#Inheritance tax specialist

Text

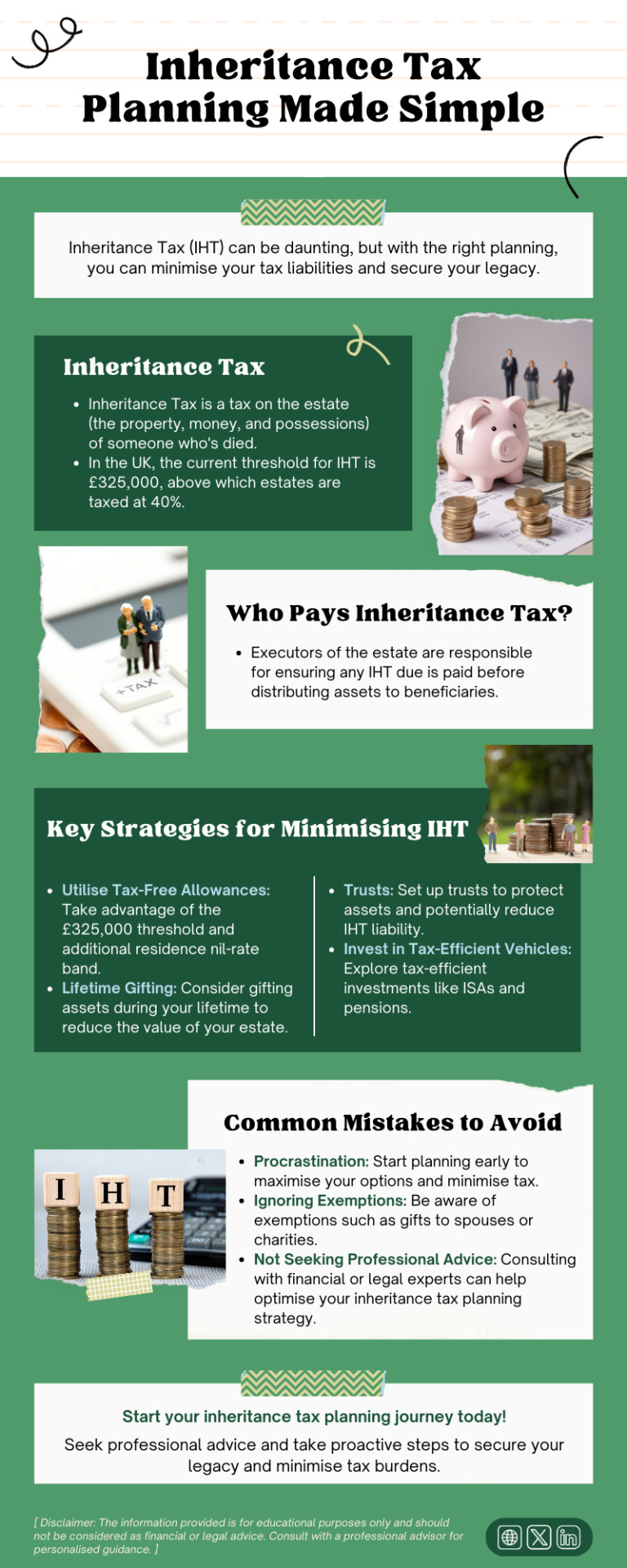

Inheritance Tax (IHT) can be daunting, but with the right planning, you can minimise your tax liabilities and secure your legacy. This infographic provides a simple and straightforward guide to inheritance tax planning.

#Inheritance tax planning#Inheritance tax advice#Inheritance tax advisor#Inheritance tax specialist#inheritance tax advice london#Inheritancetaxplanning

2 notes

·

View notes

Text

Inheritance Tax Planning and Strategies | Inheritance-tax.co.uk

Inheritance tax planning and strategies are essential for anyone looking to protect their assets and pass them on to their loved ones. In the UK, inheritance tax is a tax paid by the inheritor on the value of their inheritance, and the more valuable the inheritance, the higher the tax paid. However, there are several ways to reduce or even eliminate inheritance tax, and we have outlined some of them below:

Use Trusts: Trusts are a legal arrangement between you and another person or organization that allows you to give property or money away without having to pay inheritance tax on it. There are several types of inheritance tax planning trusts you can use, including bare trusts, interest in possession trusts, discretionary trusts, accumulation trusts, mixed trusts, trusts for a vulnerable person, and non-resident trusts.

Life Insurance Policy: A life insurance policy can help to pay any inheritance tax due, and placing your policy in a trust can help to ensure that it is not included in your estate for inheritance tax purposes.

Make Pension Plans: Pensions are not included in your estate for inheritance tax purposes, and by making pension plans, you can pay only 20% tax at retirement, as opposed to 40% inheritance tax. You can decide whether to withdraw your pension starting at age 55 or pass it on as an inheritance.

Give Away Gifts: You can give away gifts amounting to £3,000 each tax year, and these gifts will be counted toward your inheritance tax exemption. This can be an effective way to keep your estate tax-free over time.

Donate to Charity: Donating to charity is an excellent way to reduce your inheritance tax liability. Your estate won’t be subject to inheritance tax on anything you leave to charity, and the inheritance tax charged on the remaining part of your estate is reduced from 40% to 36% if you decide to donate at least 10% of your assets to charity.

Alternate Investments Market (AIM): The AIM is a market where you can invest in shares of smaller companies that are not listed on the main stock exchange. By investing in AIM shares that qualify for Business Relief, you can reduce the amount of inheritance tax due on your wealth.

Utilize Business Reliefs: Business reliefs enable you to remove your assets from your estate, relieving you of the burden of inheritance tax. By holding onto your assets for a few years, you can use business reliefs to remove them from your estate.

Overall, it's important to work with a trusted inheritance tax professional for inheritance tax planning advice. They can help you navigate the complex landscape of inheritance tax planning and ensure that your loved ones can pass on their assets without undue financial stress.

For More Information Visit Us: https://inheritance-tax.co.uk/area/inheritance-tax-planning-and-strategies/

#inheritance tax#inheritance#inheritance tax planning#tax planning#tax#property tax#finance#business#planning#inheritance tax specialist#planning and strategies#Estate planning#Paying Inheritance Tax#reduce the inheritance tax#calculate your taxable estate#calculated your taxable estate#inheritance tax advice#inheritance tax advice in London

0 notes

Text

Understanding Inheritance Tax Specialists and Living Trust Inheritance Tax in the UK

In the realm of estate planning and inheritance, navigating the intricacies of taxes can be daunting. In the UK, inheritance tax is a significant consideration for many individuals and families. This is where inheritance tax specialists come into play, offering expertise and guidance to ensure that assets are managed and passed down efficiently. Additionally, living trusts can be a valuable tool in mitigating inheritance tax liabilities. Let's delve deeper into these concepts.

How Inheritance Tax Specialists Can Help

Inheritance tax specialists are professionals who specialize in providing advice and assistance with inheritance tax planning. They possess in-depth knowledge of tax laws and regulations, helping individuals and families minimize their inheritance tax liabilities legally. These specialists work closely with their clients to develop bespoke strategies tailored to their unique financial circumstances.

How Inheritance Tax Works in the UK

In the UK, inheritance tax is levied on the estate of a deceased person above a certain threshold. As of 2024, this threshold stands at £325,000 for individuals. Anything above this threshold is subject to a tax rate of 40%. Inheritance tax applies to assets such as property, investments, savings, and possessions.

How Inheritance Tax Specialists Provide Guidance

Inheritance tax specialists assess their clients' estates and financial situations to identify opportunities for tax planning. They offer recommendations on various strategies, such as making use of exemptions and reliefs, gifting assets, setting up trusts, and drafting wills. By implementing these strategies, individuals can reduce the value of their estate subject to inheritance tax, ultimately preserving more wealth for future generations.

How Living Trusts Can Help

A living trust, also known as a revocable trust, is a legal arrangement in which assets are placed into a trust during one's lifetime. The individual creating the trust, known as the grantor, retains control over the assets and can modify or revoke the trust as needed. Upon the grantor's death, the assets held in the trust are distributed to the beneficiaries according to the terms outlined in the trust document.

How Living Trusts Address Inheritance Tax

Living trusts can play a crucial role in minimizing inheritance tax liabilities. By transferring assets into a trust, the value of those assets is effectively removed from the grantor's estate for inheritance tax purposes. This can result in significant tax savings, as the assets held in the trust are not subject to the same tax rates as those held directly by the individual.

How Living Trusts Offer Flexibility

One of the key advantages of living trusts is their flexibility. Unlike wills, which become public documents upon the grantor's death and are subject to probate proceedings, trusts offer privacy and expedited asset distribution. Additionally, living trusts can be structured in a way that allows for ongoing management of assets, ensuring that beneficiaries are provided for according to the grantor's wishes.

How to Establish a Living Trust

Establishing a living trust typically involves drafting a trust document outlining the terms and conditions of the trust, appointing a trustee to manage the trust assets, and transferring assets into the trust's name. While setting up a living trust requires careful consideration and legal expertise, the benefits it offers in terms of estate planning and inheritance tax mitigation can be substantial.

How to Seek Professional Advice

For individuals and families seeking to optimize their estate planning and minimize inheritance tax liabilities, consulting with inheritance tax specialists and legal professionals is essential. These experts can provide personalized advice and guidance tailored to individual circumstances, helping to ensure that assets are protected and passed down efficiently to future generations.

In conclusion, inheritance tax specialists play a vital role in assisting individuals and families with estate planning and inheritance tax mitigation in the UK. By leveraging their expertise and guidance, along with tools such as living trusts, individuals can navigate the complexities of inheritance tax laws and preserve more of their wealth for their loved ones.

0 notes

Note

god the Omeagorverse is brilliant brilliant brilliant. so good so delicious so nutritious to me. thank you thank you thank you for sharing it. i am actively considering taking pen to paper to physically draw out the family tree and draw like hearts and smiley faces and stars around the vile nasty rot :)

MWAH even though i still think its embarrassing im glad people are enjoying it<3 and oh dont worry i have a family tree of like nearly 900 characters at this point. It Is Evil For Me.... It's Terminal,... ten pages of character explanations below the cut do NOT click unless u want to walk around in my lovecraftian mind palace (shed of dumb ideas and deviantart OCs)

865 characters in what five months. God,

jae: hes maegor's firstborn with vis :3 maegor thinks he's lame and not good enough. jae is also oedipally insane about viserys because maegor was gross about it so he's got mommy issues about vis. he marries ceryse' niece as like an apology gift to the hightowers like sorry we did polygamy and disrespected you and inventented gay marriage sorry about that. he was also betrothed to aerea (shore up inheritance + appease rhaena) but viserra took aerea on the world's worst bachelorette party to valyria and only viserra returned alive :3. jae gots nutso after vis dies and starts bringing in boy youths as court favourites and maris kills him in a fit of rage due to his grossness and also maris has her own shit going on (lesbian drama, dw about it)

viserra: married into the lannisters to keep the iron throne's federal reserve in the clear and cos raising taxes spells real doom. she femdoms her husband and then kills him as a blood sacrifice to have kids (only death can pay for life). became regent for a while before house lannister kicked her out. marries into harrehal (lucamore the lusty is her hubby) kills him too. marries a couple more times, has a coupe kids, ends up trying to fly her dragon (vhagar btw) into the sun or moon or something. not 100% on her death yet.

daenys: oh poor baby girl. vis marries her into the starks to keep her safe from court + there was stark rebellion drama. has weird tension with her mother-in-law whos a bolton and her husband sucks too. she has 13 kids (9 make it to adulthood). daenys ends up killing maegor its a whole thing, hush hush. goes nutso after and she and vis die together codependently as one theyre the same person etcetc

aegon: jae's eldest, momma's boy. momma's special heir to the throne special boy. hates his twin brother aerion because aerion is daddy's favourite and jae obviously wishes aerion was heir instead. marries a lannister cousin and a velaryon who hate each other and it causes a succession crisis when he dies. he has a horrible emotionally and physically incestuous relationship with his sister helaena. aerion ends up kidnapping helaena and it causes a minor civil war where aegon and aerion both die RIP

aerion: jae's second, twin to aegon, daddy's specialist evil son. whats a little child endangerment between kids. kills the high septon when hes 14 cos the high septon was abusing helaena and gets exiled to essos at FOURTEEN cos he refused to admit why he did it (didnt wanna ruin helaena's reputation). he was just like lol #yolo he was cringe anyway. gets radicalised in essos cos why tf should cringe aegon get the throne when aerion is way cooler. kidnaps helaena but also in their minds its somewhat of a rescue cos everyone in westeros is weird about helaena. him and aegon die together :3 also he has a bastard with a martell bastard who does Rhoynish Restoration in essos with her three dragons she takes over volantis and burns the rot out of it at one point but thats not important. she's doing her own thing. ALSO HE CLAIMED BALERION that's also why he's so cunty about getting the throne he's like um you got vhagar the girl dragon and i got the cool old valyria dragon that granddaddy aegon rode so 🤨

helaena: helen of troy :3 she's one of grrms favourite historical girls; 6 year old who is breathtakingly gorgeous and everyone is weird about it. her cradle egg dragon is called urrax after the story of daeryssa and serwyn and also she befriended dreamfyre cos dreamfyre got depressed after rhaena died and started terrorising oldtown cos rhaelle was there. helaena did her horsegirl magic on dreamfyre and saved oldtown and so oldtown loves her. every man in the world wants to marry her but shes literally 13???? that does fucked up things to your psyche. has weird relationships with aegon and aerion due to them being her protectors and the only men growing up who werent weird about her but guess what babygirl. all feudal men are weird :3

daenerys: named after daenys which of course made the evil destiny stars align. she's basically the middle child so she's mostly ignored by both her parents. her dragon is called seafoam :3 she thinks both aegon and aerion are too neurotic to be king and she would be wayyy better. somewhat worships maegor cos he didnt gaf about primogeniture. gets married off to corlys velaryon (he still exists here) but she doesn't mind to much cos she likes exploring essos with corlys. best friends with aegon's velaryon wife and HATES the lannister wife soooo much. after aegon dies, viserys takes the throne which makes her sooooo fucking mad but she gets to be hand of the king with corlys. after viserys dies she and corlys swoop in and do the westerosi regency era until her grand-nephew comes of age. absentee mother because she's too busy girlbossing her way through the red keep

viserys: babyboy you were never gonna be normal with a name like that. jae is weird about him cos viserys looks exactly like his namesake he's also soft and likes non-reptillian animals and being nice to people which is not very targaryen of him. jae has him trained by his kingsguard to beat the pussy out of him but it just makes vis an even sadder kitten. has clinical depression (diagnosed at 5 years old) so cant even get angry and rage and blow up the red keep like he wishes he could. forced to marry aerion's spurned betrothed who's their distant cousin alyssa arryn (half targ herself, i had vaella survive and marry rodrik similar to daella). alyssa is crazygirl she gets radicalised by a red priestess from asshai 😈 they agree to have a sexless unconssumated marriage though. viserys gets voted king after aerion and aegon die (aegon's kids and wives have their own drama going on so a council is necessary) and he's like what if i just kill myself but he's got a slightly evil kingsguard boyfriend whos like nooo dont kill urself youre so powerful now ahaha. pretty okay king, basically lets daenerys rule cos he's too busy being depressed and wanting to khs :( poor baby. anyway alyssa hears a prophecy about TPTWP and AA and goes megacuckoo and does blood magic to have kids and that's its whole drama dw about it. he does end up getting to kill himself though good for him 😭

maegelle: poor baby. gets married off to the hightowers at FOURTEEN cos jae thinks she's weird and autistic and needs her outta the red keep. he's like dont u wanna be lady of the hightower? its so big!! and shes like no because my special interest is religion and prophetic dragon dreams. she weirds him out too much with her prophesies of his death etc. ends up achieving religious euphoria ecstasy etc after getting visions and doing some miracles and abandons her husband and daughters to live in a convent. she doesnt realise she's just trying to escape the cycle of targ torment the only way she knows how :(

anyway thats just like 9 of my guys i invented. i mostly do this so i have something for my brain to think about when im trying to go to sleep but The Thoughts are tormenting me. can you tell im a little funny in the brain. anyway if u made it this far i love u i love u i love u♡

#rhaena was hand of the king btw ^_^ she and maegor hate each other#sorry for the long post. keep in mind it could be way worse#au:omaegorverse#cringe oc warning#tw oc#ask#darling1darling#KISS genuinely kiss on the cheek for you im sorry to have infected you but im glad we can sit in the plague pit together :3

19 notes

·

View notes

Text

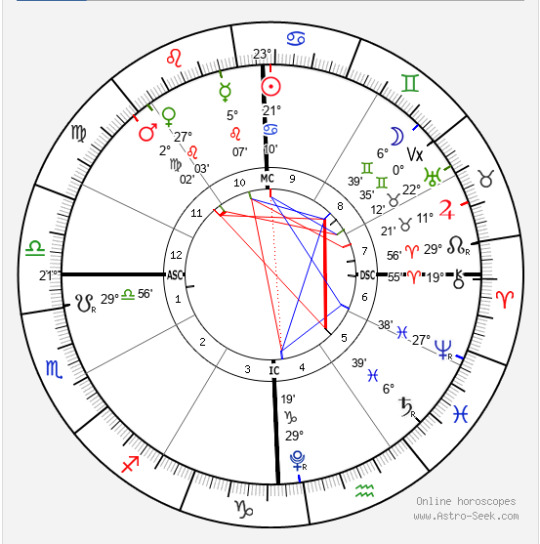

Lunar Return July 13-August 8 2023

LR Moon in 8H

Focus on ancestors, ceremonies in connection with the dead, tax and bill collectors, the dead (matters connected with), death, joint finances, friends of one’s parents, generative system, graveyards, heirs/heirlooms, inheritances, insurance, legacies, life after death, money of others, mortality, occultism, spiritual/mental regeneration, surgery, taxation, wills

Waning Crescent Moon Phase

The conclusion of the cycle. Reaping what you have sown. Carrying out your mission. Culminating karma. A time to rest and recuperate; reflect and meditate. Letting go of the past. Embracing the future.

Libra Ascendant (Theme of the Month)

Alliances, fine arts, lower half of the back, beauty/beauty parlors, bedrooms, boutiques, companionship, contracts, compromises, decorators, diplomacy, florists/flowers, fashion, fancy goods, friendliness, social gatherings, intermediaries, jewelry, justice, kidneys, love, lumbar region of the body, marriage, music, negotiations, partners, one’s dealings with the public, refinement, renal disorders, social affairs, spine (mainly lumbar region), truces, unions, weddings

Ascendant Ruler in 11H

Ankles, batteries, broadcasts, leg calves, clubs, colleagues, electricity, electronics, friends, idealism, humanitarianism, inventions, legs, motion pictures, nerve specialists, organizations, new teachings and occupations, photography, progressive, psychology, radio, rebellions, reform, research, science in general, sociability, societies, phones, tv, Internet, social media, advanced or free thought, hopes and wishes

Edit 7/17: Electronics/tv/Internet was unavailable due to a 12 hour power outage. UGH.

Other Things

Area of life important for the month= Ascendant at 21° Sagittarius degree= abundance, advertising, religious/philosophical books, ceremonies, churches, colleges, commerce, counselors, higher education, intestinal disorders, exploration, religious faith, foreign countries/travel, hips, judges/judicial matters, legal affairs, upper legs, liver, pelvis, philanthropy, philosophy, publishing, religion/spirituality, sciatic nerve, spine/sacral region of the spine, sportsmen/sporting goods, thighs, prophecy/visions

Cancer in 10H (where in your life you are able to work out some of your emotional challenges this month) = achievements, ancestors, bones, one’s career, cousins from the father’s side in a woman’s horoscope, employers, one’s father (in general) or the more authoritative parent, one’s goals, government, honors, knees, matters outside the home, one’s reputation, prestige, one’s profession, promotions, one’s public appearance, public life

Sun conjunct MC= Putting your attention on your career, reputation. Focusing more on success than home life

Chiron conjunct DC= May try to hide from your inner wounds and put on a mask of confidence. Try not to project your own wounds on to others

Venus conjunct 11H cusp= Cheerfulness, harmony with friendships, clubs, colleagues, organizations

Neptune conjunct 6H cusp= Glamour, spirituality, illusion, compassion, delusion, idealism with care and health of body, clothing, comforts, cooks/cooking, diet, doctors, employees, father’s relatives, food, hygiene, illness, labor, nutrition, public health, restaurants, school strikes, stores, workplace environment

Moon square Saturn= Hard to connect to others. May feel sad and lonely

7 notes

·

View notes

Text

I don’t know if I ever said on here that I did pass that test I had to take for work. We finally got the results and they finally let us know when we’ll get our bonuses. 71% lmao sounds about right for me! But it was a pass and that’s all that matters. So I’m now technically a Certified Customs Specialist, oOoOo. But, I don’t actually have the job title “customs specialist” because I don’t actually want to be one lmao. I’m happy with my lowly “customs analyst” job. But it’s just nice to have, in case I ever do decide to try moving up, or want to switch companies, pfft.

I’m going to try saving most of my bonus because my mom mentioned looking into Disney trips after she gets her part of her “inheritance” from after my Pa died. She has to wait until 2023 to do his final taxes and then see how much is left to split between her and my two uncles. It won’t be a lot once it’s split three ways but possibly just enough for us to actually do something like that, which would be awesome. And if I save mine and put some of my money towards it too, that would help. Plus we get our annual bonuses at work around the same time as tax time so it’d all add up.

I was also thinking of getting a PS5 and like, I do want one, but I also don’t? Like my PS4 is still doing its job well enough so I’m going back and forth on if I should get the PS5 or continue waiting on that, pfft. I could get a PS5 and still have plenty to put towards a trip but eeeeehhhh. I might just buy a few hundred dollars worth of manga instead lmaooo.

4 notes

·

View notes

Text

The Importance of Probate Valuations in Estate Management

Probate valuations are a crucial part of managing a deceased person's estate. They ensure that all assets are accurately valued, which is essential for legal, tax, and distribution purposes. Understanding probate valuations can help make the estate administration process smoother and more efficient.

What is a Probate Valuation?

A probate valuation is an assessment of the deceased person's assets at the time of their death. This includes property, personal possessions, financial assets, and any other valuables. The valuation is used to calculate inheritance tax and to ensure the correct distribution of the estate according to the will or intestacy rules.

Why Are Probate Valuations Important?

Legal Requirement: In many jurisdictions, a probate valuation is required by law to obtain a Grant of Probate or Letters of Administration.

Tax Calculation: Accurate valuations are essential for calculating any inheritance tax due on the estate. Over- or under-valuing assets can lead to significant legal and financial issues.

Fair Distribution: To ensure that beneficiaries receive their correct share of the estate, all assets must be accurately valued.

Avoiding Disputes: Clear and accurate valuations help prevent disputes among beneficiaries and other interested parties.

How to Conduct a Probate Valuation

Hiring a Professional Valuer: It's advisable to hire a professional valuer, especially for high-value or complex assets like property and antiques. Professional valuations carry more weight in legal and tax matters.

Inventory of Assets: Create a comprehensive list of all assets, including bank accounts, investments, property, vehicles, jewelry, and other personal belongings.

Documenting Values: Collect all relevant documentation that can help establish the value of assets. This might include bank statements, property appraisals, and receipts for valuable items.

Date of Death Valuation: Ensure that all assets are valued as of the date of death. This is crucial for tax calculations and legal purposes.

Challenges in Probate Valuation

Valuing Unique Items: Items like art, antiques, and collectibles can be challenging to value and may require specialist appraisers.

Market Fluctuations: Property and investment values can fluctuate, complicating the valuation process.

Hidden Assets: Discovering all assets, especially those not listed in official documents, can be a complex task.

Benefits of Professional Probate Valuation Services

Accuracy: Professionals provide accurate and defensible valuations.

Expertise: They have the expertise to value a wide range of assets.

Compliance: Professional valuations ensure compliance with legal and tax requirements.

Peace of Mind: Knowing that the estate is accurately valued can provide peace of mind during a difficult time.

Conclusion

Probate valuations are an essential part of estate management, ensuring legal compliance, accurate tax calculation, and fair distribution of assets. Engaging professional valuers can make this complex task much easier and ensure that all assets are properly accounted for. Accurate probate valuations not only fulfill legal requirements but also help provide clarity and fairness for all parties involved.

0 notes

Text

Understanding the Basics of Trust Fund Inheritance Tax: A Beginner's Guide

Trust fund inheritance tax is a complex topic that many people find confusing. However, understanding the basics of trust fund inheritance tax is essential for effective estate planning. In this beginner's guide, we'll break down the key concepts and provide clarity on this important aspect of wealth transfer.

What Is Trust Fund Inheritance Tax?

Trust fund inheritance tax, also known as estate tax, is a tax imposed on the transfer of assets from one individual to another through a trust fund upon the death of the grantor or beneficiary. The tax is based on the value of the trust assets at the time of transfer and is subject to applicable tax laws and regulations.

Key Components of Trust Fund Inheritance Tax:

Taxable Estate: The taxable estate includes all assets held in trust at the time of the grantor's or beneficiary's death, including real estate, investments, cash, and personal property. Certain deductions and exemptions may apply, depending on the jurisdiction and the size of the estate.

Tax Rates: Inheritance tax rates vary by jurisdiction and are subject to change over time. The tax rates may be progressive, meaning that higher-value estates are subject to higher tax rates. It's essential to consult with tax professionals familiar with local tax laws to understand the applicable rates.

Exemptions and Deductions: Certain exemptions and deductions may apply to reduce the taxable value of the estate for inheritance tax purposes. Common exemptions include the marital deduction, charitable deduction, and annual exclusion gifts. Understanding these provisions can help minimize tax liabilities.

Filing Requirements: Executors or trustees responsible for administering the trust fund may be required to file inheritance tax returns, such as the IHT100 form in the United Kingdom. Compliance with filing requirements is essential to avoid penalties and ensure proper tax reporting.

Tax Planning Strategies: Various tax planning strategies can help minimize trust fund inheritance tax liabilities, such as establishing irrevocable trusts, utilizing annual exclusion gifts, and exploring charitable giving options. Working with inheritance tax planning specialists can help you develop a comprehensive tax strategy tailored to your specific needs.

By understanding the basics of trust fund inheritance tax and implementing effective tax planning strategies, you can navigate the complexities of estate planning with confidence. Take proactive steps to protect your assets and ensure a smooth transfer of wealth to future generations.

0 notes

Text

Nachhilfe Buchhaltung | Buchungsschatz.com

Elevate Your Tax and Accounting Skills with BuchungsSchatz

In today’s competitive environment, proficiency in tax law and accounting is pivotal for a range of professionals, from aspiring tax consultants to established accountants. BuchungsSchatz stands at the forefront of educational services, offering specialized online tutoring designed to master these complex fields. Here's how BuchungsSchatz can empower your career through tailored learning experiences.

Master Tax Law and Accounting with Expert Tutoring

At BuchungsSchatz, we understand the critical importance of detailed and robust knowledge in tax law and accounting. Whether you’re a student, trainee, or a professional such as a tax advisor, tax specialist, or accountant, our tailored online tutoring services are crafted to enhance your expertise. We prepare you for exams, assist in clarifying complex tax queries, and provide comprehensive support with custom learning plans and professional advice. Our flexible offerings are designed to help you advance in your career and pursue further training effectively.

Specialized Tax Advisory Services

BuchungsSchatz isn’t just about tutoring; we also offer specialized tax advisory services. Operating both in Düsseldorf and digitally across Germany, we cater to private individuals, entrepreneurs, and freelancers among others. Our services range from preparing income tax returns to advising on inheritance tax returns and handling accounting for startups and influencers.

Our specialized consultation in areas like sales tax issues and procedural law ensures that your tax matters are handled with the utmost competence. We support tax advisors by creating detailed reports, aiding in the digitalization of tax processes, and navigating the complexities of procedural law. With BuchungsSchatz, you gain a partner who brings your practice into the future with progressive tax advice.

Why Choose BuchungsSchatz?

1. Premium Service with Experienced Tutors: Our tutors are not just experts in their fields; they are passionate educators committed to making learning enjoyable and effective.

2. Flexibility and Accessibility: Learn from anywhere, at any time. Our online platform provides the flexibility to fit your learning into your busy schedule without compromising on the quality of instruction.

3. Customized Learning Plans: Every learner is unique, and our educational approach reflects this. We provide individualized learning plans that are specifically designed to meet your educational goals and challenges.

4. Wide Range of Services: From tax law to accounting, our services cover a broad spectrum to ensure comprehensive support for all your educational needs.

Start Your Learning Journey Today

Are you ready to boost your knowledge and skills in tax law and accounting? Book your first tutoring session with BuchungsSchatz and embark on a learning adventure that promises not just to educate but to inspire. With our commitment to making learning fun and our dedication to providing expert, individualized support, BuchungsSchatz is your ideal partner in professional growth.

Join the many professionals and students who have advanced their careers with the help of BuchungsSchatz. Visit our website to learn more about our services and how we can help you achieve your professional and academic goals. #OnlineTutoring #LearningMustBeFun #ExpertTeam #IndividualSupport

Transform your understanding of tax law and accounting with BuchungsSchatz – where learning meets excellence.

0 notes

Text

What Is A Gold IRA?

Commonly, there are a few considerations concerned when switching from Roth IRAs and classic IRAs to the gold IRA. The finest way to get advantage of a gold IRA is to use it as an accumulation car as component of a broader, a lot more diversified investment system. A SEP IRA allows you to make annual contributions of up to 25% of your revenue or $55,000, whichever is significantly less, if you earn an yearly salary. We operate with several marketplace-top pros in this discipline to be certain that our clients are neither bogged down by paperwork nor encumbered by yearly account management. In picking out the quite most effective profile, clientele will undoubtedly have the advantage of functioning closely with the personalized professionals of the Augusta Group. If you do own some supplies in your profile, however want to consist of some diversity to reduce danger, integrating gold into your total investment photo will surely assist to ravel any market place accidents. If you do personal some stocks in your portfolio, however want to include things like some diversity to cut down risk, incorporating gold appropriate into your basic investment photograph will assist to ravel any market place collisions. Specific parameters ought to be met to make sure that gold can be held inside of your IRA, so you will will need a staff of specialists to enable you through the investment approach.

If you’re new to silver or gold person retirement account investments, you can locate a terrific deal of worth appropriate right here. If you are not so pleased about your existing investment or feel that you could use a superior investment, then the valuable Gold IRA is the greatest alternative right here to put you on the suitable tracks. Hello dear, thanks for sharing this information and facts with us , I was in fact executing some investigation on line when I noticed your publish, I genuinely fancy these submit, I think investing in a gold IRA is great, thanks for the data, I will do some thing about my retirement fund when the pandemic is more than, thanks for the info. You will intend to beware with these gold financial investments given that you do not know what you are getting. goldira1.com is a tangible asset and is not susceptible to alterations connected with inflation, organization earnings, and stock marketplace volatility. Valuable metals have an inverse romantic relationship with numerous other assets, so they’ll often safeguard your retirement. In fact, the romantic relationship concerning gold and the dollar is normally seen as an inverse 1.

When evaluating IRA custodians, some items 1 might want to examine contain length of time in business enterprise, purchaser critiques and fees and bills. Rather gold is a kind of currency that serves as a hedge of safety towards inflation which lowers the value of money in excess of time. In 2019, the World Gold Council published Accountable Gold Mining Ideas to assistance the objectives of the Paris Climate Accord. The incredibly initial thing that you will observe when you check with with an agent of Goldco is that they are actually knowledgeable regarding their solutions and providers. Pieces are normally offered to the upcoming generation as household treasures, including emotional worth past that of the piece itself. If you are not the partner of the deceased, moving an inherited annuity may possibly not get you out of tax liability. If you are not the spouse of the deceased, an inherited annuity is taxable just like any other supply of earnings. What are my principal goals for investing in physical bullion?

403(b)s- This retirement account is only available to tax-exempt organizations or school personnel. The IRS plainly specifies that only authorized and accredited economic organizations such as banking institutions or non-bank trustees can act as IRA administrators. What specifies a late purchase is not pointed out in the company statement, having said that, and there are no programs or procedures provided for self-directed IRA gold storage on their website or inside any existing press releases. Despite the fact that Goldco’s investment opportunities may not be correct for everyone, persons who are interested in investing in valuable metals will advantage from Goldco’s low charges and extremely praised purchaser support.

0 notes

Text

5 Factors Lda Pro Paralegals Consider While Providing You With Living Trust Services

Living Trust Services are essential for anyone who wishes to ensure that their assets are distributed according to their wishes after they pass away. A Living Trust is a legal document that specifies the management and distribution of an individual's assets both during and after their lifetime. A specialist who can assist you with every aspect of living trust services is an LDA Pro Paralegal.

LDA Pro Paralegals takes several things into account when offering Living Trust Services to make sure the client's needs are satisfied. You will explore a few of the factors that LDA Pro Paralegals take into account when offering Living Trust Services in this blog.

Hiring Lda Pro To Avail Of The Living Trust Services: 5 Factors They Usually Keep In Mind

Here listed below are all the 5 factors that LDA Pro considers while drafting your living trust

Client’s Goals And Objectives

The first and most important factor that LDA Pro Paralegals consider while providing Living Trust Services is the client's goals and objectives. Before drafting a living trust, it is essential to understand what the client wants to achieve. For example, if the client wants to ensure that their assets are distributed to their children in the event of their death, the LDA Pro Paralegal will draft a living trust that reflects these wishes.

Assets And Liabilities

When offering living trust services, LDA Pro Paralegals also takes the client's assets and liabilities into account. They must be aware of all the assets the client possesses, such as personal belongings, bank accounts, investments, and real estate. They must also be aware of any obligations or debts the client may have that could influence how their assets are divided.

Tax Implications

When providing Living Trust Services, LDA Pro Paralegals considers the potential tax implications. They need to find out how to lower the tax liability and if estate taxes will apply to the client's estate. Also, they might provide clients with tax-saving asset structuring advice.

Trustee Selection

The choice of trustee will also be taken into account by the LDA Pro Paralegal when offering living trust Services. The trustee holds the responsibility of overseeing the trust's assets and allocating them according to the client's desires. Selecting a dependable and accountable trustee who will honor the client's wishes is crucial.

Beneficiary Designations

Beneficiary designations are another consideration that LDA Pro Paralegals take into account when offering Living Trust Services. Beneficiary designations are significant because they specify the person who will inherit the trust's assets upon the client's passing. Working with clients, LDA Pro Paralegals will make sure beneficiary designations accurately represent their desires and are current.

So here are all the 5 factors Lda pro paralegals consider while providing you the Living Trust Services, if you find this blog useful, then do visit our official website today and explore more about our other services like flawless drafting of Gift deeds in California which is available at a reasonable price range.

0 notes

Text

Using Enterprise Investment Scheme (EIS) to Defer Capital Gains Tax on Second Home UK

New Post has been published on https://www.fastaccountant.co.uk/defer-capital-gains-tax-on-second-home/

Using Enterprise Investment Scheme (EIS) to Defer Capital Gains Tax on Second Home UK

The Enterprise Investment Scheme (EIS) stands as a compelling government initiative designed to assist smaller, higher-risk companies in raising finance by offering tax reliefs to investors who purchase new shares in these enterprises. While primarily focused on fostering investment in burgeoning companies, EIS also presents a unique opportunity for individuals looking to defer Capital Gains Tax on second home and from the sale of other assets, not just UK residential properties. This article delves into how individuals can utilize EIS to defer CGT, thereby optimizing their tax positions and supporting the growth of the UK’s entrepreneurial ecosystem.

Understanding Capital Gains Tax (CGT)

CGT is a tax on the profit (or gain) you make when you sell (or ‘dispose of’) something (an ‘asset’) that has increased in value. The tax is not on the entire amount you receive but on the gain you make. In the context of UK residential property, CGT becomes applicable when a property not designated as your main home is sold at a profit. The rates for CGT can significantly impact the net proceeds from such sales, making tax planning an essential consideration for property investors and homeowners alike.

The Enterprise Investment Scheme: An Overview

EIS is targeted at investors willing to fund small and medium-sized businesses in exchange for tax reliefs on their investments. These reliefs include income tax relief, loss relief, and the potential for CGT deferral. It’s the latter that provides an avenue for property sellers to defer the CGT due on their gains, under certain conditions.

Deferment of Capital Gains Tax On Second Home Through EIS

The deferral relief offered by EIS allows investors to defer paying Capital Gains Tax on second home, provided the gain is invested in qualifying shares of an EIS-eligible company. The key advantage here is that there is no upper limit on the amount of gain that can be deferred, and it applies to any asset sold with a CGT liability, not just shares. This means that gains from the sale of a UK residential property can effectively be ‘rolled over’ into an EIS investment, deferring the CGT until the EIS shares are disposed of.

How to Qualify for Deferral of Capital Gains Tax on Second Home

Investment Timing: The investment in the EIS shares must be made either 12 months before or 3 years after the gain arose.

EIS Eligibility: The company in which the investment is made must qualify under the EIS rules, which include certain restrictions on the company’s activities, size, and how the raised funds are used.

Holding Period: The EIS shares must be held for at least three years to maintain the CGT deferral and other tax reliefs.

Strategic Considerations

Risk Assessment: Investing in EIS-eligible companies involves higher risks. It’s crucial to conduct thorough due diligence or consult with financial advisors to understand the investment’s risk profile.

Diversification: To mitigate risk, investors might consider spreading their investment across multiple EIS opportunities.

Tax Planning: Engage with tax specialists to ensure that the investment aligns with your overall tax planning strategy, including implications for inheritance tax and the EIS investment’s impact on your income tax position.

Conclusion

The ability to defer Capital Gains Tax on second home through investments in the Enterprise Investment Scheme offers a strategic tax planning tool for individuals looking to sell UK residential properties. This scheme not only provides a tax-efficient way to manage capital gains tax on second home but also supports the growth of innovative companies across the UK. However, given the inherent risks associated with EIS investments, thorough due diligence and professional advice are paramount to making informed decisions that align with your financial goals and risk tolerance.

Frequently asked questions

What is the Enterprise Investment Scheme (EIS)?

The Enterprise Investment Scheme (EIS) is a UK government initiative designed to help smaller, higher-risk companies raise finance by offering tax reliefs to individual investors who buy new shares in those companies.

How can EIS help defer Capital Gains Tax?

EIS offers a CGT deferral relief for investors. This means if you invest a capital gain into qualifying EIS shares, you can defer paying CGT on that gain until you dispose of the EIS shares. This applies to gains made from the sale of any asset, including residential properties.

Are there limits to how much gain can be deferred through EIS?

No, there is no upper limit on the amount of gain that can be deferred through EIS. This allows significant flexibility for investors looking to manage large capital gains.

What are the key conditions for EIS CGT deferral relief?

Investment Timing: The investment must be made within 3 years after the gain was realized or up to 12 months before.

EIS Eligibility: The investment must be in shares of a company that qualifies under EIS.

Holding Period: The shares must be held for at least three years to maintain the deferral relief.

Can CGT deferral through EIS be combined with other forms of tax relief?

Yes, investing in EIS not only offers CGT deferral but also allows investors to benefit from income tax relief and potential loss relief, subject to specific conditions and limits.

What happens to the deferred CGT if I sell my EIS shares?

When you dispose of your EIS shares, the deferred CGT becomes payable. However, if the EIS investment results in a loss, you may be able to offset this loss against the gain, potentially reducing the CGT liability.

Is it possible to defer Capital Gains Tax on second home?

Yes, CGT deferral through EIS applies to gains from the sale of any assets, including residential properties that are not your main home. This makes it a useful tool for property investors.

How risky are EIS investments?

EIS investments are in smaller, higher-risk companies, which means there is a significant risk of losing capital. Investors should carefully consider their risk tolerance and consult financial advisors before making EIS investments.

Can I invest in any company and qualify for EIS benefits?

No, not all companies qualify for EIS. There are specific criteria a company must meet, such as being a trading company, having a permanent establishment in the UK, and not exceeding certain size thresholds in terms of assets and employees.

How can I ensure my investment qualifies for EIS benefits?

Before making an investment, you should ensure the company has received “EIS advance assurance” from HMRC, which indicates that the company is likely to qualify for EIS. However, the final determination of EIS eligibility is made when the investor submits their tax return and claims the EIS relief.

#Capital Gains Tax#Capital Gains Tax on Second Home#Capital Gains Tax on Second Home UK#capital gains tax on selling second home

0 notes

Text

The impact of Inheritance Tax on small business owners | Inheritance-tax.co.uk

As a small business owner, you have spent years building your company from the ground up. You have invested countless hours and money into your business, and it has become a significant part of your life. However, have you considered the impact of inheritance tax on your business? Inheritance tax is a tax levied on an estate after a person's death, and it can have a significant impact on small business owners. In this post, we will explore the impact of inheritance tax on small business owners and provide advice on how to navigate this tax.

Inheritance tax can be a significant burden on small business owners.

Small business owners are often cash-poor, and their businesses represent a significant portion of their wealth. Inheritance tax can be a significant burden on small business owners, as it requires the payment of tax on the value of the business at the time of the owner's death. This tax can be especially challenging to pay for small business owners who have little liquidity, and it can force the sale of the business to cover the tax bill. This can be a devastating outcome for small business owners who have spent years building their company and do not want to see it sold.

Planning ahead can mitigate the impact of inheritance tax on small business owners.

Planning ahead is crucial for small business owners who want to mitigate the impact of inheritance tax on their business. There are several strategies that small business owners can use to reduce their inheritance tax liability. For example, small business owners can transfer ownership of their business to family members or employees before their death, reducing the value of their estate and the amount of inheritance tax due. Additionally, small business owners can use trusts and other estate planning tools to reduce their inheritance tax liability.

Professional inheritance tax advice can help small business owners navigate the tax system.

Inheritance tax is a complex tax, and small business owners may benefit from professional inheritance tax advice UK. An inheritance tax specialist can provide small business owners with advice on how to structure their estate to reduce their tax liability. Additionally, an inheritance tax specialist can provide guidance on the use of trusts and other estate planning tools to mitigate the impact of inheritance tax on small business owners.

Business property relief can be a valuable tax break for small business owners.

Business property relief is a valuable tax break for small business owners, as it can provide relief from inheritance tax on the value of qualifying business assets. Qualifying business assets include shares in unlisted companies, and business property such as buildings and land used for the purposes of the business. Small business owners should be aware of the rules surrounding business property relief and ensure that their business qualifies for the relief.

The impact of inheritance tax on small business owners can be mitigated with life insurance.

Life insurance can be a valuable tool for small business owners looking to mitigate the impact of inheritance tax on their business. Small business owners can take out life insurance policies that pay out on their death, providing the funds necessary to pay their inheritance tax bill without having to sell their business. This can provide small business owners with peace of mind knowing that their business will not have to be sold to cover the tax bill.

Conclusion

In conclusion, inheritance tax can have a significant impact on small business owners, but there are strategies that can be used to mitigate its impact. Planning ahead, seeking professional inheritance tax advice UK, and utilizing tax breaks such as business property relief can help small business owners reduce their tax liability. Additionally, life insurance can be a valuable tool for small business owners looking to ensure that their business is not sold to cover the tax bill. By taking proactive steps to address the impact of inheritance tax on their business, small business owners can ensure that their hard work and investment are protected for future generations.

#Inheritance tax#inheritance tax advice UK#inheritance tax specialist#tax planning#tax#property tax#finance#inheritance

1 note

·

View note

Text

Understanding Inheritance Tax Planning Advice: A Comprehensive Guide

Introduction:

Inheritance tax (IHT) can significantly impact the assets passed down to loved ones after someone passes away. However, with proper planning and advice, individuals can minimize the tax burden on their estate. Let's explore what inheritance tax planning advice entails and how it can benefit you and your family.

How Inheritance Tax Planning Works:

Inheritance tax planning advice involves arranging your finances and assets in a way that minimizes the amount of tax payable on your estate after your death. It aims to maximize the value of the inheritance you leave behind for your beneficiaries.

How to Assess Your Inheritance Tax Liability:

The first step in inheritance tax planning is to assess the value of your estate and determine your potential tax liability. This includes calculating the value of your property, savings, investments, and any other assets you own.

How Inheritance Tax Exemptions and Reliefs Work:

Understanding inheritance tax exemptions and reliefs is essential for effective tax planning. These provisions allow certain assets or transfers to be excluded from the calculation of inheritance tax, thereby reducing the overall tax liability.

How to Utilize Annual Gift Allowances:

One strategy for minimizing inheritance tax is to take advantage of annual gift allowances. These allowances enable you to gift assets or money to your loved ones tax-free up to a certain limit each year.

How Trusts Can Help with Inheritance Planning:

Setting up trusts can be a valuable tool in inheritance tax planning. By transferring assets into a trust, you can remove them from your estate for inheritance tax purposes while still retaining control over how they are managed and distributed.

How to Make Use of Spousal and Charitable Exemptions:

Married couples and civil partners benefit from spousal exemptions, which allow them to pass assets to each other free of inheritance tax. Additionally, charitable donations made in your will or during your lifetime are exempt from inheritance tax.

How to Plan for Business and Agricultural Assets:

Business and agricultural assets may qualify for special reliefs, such as business property relief (BPR) and agricultural property relief (APR), which can reduce or eliminate their inheritance tax liability. Proper planning is crucial to ensure these reliefs are maximized.

How to Structure Life Insurance Policies:

Life insurance policies can play a role in inheritance tax planning by providing funds to cover any tax liabilities without depleting the estate's assets. Setting up policies in trust can ensure that the proceeds are not subject to inheritance tax.

How to Seek Professional Advice:

Given the complexities of inheritance tax planning, seeking professional advice from a qualified financial advisor or estate planning specialist is highly recommended. They can assess your individual circumstances and recommend tailored strategies to minimize your tax liability.

How to Review and Update Your Plan Regularly:

Inheritance tax planning is not a one-time task but an ongoing process. It's essential to review and update your plan regularly to account for changes in your financial situation, tax laws, and personal circumstances.

Conclusion:

Inheritance tax planning advice is vital for anyone concerned about minimizing the tax burden on their estate and maximizing the inheritance they leave behind for their loved ones. By understanding the various strategies and exemptions available and seeking professional advice when needed, individuals can ensure that their assets are passed down as efficiently as possible. Start planning today to secure your family's financial future.

0 notes

Video

youtube

Making A Professional Will Can Save You Thousands Money Tips 365 Day 17 Wills

Yesterday I said that there are two certainties in life: death, and taxes!

Taxes do not end when people die. Millions pay inheritance tax (IHT) o their parent’s estate, much of which can be legally avoided with proper tax planning.

The first step is making a Will, preferably with a professional who can advise you on mitigating IHT.

If you need help making a Will, email [email protected] for a free consultation with a specialist.

Section 24 Tax Hike Solutions Revealed By Property Accountant

Interview with Chartered Accountant and property tax specialist who reveals options and solutions to move your properties from your own name into a limited company or LLP whilst mitigating the potential HMRC pitfalls.

Email [email protected] for a free consultation on how to deal with Section 24.

Watch video now: https://youtu.be/aMuGs_ek17s

In this 45-minute interview we discuss:

· What is Section 24 and when did George Osbourne introduce this tax hike on landlords?

· 6 options available to landlords with buy-to-let properties in their own name

· What is classed as a property business and property partnership?

· Ramsay v HMRC (2013) case explained

· Incorporation Relief, Stamp Duty, CGT (Capital Gains tax) and much more…

Over 29,000 people signed a petition calling on the government to reverse this unfair tax o landlords to no avail.

Find out what you can do in this video.

Email [email protected] for a free consultation on how to deal with Section 24.

Join my Money Tips 365 Supporters Club on Spotify: -

https://podcasters.spotify.com/pod/show/charles-kelly/subscribe

#tax #section24 #savetax #Will #IHT #holidaylet #money #moneytips

0 notes

Text

Estate Planning Essentials: The Importance of Creating a Will and Estate Plan

Estate making plans starts off evolved from making preparations for the distribution of your belongings and homes under your possession. It encompasses numerous prison files and strategies geared toward ensuring your needs are finished effectively.

The Importance of Creating a Will:

A will is the cornerstone of any estate plan. It outlines your desires regarding asset distribution and ensures your loved ones acquire what you plan them to have. Without a will, country legal guidelines might dictate how your property receives distributed.

Elements of an Effective Estate Plan:

An powerful property plan incorporates numerous additives, together with a will, trusts, powers of lawyer, and healthcare directives. These elements paintings collectively to cowl exclusive components of your property and end-of-existence needs.

Selecting Beneficiaries and Executors:

Careful consideration in deciding on beneficiaries and executors is pivotal. Beneficiaries are folks that will inherit your property, even as executors are entrusted with executing your will and handling the property.

Tax Implications in Real Estate Planning:

Understanding tax implications is crucial in estate making plans. Certain strategies can reduce tax burdens, making sure that greater of your property passes for your beneficiaries.

Avoiding Family Disputes:

A nicely-thought-out estate plan can prevent ability conflicts amongst family members. Clearly outlining your intentions reduces the chance of disputes over asset distribution.

Guardianship for Dependents:

For dad and mom with minor youngsters, an estate plan lets in for the designation of guardians. This ensures the care of your youngsters through people you accept as true with if some thing takes place to you.

Regularly Reviewing and Updating the Estate Plan:

Life & want modifications with time, and so need to your estate plan. Regular evaluations and updates make certain your plan aligns with your modern circumstances and destiny goals.

Common Misconceptions about Estate Planning:

Many misconceptions exist round property planning. Dispelling these myths is vital for people to make informed selections concerning their estates. Best manner to consult a couple of specialists in your documentations and methods planned, so gaps can be observed and removed.

Estate Planning: Hiring Professionals vs. DIY:

While some opt for DIY estate planning, hiring experts including estate lawyers and economic advisors can offer information and ensure your plan complies with legal necessities. But it’s far usually recommended to have multiple to have different and better views at the plans.

Addressing Real Estate inside the Estate Plan:

Real estate constitutes a sizeable part of many estates. Clear commands concerning every estate guarantees its right management & distribution in keeping with your needs.

Safeguarding Business Interests within the Plan:

For business proprietors, integrating commercial enterprise succession plans into the property ensures the seamless transfer of business ownership and operations. Detailed documentation with consultant advises is must have well planned ownership transfers.

Integrating Digital Assets into the Estate Plan:

In the virtual age, along with virtual assets like cryptocurrency, social media accounts, and intellectual belongings is important inside an estate plan to keep away from complications for heirs. Include them properly in time for your list of belongings.

Creating a will and property plan is a essential responsibility. It no longer handiest presents peace of thoughts but also guarantees your assets are dealt with in keeping with your desires, safeguarding your loved ones’ destiny.

0 notes