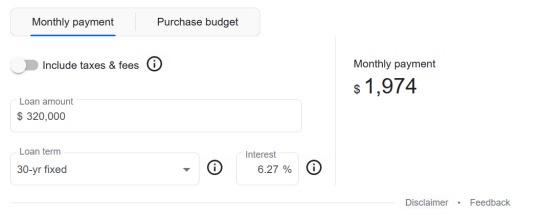

Now, monthly payments at 6.27%:

This results in paying back, in total, $710,640. That's more than twice the initial loan of $320,000.

And, of course, it means the same exact property which could be paid for with a monthly budget of ~$1,300 in early 2021 now requires a monthly budget of ~$2,000 in 2023.

Also, those pandemic lows were an anomaly... Historically, mortgage interest rates were on average HIGHER than 6.27% - but also, historically, wages were much better relative to the prices of homes and people could afford the high interest rates (with the exception of the people who got screwed over in the 2008 housing market meltdown... There's a really good Cold Fusion video on that.)

And because these low interest rates were an anomaly, they may never come back...

So with mortgage interest rates going up, home-buying becomes harder. When home-buying becomes harder, rents increase (because renters have no alternative).

So who DOESN'T get affected?

ENTITIES THAT CAN PAY IN ALL CASH.

They need no mortgage. They pay the sticker price on-spot with no interest applying to them. And I say ENTITIES because, sure, some people can buy their home in all-cash. But a huge number of the entities that can buy in all cash are BIG investment companies--the Blackrocks and the Mega-landlords who scoop up properties to sit on, rent out, and turn for a profit later like it's a piece of stock, and not a habitable property...

Anyway I don't have a conclusion for this. Fix wages, or bring interest rates back down, or kill Blackrock. Preferably all 3.

#Federal Reserve shivering quaking 'but if poor people have disposable income then companies will have no CHOICE but to price-gouge and#turn record profits and fuel inflation... theres no helping it... we have to make#everything harder for poor people...'#gonna start a bingo card if this breaches containment and sparks an argument on libertarian tumblr

280 notes

·

View notes