#stock market news today: svb

Text

Is the Fed Asleep at the Wheel? Silicon Valley Bank Collapse Raises Eyebrows!

Once upon a time in the land of banking regulation, there was a powerful entity called the #FederalReserve. It was tasked with keeping a watchful eye over the banks in the kingdom. But alas! The great and powerful Fed appears to have dozed off, allowing the collapse of Silicon Valley Bank (SVB) to occur right under its nose.

Michael Barr, the #Fed’s vice chair for supervision, admitted in a report that the supervisors failed to fully appreciate #SVB’s vulnerabilities as it grew in size and complexity. It seems that the watchdogs were too busy admiring their shiny badges to take the necessary action when risks were identified. The result? Panic, chaos, and a game of finger-pointing between the Fed and the Federal Deposit Insurance Corp. (FDIC).

Meanwhile, banks like First Republic Bank in San Francisco are left to navigate choppy waters, searching for a lifeboat amidst the storm. To add insult to injury, the FDIC has released a separate report that essentially says, “We found problems, but it’s not our fault the bank failed!” Classic blame-shifting manoeuvre, wouldn’t you say?

Now, Michael Barr has called for an overhaul of rules for banks with more than $100 billion in assets and a re-evaluation of how regulators treat deposits above the $250,000 federal insurance limit. Apparently, hindsight is 20/20, and the time to act is after the ship has already sunk.

Fed Chair Jerome Powell has given his support for these proposed changes, which would reverse some decisions made earlier in his tenure. One can’t help but wonder if the motivation behind this sudden change of heart is to save face or genuinely create a more resilient banking system.

In response to the report, some Republicans in Congress have criticised the push for more regulation. Rep. Patrick McHenry, chairman of the House Financial Services Committee, referred to it as a “self-serving justification of Democrats’ long-held priorities.” As if the world of banking regulation wasn’t confusing enough, let’s throw some political mud-slinging into the mix!

What’s truly remarkable is that amidst all the bureaucratic bungling, the Fed has placed blame on its own structure. It seems the watchdogs were too busy playing fetch with red tape to do their jobs effectively.

And so, dear reader, as we reach the end of this cautionary tale, we must ask ourselves: will the Federal Reserve learn from its mistakes, or will it continue to snooze through future crises? Only time will tell. But one thing is certain: when the next bank collapse comes knocking, the Fed might want to consider setting a louder alarm clock.

#breaking news#economy#finance#business news#headlines today news#latest news#news#trending news#svb#stock market news today: svb#svb collapse#fdicinsured

4 notes

·

View notes

Text

Stock market news today: SVB, Dow and S&P 500 updates

Stocks fall sharply as bank fears consume global markets

#Stock #market #news #today #SVB #Dow #updates

View On WordPress

0 notes

Text

"The underlying reason why the failure of a medium-sized bank in California created so much angst worldwide is that international capitalism has never been able to get back on its feet after 2008.

In more detail: Central banks (the FED, the ECB, etc.) have one basic tool – the interest rate. When they want to put a brake on economic activity to keep inflation in check, they raise the interest rate, and vice-versa. But, in addition to price stability, central banks have two other goals: the stability of the banking system, and the balancing of liquidity with investment. The interest rate chosen by the central bank is one. That same number (e.g. 3%) must achieve three objectives simultaneously: price stability, banking system stability, and balancing between liquidity and investment.

And herein lies the reason why I argue that, after 2008, capitalism cannot recover: There is no longer one interest rate that can achieve all three of these objectives simultaneously. This is the tragedy of central bankers: If they want to tame inflation (at a high enough interest rate), they trigger a banking crisis and, as a result, they are forced to bail out the oligarchs who, despite being bailed out, drive investments below liquidity. If, on the other hand, they impose a lower interest rate to avoid triggering a banking crisis, then inflation gets out of control – with the result that businesses expect interest rates to rise, which discourages them from investing. And so on and so forth.

Back to 2008, then?

No, for two reasons. First, the problem for US banks today is not that their assets are junk (e.g. structured derivatives based on red loans) as they were in 2008, but that they own government bonds which they are simply forced to sell at a discount. Second, the Fed bailout announced yesterday is different from the one in 2008 – today it is the banks and depositors who are being bailed out, but not the bank owners-shareholders. These two reasons explain why bank stocks are falling but there is no total collapse of stock markets.

The fact that there is no total collapse of the stock markets does not, of course, mean that the crisis of capitalism – which has been developing continuously since 2008 – is not deepening. It simply does not have the characteristics of an instantaneous, heavy-handed fall.

What should have been done?

Since 2008, governments and central banks have been trying to prop up the banks through a combination of socialism for the banks, and austerity for everyone else. The result is what we see today: The metastasis of the crisis from one “organ” of capitalism to another, with the magnitude of the crisis increasing with each such metastasis.

What could be done as an alternative? The exact opposite: austerity for the banks, with nationalisation of those who cannot survive. And socialism for workers – a basic income for all, a return to collective bargaining and, further out, new forms of participatory ownership of high- and low-tech companies. In other words, nothing short of a political revolution.

To those who fear the idea of a political revolution, my message is simple: Prepare to pay the price of the escalating crisis of a capitalism determined to take us all to its grave."

5 notes

·

View notes

Text

Today's markets: Calmer seas after SVB sale

New Post has been published on https://petn.ws/GbTyf

Today's markets: Calmer seas after SVB sale

It’s certainly calmer this morning. European stock markets have bounced as a buyer was found for Silicon Valley Bank’s assets. First Citizens will buy most of SVB’s assets for $72bn, helping to lift sentiment across the banking sector after a rocky end to last week, though the pall of banking stress still hangs over the […]

See full article at https://petn.ws/GbTyf

#OtherNews

1 note

·

View note

Link

#Asianmarkets#banking-sectorstability#bankruptcyfiling#BofAGlobalResearch#CreditSuisse#Dow#downtrend#FederalReserve#FederalReservemeeting#interest-ratecuts#Nasdaq#Nifty#Nifty50#People’sBankofChina#S&P500#SVBFinancialGroup#UBS

0 notes

Text

Saturday Night Fixer #191

🔫💰Guerre di banche e droni🛩🛫

👉 SVB e le sue sorelle.

Stocks moving big midday: CS, FRC, HAL

👉Why Credit Suisse Is Losing Investors’ Faith After SVB’s Collapse

👉 Credit Suisse to Borrow Up to $54 Billion From Central Bank – The New York Times

👉 Stock market today: Live updates

👉Eleven Banks Deposit $30 Billion in First Republic Bank – WSJ

👉 L’OP. Sostiene Krugman… Three and a Half Myths…

View On WordPress

0 notes

Text

New Post has been published on All about business online

New Post has been published on http://yaroreviews.info/2023/03/credit-suisse-shares-hit-as-investor-fears-reignite

Credit Suisse shares hit as investor fears reignite

Reuters

By Nick Edser

Business reporter

Credit Suisse’s share price has fallen by more than 10% and stocks markets have edged lower despite attempts to calm fears about a crisis in the banking sector.

The troubled Swiss lender had secured a £45bn lifeline from the country’s central bank.

However, after a brief rise, its shares are now tumbling while markets across the UK and Europe have turned negative.

Major US indexes fell, amid fears of more trouble.

On Thursday, a group of Wall Street giants injected $30bn (£24.8bn) into First Republic, a smaller domestic bank seen as at risk of failure following the collapse of two other mid-sized US banks in recent days.

The rescue by the group of 11 banks including JP Morgan and Citigroup had appeared to calm stock markets. In Asia, Japan’s Nikkei share index closed 1.2% higher.

But shares in First Republic fell more than 15% on Friday after the bank said its was suspending its dividend – its payment to shareholders – “during this period of uncertainty”.

Stock markets in the UK, France and Germany all opened higher but have since fallen.

In New York, the Dow Jones Industrial Average index fell by nearly 1%. The Nasdaq and the S&P 500 indexes were also trading lower.

Meanwhile, a sell-off in Credit Suisse shares has gathered pace.

Shares in Credit Suisse sank earlier in the week on concerns over its future, before the Swiss National Bank said stepped in with emergency funds.

Credit Suisse has been troubled for a long time and continues to be loss-making.

Earlier this week, it rattled investors when it admitted that it had found “material weakness” in its financial reporting.

The issues at Credit Suisse coincided with the failure of two lenders in the US – Silicon Valley Bank (SVB) and Signature Bank – raising fears over the health of the banking system.

US regulators stepped in at the weekend to ensure that customers at SVB and Signature Bank had full access to their money.

Days later, concerns emerged that San Francisco-based First Republic would be the next bank at risk of a rush of customers withdrawing their deposits.

It shares had sunk by nearly 70% over the last week.

The 11 US banks who announced the support said the action reflected their “confidence in the country’s banking system”.

US financial officials said the move was “most welcome, and demonstrates the resilience of the banking system”.

Getty Images

Swetha Ramachandran, investment director at GAM Investments, said that recent events were “very different to 2008” during the financial crisis.

She said authorities were moving “proactively” to stem problems at banks.

“What they’re trying to do is really ringfence the specific issues around individual isolated banks to stop them from becoming systemic,” she told the BBC’s Today programme.

Central banks around the world have sharply raised borrowing costs over the past year to try to curb the pace of overall price rises, or inflation.

The moves have hurt the values of the large portfolios of bonds bought by banks when rates were lower, a change that contributed to the collapse of Silicon Valley Bank, and has raised questions about whether other firms are facing similar situation.

Jeffrey Cleveland, chief economist at US asset manager Payden and Regal, said other banks could be caught up in the problem.

“There could be other vulnerabilities… if central banks are intent on continuing to raise interest rates,” he told the BBC’s Today programme.

“Historically when that happens we do see fragility, we do see problems in the financial system.”

Before the turbulence in the banking sector erupted, both the US Federal Reserve and the Bank of England had been expected to raise interest rates further at meetings next week. However, due to recent events, some have speculated these rate rises might be scaled back or even scrapped.

On Thursday, the ECB announced a further increase to interest rates from 2.5% to 3%.

Related Topics

Companies

Stock markets

Banking

More on this story

Multi-billion dollar rescue deal for US bank

16 hours ago

Credit Suisse to borrow $54bn to shore up finances

1 day ago

How bad is US banking crisis and what does it mean?

2 days ago

Warning that US banks face more pain

2 days ago

0 notes

Text

Confidence, Perception and Reality

With bank failures in the news, confidence in government is wavering bigly…and regardless of facts, perception and reality aren’t the same.

We’ve written numerous articles on confidence in government – or lack thereof – …HERE, HERE, HERE, and HERE.

And we constantly remind you that confidence always outweighs reality.

In other words, it’s basically what you believe to be true is true.

Unfortunately, most people’s perception is often wrong…especially when it comes to the markets.

Example:

There have been all sorts of studies on fundamentals that say if interest rates go up, stocks go down.

It’s not true.

Why?

Because the stock market has never peaked with interest rates twice in history.

If you think you are going to make 25% in the market, you’ll pay 10% interest

But if you really think the market is only going to go up 10%, you won’t pay 10%.

So, it’s always the difference between what you believe and reality.

History, Confidence, Perception and Reality

History proves that all empires eventually collapse under the weight of their own debt.

READ: History Repeats Because Human Nature Doesn’t Change March 16, 2019

And once the government accumulates enormous debt, it targets its citizens aggressively.

That is what we are seeing today with the antics from the District of Caligula regarding honoring deposits at the SVB bank.

To think that the Neocons in DC would screw bank depositors – to the tune of OVER $150 Billion – is unimaginable.

And yet the fact that the Boyz were NOT going to cover all deposits reflects the truth in the collapse of confidence in government.

As a result, O’Biden’s Neocons unleashed a financial panic that won’t be resolved anytime soon.

Does that mean the markets are going to crash?

Nope.

In fact, when loss of confidence in governments accelerates – like now – smart money moves away from the public sector (Govt bonds) and into the private sector (Stocks, real estate, precious metals, collectibles, commodities, etc.).

This reinforces what we’ve been saying for years about how we’re still in The Most Hated Bull Market in History.

And that opportunities of a lifetime await those with ears to hear.

So, listen to what the markets are currently saying by reading our March issue of “…In Plain English” newsletter (HERE).

And share this with a friend…especially if they think – like the rest of the sheeple – that the markets are going to crash.

They’ll thank YOU later.

And Remember: We’re Not Just About Finance

But we use finance to give you hope.

***************************

Invest with confidence.

Sincerely,

James Vincent

The Reverend of Finance

Copyright © 2023 It's Not Just About Finance, LLC, All rights reserved.

You are receiving this email because you opted in via our website.

Read the full article

0 notes

Text

Hot Stocks to buy for Swing Trading for this week – Expert Stock Picks of the Week by StockXpo

Hello to all our readers including Traders, Investors, Analysts, and others!!!!

Stocks Making the Biggest Moves After Hours: SVB Financial, Oracle, Gap, and More

The stock market has been volatile in recent days, with investors closely monitoring the latest news and developments. Several companies have reported their quarterly earnings, with some stocks experiencing significant gains after hours. SVB Financial, Oracle, Gap, and more are among the stocks making the biggest moves in the after-hours market.

SVB Financial, the parent company of Silicon Valley Bank, reported better-than-expected earnings, leading to a 3.8% surge in its stock price after hours. The bank's earnings per share (EPS) of $6.09 beat analysts' estimates of $4.36, driven by strong loan growth and fee income.

Oracle also reported impressive earnings, beating Wall Street estimates on both the top and bottom lines. The tech giant's stock price rose by 2.8% in after-hours trading, as the company's cloud services and license support revenue surpassed expectations.

Gap, on the other hand, experienced a decline in its stock price after reporting weaker-than-expected earnings. The company's net sales of $4.4 billion fell short of analysts' estimates of $4.7 billion, leading to a 2.6% drop in its stock price after hours.

In Just a Few Minutes, This Week Powell Changed Everything on Markets' View of Interest Rates

Federal Reserve Chairman Jerome Powell's remarks at a congressional hearing this week have changed the market's view of interest rates. Powell's comments on the economy, inflation, and the central bank's policy stance have sent ripples across the stock market.

Powell said that the recent rise in inflation is likely to be transitory, but he did acknowledge that it could last longer than expected. He also reiterated the Fed's commitment to keeping interest rates low until the economy has fully recovered from the pandemic.

The market reacted to Powell's remarks, with the Dow Jones Industrial Average closing at a new record high. The S&P 500 also closed higher, while the Nasdaq Composite fell slightly.

Jim Cramer's Investing Club Meeting Friday: Be Selective Buying in This Market Jim Cramer, the host of CNBC's “Mad Money," is holding his monthly investing club meeting on Friday. Cramer will be discussing the current state of the stock market and offering advice on which stocks to buy and which to avoid.

Cramer has been bullish on the stock market in recent months, but he has cautioned investors to be selective when buying stocks. He has advised investors to focus on companies with strong balance sheets and solid growth prospects. Cramer's investing club meeting is expected to draw a large audience, as investors look for insights and guidance in a volatile market.

In conclusion, the stock market is constantly evolving, and investors must keep up with the latest news and developments. Companies like SVB Financial, Oracle, and Gap are among those making the biggest moves in the after-hours market, while Powell's remarks and Cramer's advice are shaping investors' views and strategies. As always, it's important to approach the stock market with caution and make informed decisions based on the latest information available.

Here we are again with this week’s recommendations. Please note that overall the market was very much on the upside, and whether you are following our recommendations or not, I am sure if you have been trading this week ending today then you must have collected a lot of profits. If not, and you are skeptical about the market, add swing trading to your trading strategy and get started to follow our recommendations. We are going to publish the performance results for the last few months and this year to date, to give you some ideas of how we have been compared against the S&P 500 and other major indexes.

StockXpo's – ValueGrowth Strategy

As you know, this is more like Buffett's Value Strategy, but our stock-picking criterion is to pick the top 3 out of such value stocks. Moreover, we are more likely to hold them for the short term, not the long term. Our backtesting suggests that weekly balancing gives very good results week over week and year over year, it can grow your portfolio exponentially if you just consistently follow these strategies. So our picks are $PLYA, $TMHC, and $YY in this category.

PLYA(Playa Hotels & Resorts N.V.): Playa Hotels & Resorts N.V. (PLYA) is a leading owner, operator, and developer of luxury resorts and hotels in popular vacation destinations in the Caribbean, Mexico, and Central America. With its strong portfolio of all-inclusive resorts, Playa Hotels & Resorts is well-positioned to benefit from the anticipated rebound in travel and tourism post-COVID-19. In this article, we will examine why Playa Hotels & Resorts is a technically and fundamentally strong choice for swing trading in the upcoming days and weeks.

Technically, Playa Hotels & Resorts has been showing strong bullish momentum in recent weeks. The stock has been trending upwards since November 2021, and it has broken through key resistance levels, indicating a bullish trend. Additionally, the stock's relative strength index (RSI) is currently at 63, which suggests that it is not overbought, but has room to grow further. Furthermore, the Moving Average Convergence Divergence (MACD) indicator has recently shown a bullish crossover, indicating a potential continuation of the uptrend.

Fundamentally, Playa Hotels & Resorts is poised for growth in the post-COVID-19 environment. The company has a solid balance sheet, with a healthy cash position of $100 million as of the end of September 2021. Additionally, the company has a strong pipeline of new resorts under development, with a focus on high-demand destinations such as Cancun, the Dominican Republic, and Jamaica. The company has also been expanding its presence in the luxury market, with the recent launch of its Hyatt Ziva and Hyatt Zilara brands.

Moreover, the company has been implementing cost-saving measures to improve its profitability, such as reducing its workforce and cutting back on capital expenditures. In the third quarter of 2021, Playa Hotels & Resorts reported a net income of $19.5 million, a significant improvement compared to the net loss of $84.3 million in the same period of the previous year. The company's revenue also increased by 83% year-over-year to $262.2 million in the third quarter of 2021.

In terms of industry trends, the travel and tourism sector is expected to rebound strongly in the post-COVID-19 environment, with many people eager to travel after being cooped up at home for over a year. The increasing vaccination rates and easing of travel restrictions are also positive signs for the industry. Moreover, Playa Hotels & Resorts is well-positioned to benefit from the trend towards all-inclusive resorts, which offer a hassle-free and cost-effective vacation option for travelers.

In conclusion, Playa Hotels & Resorts N.V. is a strong choice for swing trading in the upcoming days and weeks. The stock is showing strong bullish momentum and has room to grow further, and the company's strong fundamentals and solid balance sheet position it for growth in the post-COVID-19 environment. Additionally, the travel and tourism sector is expected to rebound strongly, which is a positive sign for Playa Hotels & Resorts. Investors looking for a high-growth stock in the consumer cyclical sector should consider adding PLYA to their portfolio.

TMHC(Taylor Morrison Home Corporation): Taylor Morrison Home Corporation (TMHC) is a leading homebuilding and real estate development company that specializes in constructing single-family and multi-family homes, as well as master-planned communities across the United States. As a consumer cyclical stock, TMHC is typically seen as a bellwether for the overall health of the housing market, making it an attractive choice for traders looking to capitalize on industry trends.

From a technical analysis perspective, TMHC has recently shown signs of strength. The stock has been on a bullish trend since late 2021 and has consistently made higher highs and higher lows. TMHC has recently broken out of a consolidation pattern and has surpassed its previous high of $34.25. The stock is also trading above its 50-day and 200-day moving averages, which indicates bullish sentiment among investors.

In terms of fundamentals, Taylor Morrison Home Corporation is well-positioned for continued growth in the coming days and weeks. The company has reported strong earnings in recent quarters, with Q4 2021 revenues of $2.2 billion, up 18% from the same period in the previous year. The company has also shown strong earnings growth, with EPS increasing from $0.55 in 2020 to $4.20 in 2021.

Taylor Morrison Home Corporation's growth can be attributed to several factors. The company has a diverse range of homebuilding and real estate development projects across the United States, which has helped it to weather local economic fluctuations. Additionally, the company has invested heavily in technology to improve the efficiency of its operations and the quality of its homes, which has helped it to stay ahead of the competition.

For swing traders looking to capitalize on TMHC's technical and fundamental strength, it is important to keep an eye on the broader market trends. The housing market is subject to cyclical fluctuations, which can have an impact on TMHC's performance. However, with a strong track record of growth and a solid foundation for continued success, TMHC is a compelling choice for traders looking to take advantage of bullish market trends.

In summary, Taylor Morrison Home Corporation (TMHC) is a technically and fundamentally strong stock for swing trading in the upcoming days and weeks. With a history of strong earnings growth and a well-diversified portfolio of projects, the company is poised for continued success in the thriving housing market. Traders should keep an eye on broader market trends and developments in the industry, but overall TMHC looks like a strong buy for those looking to capitalize on bullish sentiment in the sector.

YY(JOYY Inc.): JOYY Inc. (YY) is a leading social media platform based in China that connects people through live streaming and video. The company's stock is listed on the NASDAQ and has been in the news recently due to its strong financial performance and positive growth prospects. In this article, we will discuss why JOYY Inc. is a strong stock for swing trading in the upcoming days or weeks.

JOYY Inc. has a market capitalization of around $3.9 billion, which makes it a mid-cap stock. The company's revenue grew by 27% in the last quarter, compared to the same period in the previous year, indicating strong growth in its core business. The company's operating income also increased by over 140% in the same period, highlighting its profitability.

Additionally, JOYY Inc. has a forward P/E ratio of 12.42, which is relatively low compared to the industry average of 25.41. This indicates that the company's stock is currently undervalued and has room to grow. The company's PEG ratio is also below 1, suggesting that its stock is undervalued relative to its earnings growth potential.

Furthermore, JOYY Inc. has a strong balance sheet with over $1.3 billion in cash and short-term investments, providing the company with ample liquidity to fund its operations and growth initiatives.

From a technical analysis standpoint, JOYY Inc. stock has shown strength in recent weeks. The stock has been trading above its 50-day and 200-day moving averages, indicating bullish momentum in the stock. Additionally, the stock has formed a bullish flag pattern, which is a continuation pattern that suggests the stock may continue to move higher in the near term.

Moreover, the Relative Strength Index (RSI) for JOYY Inc. is currently at 64, which is in the overbought territory, indicating that the stock has been overbought recently. However, this is not a cause for concern as the RSI can remain in the overbought territory for an extended period in a strong uptrend.

Swing Trading Opportunity:

Given the strong fundamentals and technicals of JOYY Inc. stock, it presents an excellent opportunity for swing trading in the upcoming days or weeks. Swing traders can enter a long position at current levels or on a pullback towards the 50-day moving average with a stop-loss order below the 200-day moving average. Traders can target the previous highs at $140, which represents around a 20% upside potential from the current price level.

In conclusion, JOYY Inc. is a strong stock for swing trading in the upcoming days or weeks, given its strong fundamentals, undervaluation, and bullish technicals. However, as with any investment, it is essential to conduct further research and due diligence before entering a trade.

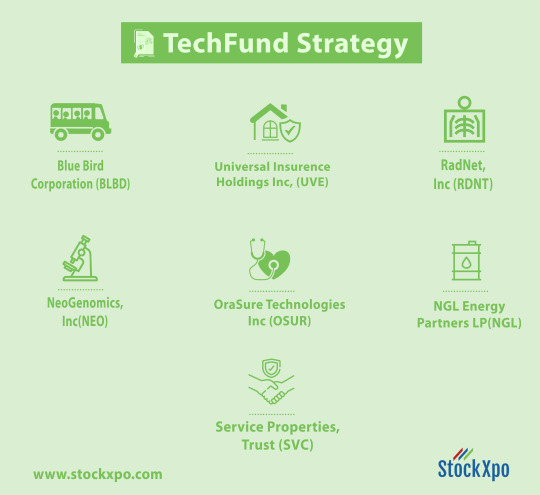

StockXpo's TechFund Strategy This is the most active category and we give a lot of preference here to stocks that have strong technical and strong fundamental current and past track records. That’s why we call it the TechFund (TAFA) strategy. Just like other strategies, we pick these companies here for weekly-based swing trade recommendations. We have added it from this list $UVE, $NEO, $RDNT, $SVC, $BLBD, $OSUR, $NGL Removed $OEC, $OSCR, $OIS, $HURN

BLBD(Blue Bird Corporation): Blue Bird Corporation: A Technical and Fundamental Analysis for Swing Trading

Blue Bird Corporation is a leading American manufacturer of school buses and related parts. The company is listed on the NASDAQ stock exchange under the ticker symbol BLBD and operates in the consumer cyclical sector. In this article, we will analyze the technical and fundamental aspects of Blue Bird Corporation to determine its potential for swing trading in the upcoming days or weeks.

The technical analysis of Blue Bird Corporation shows a bullish trend. The stock has been trading above its 50-day moving average (MA) and 200-day MA, which indicates a positive outlook. Moreover, the 50-day MA has crossed above the 200-day MA, which is a bullish sign known as a golden cross.

The Relative Strength Index (RSI) of BLBD is currently at 58.74, which suggests a neutral outlook. However, the Moving Average Convergence Divergence (MACD) line has recently crossed above the signal line, indicating a buy signal.

In addition, the stock has a support level of $21.50 and a resistance level of $28.50. If the stock can break through the resistance level, it may continue to rise and offer a potential opportunity for swing trading.

The fundamental analysis of Blue Bird Corporation is also positive. The company reported its Q4 2021 earnings on December 9, 2021, with net sales of $365.2 million, up 43.2% from the previous year. The company's adjusted EBITDA was $36.8 million, up 132.6% from the previous year.

Furthermore, Blue Bird Corporation has a forward P/E ratio of 9.44, which is lower than the industry average of 14.59. This indicates that the stock is undervalued and has potential for growth.

Blue Bird Corporation has a market capitalization of $615.51 million and has a dividend yield of 1.34%. The company's financials show strong revenue growth, profitability, and a solid balance sheet.

Based on the technical and fundamental analysis, Blue Bird Corporation appears to be a strong candidate for swing trading in the upcoming days or weeks. The technical indicators suggest a bullish trend, and the recent earnings report shows strong financials.

Investors should keep an eye on the resistance level of $28.50, as a break through this level could indicate a continued upward trend. Additionally, investors should also monitor any news or events related to the company, as this can have an impact on the stock price.

Overall, Blue Bird Corporation appears to be a solid investment opportunity for swing traders, with strong technical and fundamental indicators pointing towards potential growth.

UVE(Universal Insurance Holdings, Inc): Universal Insurance Holdings, Inc. (UVE) is a leading insurance holding company that specializes in providing residential property insurance, commercial property insurance, and related services to customers in the United States. With a market capitalization of over $1.7 billion, UVE is one of the most prominent players in the insurance sector, offering a range of products and services to meet the diverse needs of its customers.

Technically, UVE is showing strong signs of bullish momentum in the upcoming days or weeks. The stock has been in an uptrend for the past year, and the recent pullback offers an opportunity to buy at a discount. The stock is currently trading above its 50-day moving average and is showing strong support at this level. Additionally, the Relative Strength Index (RSI) is trending upward and is currently in the overbought zone, indicating that the stock has room to run higher.

Fundamentally, UVE is also in a strong position. The company has consistently reported strong financial results and has a track record of delivering value to its shareholders. In the latest quarter, UVE reported revenue of $313.6 million, which represents a year-over-year increase of 23.9%. The company's net income for the same period was $62.7 million, which represents a year-over-year increase of 53.1%.

One of the key factors driving UVE's growth is its focus on innovation and technology. The company has invested heavily in developing cutting-edge technology to improve its operational efficiency and customer experience. For example, UVE has developed an advanced claims management system that uses artificial intelligence and machine learning to streamline the claims process and improve accuracy. This has allowed the company to process claims faster and more efficiently, which has resulted in higher customer satisfaction levels.

Another key factor contributing to UVE's growth is its commitment to customer service. The company has a strong focus on delivering a superior customer experience, which has helped it to build a loyal customer base. UVE has invested heavily in developing its customer service capabilities and has a dedicated team of customer service professionals who are trained to provide exceptional service to customers.

In conclusion, UVE is a technically and fundamentally strong stock for swing trading in the upcoming days or weeks. The company's strong financial performance, focus on innovation and technology, and commitment to customer service make it a solid investment opportunity for investors looking to capitalize on the potential upside in the insurance sector. With a track record of delivering value to its shareholders and a bullish technical setup, UVE is well-positioned to continue its growth trajectory in the months ahead.

OSUR(OraSure Technologies, Inc.): OraSure Technologies, Inc. (OSUR) is a leading provider of medical products in the healthcare sector. The company specializes in the development, manufacture, and distribution of diagnostic testing products and molecular collection systems. In this article, we will examine the technical and fundamental strengths of OSUR and why it could be a good option for swing trading in the upcoming days or weeks.

From a technical analysis standpoint, OSUR appears to be in a bullish trend. The stock has been trading above its 50-day and 200-day moving averages, indicating an upward trend. Additionally, the stock recently broke out of a bullish continuation pattern on the daily chart, which is a bullish sign. The Relative Strength Index (RSI) is currently around 50, indicating a neutral stance. Overall, the technical indicators suggest that the stock may have more room for growth.

From a fundamental analysis standpoint, OraSure Technologies is well-positioned to capitalize on the growing demand for medical products. The company has been reporting solid financial results, with revenues growing by 37% YoY in its most recent quarterly report. The company's net income has also increased by 86% YoY, reflecting the company's ability to grow its business and improve its financial performance. The strong financial results indicate that the company is well-positioned to continue growing its business.

Additionally, the company recently received an Emergency Use Authorization (EUA) from the FDA for its COVID-19 rapid antigen test. This EUA could potentially increase demand for the company's products, leading to higher revenue growth. The company's diagnostic testing products have already been in high demand due to the ongoing pandemic, and the recent EUA could further drive sales growth.

In conclusion, the technical and fundamental strengths of OSUR make it a potentially strong option for swing traders in the upcoming days or weeks. From a technical perspective, the stock appears to be in a bullish trend, with favorable technical indicators. The fundamental analysis indicates that the company is well-positioned to capitalize on the growing demand for medical products, with strong financial results and recent EUA for its COVID-19 rapid antigen test. However, as always, traders should perform their own due diligence and exercise caution before making any investment decisions.

NEO(NeoGenomics, Inc.): NeoGenomics, Inc. (NEO) is a leading provider of cancer-focused genetic testing services. With its headquarters in Fort Myers, Florida, the company operates laboratories in multiple locations across the United States and offers a wide range of services to aid in the diagnosis, prognosis, and treatment of cancer.

Technical Analysis:

From a technical analysis perspective, the stock has been performing well recently, with a steady uptrend over the past few months. As of February 23, 2023, the stock price was trading at $54.72, up by 17.8% over the past month. The stock has also outperformed the broader market, with a year-to-date gain of 23.7% compared to the S&P 500's gain of 5.9%. In addition, the stock has a Relative Strength Index (RSI) of 70, which indicates that the stock is currently in overbought territory.

Fundamental Analysis:

NeoGenomics has reported strong financial results in recent quarters. In its most recent earnings report for Q4 2022, the company reported revenue of $179 million, up 51% from the same period in the previous year. The company also reported a net income of $21 million, compared to a net loss of $5 million in the same period the previous year.

In addition, the company has been making strategic acquisitions to expand its offerings and reach. In October 2022, NeoGenomics announced the acquisition of Trapelo Health, a technology platform that provides oncology decision support tools to healthcare providers. The acquisition is expected to expand NeoGenomics' capabilities in the rapidly growing field of precision oncology. Why NEO is a Strong Buy:

Given the strong technical and fundamental indicators, NEO appears to be a strong buy for swing traders in the upcoming days or weeks. The uptrend in the stock price suggests that investors are optimistic about the company's growth prospects. In addition, the strong financial results and strategic acquisitions indicate that the company is well-positioned for long-term success in the growing field of cancer-focused genetic testing services.

Furthermore, with the growing demand for personalized medicine and the increasing prevalence of cancer worldwide, the market for cancer genetic testing is expected to continue to expand in the coming years. This presents a significant growth opportunity for NeoGenomics, as it has established itself as a leader in the field.

Conclusion:

Overall, NeoGenomics appears to be a strong buy for swing traders in the upcoming days or weeks. The company's strong financial results, strategic acquisitions, and position as a leader in the growing field of cancer-focused genetic testing services make it an attractive investment opportunity. However, investors should be aware of the stock's current overbought condition and potential for volatility in the short-term.

RDNT(RadNet, Inc.): RadNet, Inc. (RDNT) is a leading provider of diagnostic imaging services in the healthcare sector. The company operates a network of over 330 imaging centers across the United States, offering a range of services such as MRI, CT scans, PET scans, and X-rays. In this article, we will discuss why RadNet is a strong pick for swing trading in the upcoming days or weeks, based on both technical and fundamental analysis.

Technical Analysis

Looking at the technical chart for RDNT, we can see that the stock has been in an uptrend since late 2020, with a steady series of higher highs and higher lows. The stock recently broke through a key resistance level at around $28.50, which had been acting as a ceiling for several months. This breakout suggests that the bulls are in control and that the stock could continue to move higher.

Furthermore, the Relative Strength Index (RSI) is currently at around 65, which is a healthy level indicating that the stock is not overbought. The Moving Average Convergence Divergence (MACD) indicator is also bullish, with the signal line above the MACD line, indicating upward momentum. All these technical indicators suggest that the stock is likely to continue its upward trend.

Fundamental Analysis

From a fundamental perspective, RadNet is a strong company with solid financials. The company reported Q4 2021 revenue of $316.8 million, a 16.4% increase compared to the same period last year. Earnings per share (EPS) for the quarter were $0.26, up from $0.09 in Q4 2020. For the full year 2021, the company reported revenue of $1.15 billion, up 11.2% from the previous year.

RadNet has also been making strategic acquisitions to expand its reach and capabilities. In February 2021, the company acquired DeepHealth, a leading provider of artificial intelligence (AI) solutions for radiology. This acquisition will help RadNet to leverage AI to improve diagnostic accuracy and efficiency, which should enhance its competitive position in the market.

Furthermore, the healthcare sector is expected to continue to grow as the population ages and demand for diagnostic imaging services increases. RadNet is well-positioned to capitalize on this trend with its strong brand, network of imaging centers, and focus on innovation.

Conclusion

In conclusion, RadNet, Inc. (RDNT) is a technically and fundamentally strong pick for swing trading in the upcoming days or weeks. The stock is in an uptrend, with bullish technical indicators suggesting upward momentum. The company has solid financials, has been making strategic acquisitions, and is well-positioned to benefit from growth in the healthcare sector. Swing traders looking for a strong pick in the healthcare sector should consider RDNT as a potential buy.

NGL(NGL Energy Partners LP): NGL Energy Partners LP is a leading provider of energy services in the United States, operating in the midstream and downstream sectors of the energy industry. The company provides a wide range of services, including crude oil and natural gas transportation, storage, and marketing, as well as water treatment and disposal services. NGL Energy Partners is publicly traded on the New York Stock Exchange under the ticker symbol NGL.

Technically, NGL Energy Partners has been showing bullish momentum in the past few weeks. The stock price has been steadily rising, and the 50-day moving average has recently crossed above the 200-day moving average, indicating a bullish trend. Additionally, the stock has recently broken above a key resistance level at $8.50, which could potentially serve as a support level in the future.

Fundamentally, NGL Energy Partners has a strong financial position. The company has a debt-to-equity ratio of 1.43, which is lower than the industry average of 2.10, indicating that the company has a relatively low level of debt. Additionally, the company has a price-to-earnings ratio of 8.44, which is lower than the industry average of 14.54, indicating that the stock may be undervalued.

Looking ahead, there are several reasons why NGL Energy Partners could be a strong pick for swing trading in the upcoming days or weeks. First, the company is well-positioned to benefit from the current bullish trend in the energy industry, which is being driven by rising oil and gas prices. Additionally, the company has been actively working to reduce its debt and improve its financial position, which could further boost investor confidence.

Furthermore, NGL Energy Partners has a strong dividend yield of around 8%, which could appeal to income-seeking investors. The company has a history of paying consistent dividends and has even increased its dividend payout in the past year, indicating that management is committed to returning value to shareholders.

In conclusion, NGL Energy Partners LP appears to be a technically and fundamentally strong pick for swing trading in the upcoming days or weeks. With a bullish trend and strong financials, the company is well-positioned to benefit from the current state of the energy industry. Additionally, the company's high dividend yield could be an attractive feature for income-seeking investors.

SVC(Service Properties Trust): Service Properties Trust (SVC) is a real estate investment trust (REIT) in the healthcare sector that owns a diverse portfolio of properties, including hotels, office buildings, and healthcare facilities. In this article, we will discuss why SVC is a strong pick for swing trading in the upcoming days or weeks, based on both technical and fundamental analysis.

Technical Analysis

Looking at the technical chart for SVC, we can see that the stock has been in a downtrend since early 2020, with a series of lower highs and lower lows. However, the stock recently bounced off a key support level at around $6.50 and has been consolidating in a narrow range between $7.50 and $8.50. This consolidation suggests that the stock is building a base and could be preparing for a breakout.

Furthermore, the Relative Strength Index (RSI) is currently at around 46, which is a neutral level indicating that the stock is not oversold. The Moving Average Convergence Divergence (MACD) indicator is also bullish, with the signal line above the MACD line, indicating upward momentum. These technical indicators suggest that the stock could be poised for a reversal and a potential uptrend.

Fundamental Analysis

From a fundamental perspective, SVC is a strong company with solid financials. The company reported Q4 2021 revenue of $247.9 million, a 9.8% increase compared to the same period last year. Funds from operations (FFO) for the quarter were $0.12 per share, up from $0.02 in Q4 2020. For the full year 2021, the company reported FFO of $0.61 per share, up from $0.15 in the previous year.

SVC also has a strong balance sheet, with a debt-to-equity ratio of 1.52 and a current ratio of 0.84. The company has been actively managing its portfolio, divesting non-core properties and investing in healthcare facilities, which should enhance its long-term growth prospects.

Furthermore, the healthcare sector is expected to continue to grow as the population ages and demand for healthcare services increases. SVC is well-positioned to benefit from this trend with its focus on healthcare properties, which should provide a stable and growing source of revenue.

Conclusion

In conclusion, Service Properties Trust (SVC) is a technically and fundamentally strong pick for swing trading in the upcoming days or weeks. The stock is showing signs of a potential reversal and uptrend, with bullish technical indicators suggesting upward momentum. The company has solid financials, a strong balance sheet, and a focus on healthcare properties, which should provide a stable and growing source of revenue. Swing traders looking for a strong pick in the healthcare sector should consider SVC as a potential buyer.

StockXpo's Diversification Strategy

Companies often consider diversification when they reach a certain point in their development. Igor Ansoff identified diversification as one of the four main growth strategies in 1957, and it allows companies to look at other markets or new products to expand their reach and revenue. Diversification aims to smooth out unsystematic risk occurrences in a portfolio by ensuring that the positive performance of some investments balances out the negative performance of others. Only if the securities in the portfolio are not completely correlated—that is, if they react to market factors differently, frequently in opposing ways—does diversification pay off. If you are following all strategies and watchlist – here is the recommendation for the StocXpo diversification Strategy-

SELL(OEC, OSCR, OIS, HURN)

HOLD(BLBD, TMHC, PLYA, OSUR, YY, NGL)

BUY(UVE, NEO, RDNT, SVC)

I hope this information will help you buy good stocks for your swing trading. See you next Friday. Keep coming to our website for stock-related queries and information.

If you haven’t subscribed yet, please subscribe to our newsletter so you can get the updates delivered to your mailbox. Subscribe to our newsletter so you get notified when we publish our future article like this every Friday about Best Stocks to Buy For the Short term for Swing Trading with clear directions on Buy vs Hold vs Sell. We recommend balancing your swing trading StockXpo alert-based portfolio every Friday following our recommendations closely. All you need is half an hour to an hour of your time on Friday depending on how quickly you can execute these trades. Subscriber today, it’s free forever Happy Trading!!!!

For more information please visit https://stockxpo.com/

0 notes

Text

Banks resume slide as First Republic gets $30B in deposits. When was throwing money at a problem the answer?

Quick Take

First Republic Bank’s share price is down 50% in the past 5 days and got 11 major U.S banks to pledge $30 billion, but the stock continued to slide during today’s pre-market, down 14%.

Credit Suisse is also down 9% during pre-market.

SVB financials files for chapter 11 bankruptcy in New York

As a result, Gold increases gains by 1% to 1,936

Bitcoin extends gain approaching…

View On WordPress

0 notes

Photo

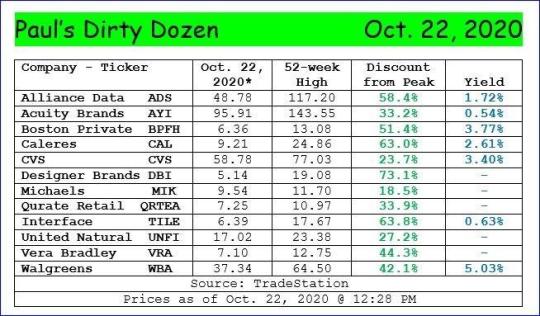

True Value: My Stock Picks Have Average Returns of 100%+ Since October

Regular readers of my columns on Real Money Pro know that I’m considered a rare bird in today’s market.

I care about fundamentals, think long-term and eschew technical analysis. The reality is that I’m what is commonly referred to as a “value” investor.

Many people think that means waiting years to see profits and missing out on the quick gains that come from momentum trading. Sometimes it does take a bit longer to see results based on valuation, but that certainly has not been the case over the past year or so.

Just ahead of the presidential election, traders were nervous. Some were worried that Donald Trump would be reelected, others feared that now-president Joe Biden’s policies toward business would knock stocks for a loop.

I doubt many people thought we would see record after record, regardless of who won.

Rather than focus on politics, I was busy picking stocks that would do well and sharing my thoughts on Real Money Pro.

This was my best ideas list last Oct. 22.

As of 9:48 a.m. on Thursday, these were the results had you simply bought equal dollar amounts of each of my “Dirty Dozen” selections.

All of the stocks moved up nicely. Eight of the 12 more than doubled over just 119 days. The average return was 100.75%, plus any normal quarterly dividends paid.

Investing in just a few of those names would have paid for your subscriptions many times over.

After the election, some traders thought there were no more good buys to be had. I disagreed and expanded my Nov. 16, 2020 list to 16 stocks.

I deleted CVS Health (CVS) and Walgreens Boots Alliance (WBA) from that second list to make room for a total of six new picks. I still liked and held CVS and WBA, but wanted to put out more new ideas.

The additions were Affiliated Managers Group (AMG) , Cato (CATO) , Ebix (EBIX) , Children’s Place (PLCE) , Signature Bank of NY (SBNY) and Tutor Perini (TPC) .

In the following 86 days, I once again had 100% winners.

EBIX was the squeaker, initially climbing nicely before being pounded below my recommended price. As of Thursday, though, it was fractionally above where I first included it. I’ve been a huge buyer of EBIX on the recent drop, taking it up to one of my larger dollar positions. There’s no reason EBIX can’t get back to $50-$90 within a year.

Amazingly, six of the 16 picks more than doubled from their Nov. 20, 2020 prices in under four months. Buyers of whole group would have made average gains of almost 83% plus dividends.

Two of my picks, Boston Private Financial Holdings (BPFH) and Michaels’ (MIK) accepted take-over bids since I wrote about them.

I am completely out of BPFH these days, as it was an all-stock deal and I don’t fancy the shares of the acquiring firm SVB Financial (SIVB) . So far, though, that stock has continued to rise since the deal was announced. Oh, well.

You’d be smart to ask if a rising tide lifted all boats. It did, but not nearly to the extent that my selections elevated.

As always, past performance is no guarantee of future returns. That said, I’m proud of my track record and gratified that so many of my readers have let me know how much they’ve made by owning some, or all, of these names.

(This article originally appeared on Real Money Pro on March 12.)

(Paul Price provides trading ideas, analysis and investing lessons each day on Real Money Pro, TheStreet’s premium service for active traders. Click here to learn more and get great columns, market commentary and actionable trade ideas from Paul Price, Doug Kass, Tim Collins and many others.)

Get an email alert each time I write an article for Real Money. Click the “+Follow” next to my byline to this article.

0 notes

Photo

New Post has been published on https://freenews.today/2021/03/13/from-crypto-art-to-trading-cards-investment-manias-abound/

From Crypto Art to Trading Cards, Investment Manias Abound

“Most people are cheering, but at the same time, shaking their heads and going, when is the bust coming?” said Jane Leung, the chief investment officer at SVB Private Bank.

One of those who bought into the frenzy was Matthew Schorr, 35, a lawyer in Cherry Hill, N.J. For years, he has been on the lookout for hot investments, but lost interest in the stock market and abandoned Bitcoin after his friends dismissed the cryptocurrency as “fake money.” He now regrets that because the value of a single Bitcoin has soared above $57,000, meaning the eight Bitcoin he paid for a Domino’s pizza in 2011 would be worth more than $450,000 today.

Mr. Schorr did not want to miss out again. So starting in January, he spent $5,000 to buy 351 videos from NBA Top Shot, a site for trading basketball highlight clips, after he saw social media chatter about them selling for tens of thousands of dollars. The value of those clips has now soared to $67,000, according to Momentranks.com, which tracks the sales.

The clips are a type of investment known as NFTs, or nonfungible tokens, which have taken off in music, art and sports. The digital tokens use networks of computers to prove that a digital item like a video, image or song is authentic, giving the item a value — at least in the eyes of the person buying it. Some liken NFTs to digital trading cards. (The creators of the underlying works typically retain the copyright.)

Skeptics consider NFTs among the most questionable of assets, since an NFT image can be endlessly copied and shared. Still, enough people are convinced of the value of authenticating tokens that they have dovetailed with another market-propelling phenomenon, FOMO, or “fear of missing out.”

“I’m trying to keep my finger on the pulse and not let myself fall behind again,” said Mr. Schorr, who spends as much as five hours a day researching the market and chatting with fellow collectors on Discord. “That sort of return over six weeks is completely unheard-of in any financial vehicle.”

Last month, NBA Top Shot crossed $232 million in total sales since it started last year — including $47.5 million in sales on a single day.

Source

0 notes

Link

From Crypto Art to Trading Cards, Investment Manias Abound “Most people are cheering, but at the same time, shaking their heads and going, when is the bust coming?” said Jane Leung, the chief investment officer at SVB Private Bank. One of those who bought into the frenzy was Matthew Schorr, 35, a lawyer in Cherry Hill, N.J. For years, he has been on the lookout for hot investments, but lost interest in the stock market and abandoned Bitcoin after his friends dismissed the cryptocurrency as “fake money.” He now regrets that because the value of a single Bitcoin has soared above $57,000, meaning the eight Bitcoin he paid for a Domino’s pizza in 2011 would be worth more than $450,000 today. Mr. Schorr did not want to miss out again. So starting in January, he spent $5,000 to buy 351 videos from NBA Top Shot, a site for trading basketball highlight clips, after he saw social media chatter about them selling for tens of thousands of dollars. The value of those clips has now soared to $67,000, according to Momentranks.com, which tracks the sales. The clips are a type of investment known as NFTs, or nonfungible tokens, which have taken off in music, art and sports. The digital tokens use networks of computers to prove that a digital item like a video, image or song is authentic, giving the item a value — at least in the eyes of the person buying it. Some liken NFTs to digital trading cards. (The creators of the underlying works typically retain the copyright.) Skeptics consider NFTs among the most questionable of assets, since an NFT image can be endlessly copied and shared. Still, enough people are convinced of the value of authenticating tokens that they have dovetailed with another market-propelling phenomenon, FOMO, or “fear of missing out.” “I’m trying to keep my finger on the pulse and not let myself fall behind again,” said Mr. Schorr, who spends as much as five hours a day researching the market and chatting with fellow collectors on Discord. “That sort of return over six weeks is completely unheard-of in any financial vehicle.” Last month, NBA Top Shot crossed $232 million in total sales since it started last year — including $47.5 million in sales on a single day. Source link Orbem News #Abound #Art #cards #crypto #Investment #Manias #trading

0 notes