#PersonalFinance

Text

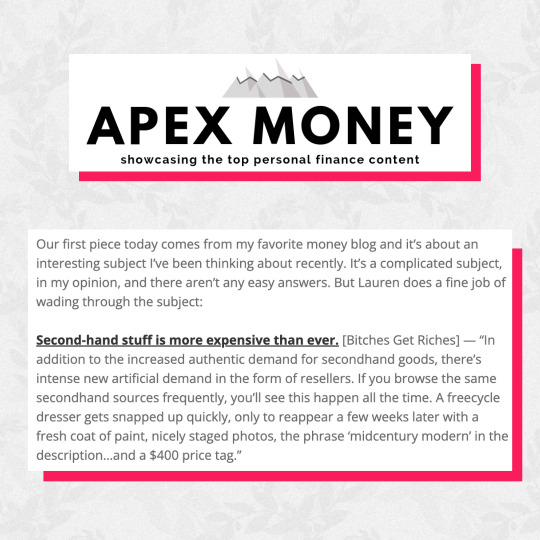

Hey, that's our article! Thanks for the feature, Jim and J.D.! We love Apex Money's daily newsletter of excellent finance reads from around the interwebs. You can subscribe at apexmoney.com.

And here's the article if you haven't read it yet:

It’s Not Your Imagination—Secondhand Stuff IS More Expensive Than Ever

#newsletter#apexmoney#jdroth#jimwang#blogs#blogging#blogfeature#personalfinance#careeradvice#money#moneytips

22 notes

·

View notes

Text

#savings#money#deals#financialfreedom#sale#finance#savingmoney#coupons#couponing#investment#couponcommunity#savemoney#discount#personalfinance#budget#investing#debtfreecommunity#deal#budgeting#save#wealth#neverpayfullprice#debtfree#insurance#retirement#financialliteracy#clearance#business#financialplanning#investments

15 notes

·

View notes

Text

Las mejores alternativas de tarjetas de crédito en dólares para Latinoamérica en 2023

Latinoamérica está experimentando una revolución financiera digital. Aunque apenas el 49.1% de la población mexicana tiene acceso a servicios bancarios, los métodos de pago digitales y soluciones innovadoras están llenando ese vacío, ofreciendo alternativas financieras frescas a la población. En este artículo, exploraremos las opciones disponibles para los latinoamericanos que desean solicitar tarjetas de crédito en dólares y cómo Neomoon se alza como líder en este espacio.

Alternativas disponibles

Neobancos: Bancos puramente digitales como Nubank que ofrecen soluciones primordialmente a través de aplicaciones móviles.

Startups de Tarjetas: Compañías como Stori, Rappi Pay, y Fondeadora proponen tarjetas gestionadas en su mayoría a través de aplicaciones.

Otras tarjetas populares para viajar: Opciones como Revolut, N26 y Wise, que presentan soluciones sin comisiones para viajeros.

Neomoon: Una innovadora propuesta que va más allá de ser simplemente una tarjeta, integrando el mundo de las criptomonedas con el financiero convencional.

Neomoon: Más que una tarjeta

Neomoon es una combinación de múltiples soluciones financieras: es tarjeta, es neobanco, es billetera digital, y es mucho más.

Diversidad de opciones: Proporciona tanto una tarjeta de crédito virtual Mastercard Gold como una física Platinum Mastercard, ambas en dólares estadounidenses.

Versatilidad Financiera: No se limita a ser solo una tarjeta. Funciona también como un neobanco y una billetera digital, ofreciendo cuentas en dólares tanto a usuarios como a comercios.

Portal P2P Propio: Neomoon brinda su propio espacio de intercambio peer-to-peer, permitiendo el intercambio de distintos medios de pago y facilitando las transacciones dentro y fuera de su ecosistema.

Soluciones Tecnológicas para Comercios: Desde POS ilimitados hasta herramientas que impulsan ventas, Neomoon se posiciona como un aliado indispensable para los negocios.

Tecnología Inclusiva: Ya sea que tengas el smartphone más avanzado del mercado o ni siquiera cuentes con uno, Neomoon tiene soluciones adaptadas a cada usuario.

Comunidad en Crecimiento: Con más de 200 mil usuarios, su expansión ha sido en gran parte orgánica, impulsada por recomendaciones boca a boca. Es muy probable que conozcas a alguien que ya esté aprovechando los beneficios de Neomoon.

Adicionalmente, te invitamos a seguir la cuenta oficial de Neomoon en Instagram, donde encontrarás valioso contenido sobre educación financiera y las últimas actualizaciones de la plataforma.

Conclusión

En medio de una gama amplia y variada de tarjetas para viajar sin comisiones en 2023, Neomoon se destaca no solo por sus ventajas en términos de tarjeta de crédito, sino por ser una solución financiera integral. Con una propuesta que integra el mundo financiero tradicional y digital, y adaptada a las diversas necesidades del mercado latinoamericano, Neomoon se presenta como la opción de futuro para aquellos que buscan innovar en sus finanzas personales y comerciales.

#neomoonapp#usdc#fedorsaldivia#ahorro#financial inclusion#personalfinance#latam#finanzaspersonales#usdt#challengerbank#neomoon#neobank#stablecoin#blockchain#inversiones#cuentasendolares#datoscuriosos#formasdeahorrar

10 notes

·

View notes

Text

"As women, society tells us to curb our spending while telling men to increase their earning potential.

I'm done internalizing or perpetuating this patriarchal bullshit."

Delyanne Barros (@DelyanneMoney on twt, @delyannethemoneycoach on IG)

#personalfinance#business#accounting#inspirational quotes#quotes#quoteoftheday#life quote#inspiration#money#investing#patriarchy#gender bias#women#women's rights#women in finance#finance#society#smash the patriarchy#gender equality#sexism#double standards#united states#history#culture

6 notes

·

View notes

Text

Fintlivest Services Private Limited is a financial service provider with personalized solutions for all types of financial planning. Our aim is to provide single window access to a wide range of financial products, including mutual funds, equities, IPO, ETFs, bonds, FDs, insurance PMS, NPS, loans etc, to help meet diverse financial objectives. We provide all financial services with transparency. Our focus is on putting the customer first and ensuring a guaranteed high return on investment.

2 notes

·

View notes

Text

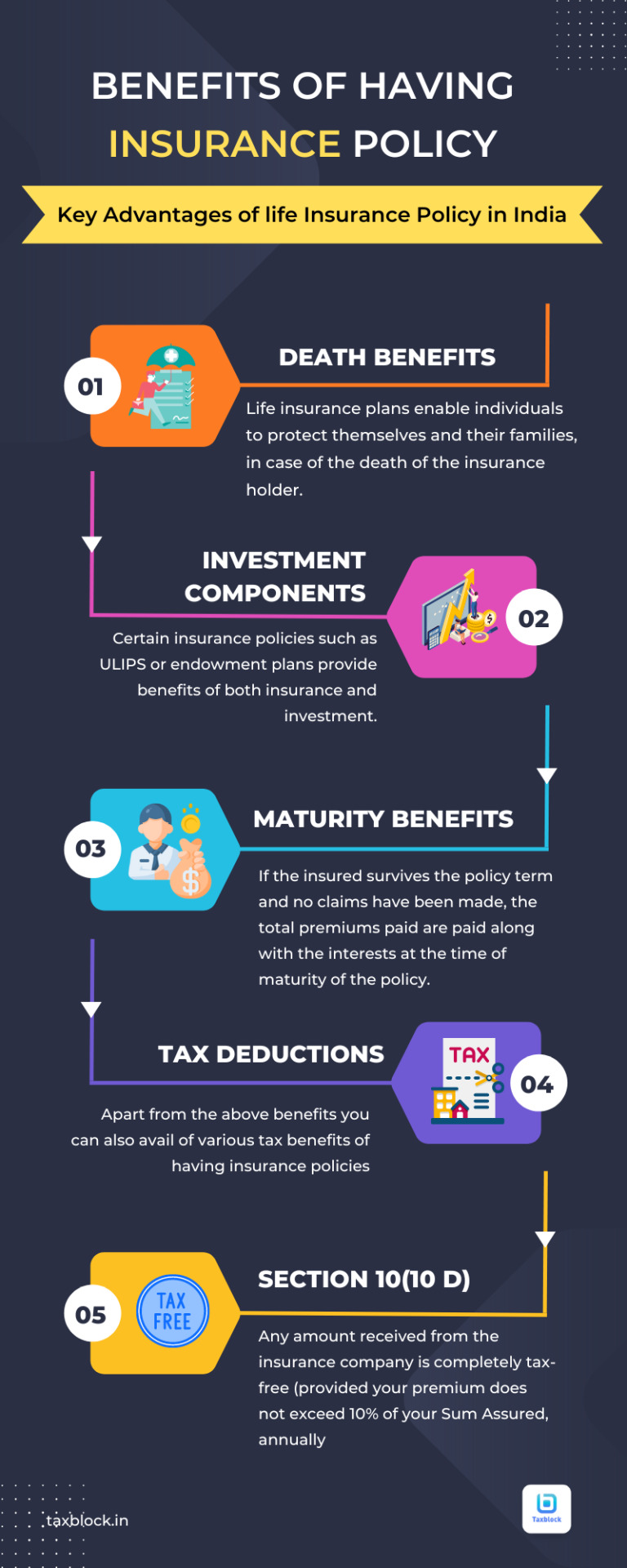

The top five key benefits of having an insurance policy in India Click on the link to learn more about an insurance policy.

#finance#money#investing#financialfreedom#investment#entrepreneur#invest#success#forex#motivation#investor#accounting#personalfinance#financialliteracy#wallstreet#smallbusiness#credit#insurancepolicy#financialservices#infographic#tumblrpost#financeeducation

31 notes

·

View notes

Text

How to Save Money with a Tight Budget!!!

Wallet feeling lighter than a feather? Don't worry, fam! We're all about saving smart, not living like a broke student (again). Share your budgeting hacks, score deals like a pro, and ditch sneaky spending habits in the comments! Let's turn #SquadGoals into #SavingsGoals!

Saving Money Responsibly

Pay yourself first

Avoid accumulating new debt

Set reasonable savings goals

Establish a time frame for your goals

Keep a budget

Record your expenses

Double-check all payment amounts

Start saving as early as possible

Consider contributing to a retirement account

Make stock market investments cautiously

Don't get discouraged

Chopping Your Expenses

Remove luxuries from your budget

Find cheaper housing

Eat for cheap.

Reduce your energy usage.

Use cheaper forms of transportation

Have fun for cheap (or free)

Avoid expensive addictions.

Spending Money Brilliantly

Spend money on absolute essentials first

Save for an emergency fund

Pay off your debt

Put away money next

Spend on smart non-essentials

Spend on luxuries last

#finance#money#investing#business#economy#budgeting#debtfree#financialliteracy#financialfreedom#personalfinance#sidehustle#passiveincome#fintwit#financialgoals#millennialmoney

2 notes

·

View notes

Text

10 Easy Ways To Save Money On Low Income: Key To Financial Freedom | WealthCannons

youtube

This video contains essential money-saving advice that is very practical if you earn a low income and struggle to save part of your income for emergencies, investing and other essential stuff that is dear to you. Applying the money-saving hacks in the video will help you to save money fast even if you are on minimum wage. The video contains tips on minimalism, budgeting, frugal living, and money management tips and these tips will surely make a big impact on your life.

#saving#money#investing#income#financialeducation#rich#budget#realestate#automatedincome#expenses#passiveincome#lowincome#personalfinance#personaldevelopment#Youtube

2 notes

·

View notes

Text

10 Essential Tips for Effective Financial Management

Introduction

Effective financial management is the cornerstone of a stable and prosperous life. Whether you're an individual or a business owner, mastering the art of managing your finances can lead to greater financial security and opportunities. In this article, we will delve into the 10 essential tips for effective financial management, providing you with actionable advice to help you make informed financial decisions.

1. Create a Detailed Budget

Managing your finances starts with creating a detailed budget. A budget helps you track your income, expenses, and savings goals. By understanding where your money goes, you can make necessary adjustments to achieve your financial objectives.

2. Set Clear Financial Goals

To effectively manage your finances, set clear and achievable financial goals. These goals will serve as a roadmap for your financial journey, helping you stay motivated and focused.

3. Build an Emergency Fund

Life is full of unexpected surprises, and having an emergency fund is crucial. Aim to save at least three to six months' worth of living expenses in an easily accessible account.

4. Reduce Debt

High-interest debts can hinder your financial progress. Create a plan to reduce and eventually eliminate your debts. Start by paying off high-interest debts first.

5. Invest Wisely

Make your money work for you by investing wisely. Diversify your investments, consider long-term strategies, and seek advice from financial experts if needed.

6. Monitor Your Credit Score

Your credit score plays a significant role in your financial life. Regularly monitor it and take steps to improve it if necessary. A good credit score can lead to better borrowing terms and financial opportunities.

7. Save for Retirement

Don't wait until retirement is around the corner to start saving. The earlier you begin, the more you can accumulate. Explore retirement account options and contribute regularly.

8. Review and Adjust

Financial management is not a one-time task. Periodically review your budget, goals, and investments. Make adjustments as your financial situation changes.

9. Seek Professional Advice

If you find financial management overwhelming, consider seeking advice from a financial advisor. They can provide personalized guidance and strategies to optimize your finances.

10. Stay Informed

Stay updated on financial news, trends, and opportunities. Knowledge is power, and being informed will help you make better financial decisions.

10 Essential Tips for Effective Financial Management

In this section, we will briefly recap the ten essential tips for effective financial management:

Create a Detailed Budget

Set Clear Financial Goals

Build an Emergency Fund

Reduce Debt

Invest Wisely

Monitor Your Credit Score

Save for Retirement

Review and Adjust

Seek Professional Advice

Stay Informed

FAQs

Q: How do I start creating a budget?

A: Begin by listing all your sources of income and your monthly expenses. Categorize your expenses and identify areas where you can cut back.

Q: What's the ideal emergency fund size?

A: Aim for three to six months' worth of living expenses, but adjust based on your personal circumstances and risk tolerance.

Q: Can I manage my investments on my own?

A: While it's possible to manage your investments independently, seeking advice from a financial advisor can help you make more informed decisions.

Q: How often should I review my financial goals?

A: Regularly review your financial goals, at least once a year, and adjust them as needed to reflect changes in your life or financial situation.

Q: What's the best way to improve my credit score?

A: To boost your credit score, pay bills on time, reduce outstanding debts, and avoid opening too many new credit accounts.

Q: When should I start saving for retirement?

A: Start saving for retirement as early as possible to maximize your savings. The earlier you begin, the more you can accumulate over time.

Conclusion

Effective financial management is a skill that anyone can master with dedication and commitment. By following these 10 essential tips for effective financial management, you can take control of your finances, secure your future, and achieve your financial dreams. Remember that financial management is an ongoing process, so stay informed, adapt to changes, and always strive for financial excellence.

#FinancialManagement#MoneyManagement#PersonalFinance#FinancialGoals#Budgeting#InvestingTips#CreditScore#RetirementPlanning#DebtManagement#FinancialFreedom#Savings#FinanceTips#SmartInvesting#BudgetingTips#FinancialPlanning#WealthManagement#FinancialEducation#Finance101#FinancialAdvisor#MoneyMatters#MoneySmarts

4 notes

·

View notes

Text

The Top 10 Financial Obstacles That Prevent People from Achieving Their Goals

The top 10 financial obstacles that prevent people from achieving their goals include:

Living beyond one's means

Lack of emergency savings

High credit card debt

No budget

No retirement savings plan

No investment portfolio

Over-reliance on a single source of income

No financial education

Neglecting insurance coverage

Not having a plan for paying off debt

It's important to maintain a healthy lifestyle, even when you're on the go. If you're looking for healthy fast food options, be sure to check out https://www.aajkaakhbaar.com/are-you-saving-enough-money-to-hit-your-financial-goals. This website provides a comprehensive list of the top 10 healthy fast food options, so you can enjoy a delicious and nutritious meal, no matter where you are. Whether you're looking for a quick breakfast, a healthy lunch, or a satisfying dinner, this site has you covered.

#goals#financialobstacles#money#business#wealth#financialfreedom#personalfinance#moneytips#financialliteracy#financialindustry#personalwealth#wealthy#finance#financing#financialindependence#millionaire#investing#invest#aajkaakhbaar#aajkasamachar#realnewsofus

13 notes

·

View notes

Text

"Mastering Finances: Unlocking Wealth with Our Money-Making Tutorials"

------------------------------------------------------------------------

DM ME (instagram: z3tko) SAME MONEY ONLY FOR 20$ 💳💸

#FinanceTips#MoneyTutorials#FinancialSuccess#WealthBuilding#IncomeBoost#MoneyManagement#FinancialFreedom#InvestingAdvice#BudgetingTips#FinancialEducation#PersonalFinance#MoneyMatters#FinancialEmpowerment#FinancialGoals#MoneySkills#FinancialWisdom#MoneySavvy#MoneyTalks#EconomicEmpowerment#FinancialResources#FinancialJourney

2 notes

·

View notes

Photo

The Bitches in the same place, at the same time?? It’s more likely than you think! Tune in to the BGR YouTube channel TONIGHT at 9pm EST (link in the comments) for a live AMA with both Kitty & Piggy! #bitchesgetriches #personalfinance #AMA #FIRE #earlyretirement #animorphs #noseriouslyaskthemaboutanimorphs https://www.instagram.com/p/Cp5Dfn_OJ4Y/?igshid=NGJjMDIxMWI=

#bitchesgetriches#personalfinance#ama#fire#earlyretirement#animorphs#noseriouslyaskthemaboutanimorphs

24 notes

·

View notes

Text

Navigating Financial Success with Advisory Services: A Certified Accountant's Guide to Maximizing Income

Introduction:

In the complex landscape of personal and business finance, securing your financial future and maximizing your income are paramount goals. To achieve these objectives, many individuals and businesses turn to Certified Accountants who provide essential advisory services. In this comprehensive guide, we'll explore the world of advisory services offered by certified accountants and how they can help you optimize your income. Whether you're an individual seeking financial guidance or a business owner looking to enhance your bottom line, this article will provide valuable insights to help you achieve financial success.

Understanding Advisory Services

1.1 What Are Advisory Services?

Advisory services, in the context of certified accountants, encompass a wide range of financial and strategic guidance aimed at helping individuals and organizations make informed decisions to achieve their financial objectives. These services extend beyond traditional accounting and auditing and focus on proactively improving financial outcomes.

1.2 Role of a Certified Accountant

A certified accountant, often referred to as a Certified Public Accountant (CPA), is a licensed professional with extensive expertise in accounting, taxation, and financial management. Certified accountants go beyond number-crunching; they provide invaluable insights and recommendations to enhance financial health.

How Advisory Services Maximize Income

2.1 Income Optimization Strategies

Certified accountants leverage their knowledge and experience to help clients identify and implement income optimization strategies, such as:

Tax Planning: Crafting tax-efficient strategies to minimize tax liabilities and maximize take-home income.

Investment Guidance: Providing advice on investment portfolios and strategies to generate additional income streams.

Expense Management: Analyzing expenses to identify cost-saving opportunities and increase disposable income.

2.2 Business Income Growth

For businesses, certified accountants play a crucial role in income growth by:

Financial Analysis: Conducting in-depth financial analysis to identify revenue-generating opportunities.

Budgeting and Forecasting: Creating budgets and financial forecasts to set income targets and measure performance.

Risk Management: Developing strategies to mitigate financial risks that may affect income.

Certified Accountants as Financial Advisors

3.1 The Dual Role

Certified accountants often serve as both financial advisors and accountants. In their advisory role, they:

Provide Comprehensive Financial Planning: Crafting personalized financial plans aligned with clients' goals.

Offer Investment Guidance: Recommending investment options and asset allocation to optimize income.

Retirement Planning: Helping clients plan for a secure financial future with income sustainability.

3.2 Certified Accountant vs. Traditional Financial Advisor

While both certified accountants and traditional financial advisors offer valuable financial guidance, certified accountants bring a unique perspective with their expertise in tax planning, accounting, and compliance. This allows for a holistic approach to income optimization.

Chapter 4: The Importance of Advisory Services

4.1 Personal Finance

For individuals, advisory services provided by certified accountants can lead to:

Improved financial decision-making.

Enhanced wealth accumulation and preservation.

Reduced tax burdens and increased disposable income.

4.2 Business Finance

For businesses, these services contribute to:

Sustainable growth and profitability.

Improved cash flow management.

Compliance with tax regulations and financial reporting standards.

Chapter 5: Choosing the Right Certified Accountant

When seeking advisory services to maximize income, consider the following factors:

Qualifications: Ensure the accountant is a certified professional with relevant credentials.

Experience: Assess their experience in providing advisory services.

Specialization: Look for an accountant with expertise aligned with your needs, whether it's personal finance, small business, or corporate finance.

References: Check client references and reviews to gauge their reputation.

Conclusion

Advisory services provided by certified accountants offer a holistic approach to income optimization for both individuals and businesses. These professionals bring unique insights and strategies to the table, ensuring that you make informed financial decisions and maximize your income potential. Whether you're aiming for personal financial success or striving to grow your business, partnering with a certified accountant can be the key to achieving your financial goals. In the ever-evolving financial landscape, the guidance of a certified accountant is your path to securing a prosperous future.

Remember that the right certified accountant can be your trusted partner in financial success, providing guidance, expertise, and strategies tailored to your unique financial situation and goals.

#AdvisoryServices#IncomeOptimization#CertifiedAccountant#FinancialGuidance#TaxPlanning#InvestmentStrategies#ExpenseManagement#BusinessGrowth#FinancialAdvice#PersonalFinance#Budgeting#RetirementPlanning#FinancialSuccess#WealthManagement#FinancialDecisions#FinancialHealth#IncomeStrategies#MoneyManagement#FinancialGoals#FinanceTips#Toronto#Canada

2 notes

·

View notes

Text

👉 What is TRW? 🤔

👉 Learn more: https://jointherealworld.com/?a=lmdcmmhttk

3 notes

·

View notes

Text

How To Do Financial Planning

Introduction

Financial Planning is important for everyone, regardless of income or age. It can help you make smart decisions with your money, reach your financial goals, and make the most of your income.

There are a few key steps to financial planning: determine your financial goals, analyze your current finances, create a budget, invest your money, and review your progress. By taking these steps and sticking to your plan, you can improve your financial health and secure a bright future.

The Importance of Financial Planning.

Why You Should Plan Your Finances

Advice Only Financial planning is important because it allows you to take control of your finances and set yourself up for success in the future. By creating a budget and investing your money wisely, you can make sure that you are prepared for whatever life throws your way.

There are many benefits to financial planning, including:

• Giving you peace of mind: If you know that your finances are in order, you can relax and enjoy your life without worrying about money.

• Helping you reach your goals: A good financial plan will help you save up for things like a down payment on a house or retirement.

• Making sure you are prepared for emergencies: If you have an emergency fund, you will be less likely to go into debt if something unexpected comes up.

• Saving you money in the long run: By planning ahead, you can avoid costly mistakes like overspending or taking on too much debt.

How Financial Planning Can Benefit You

Financial planning can benefit everyone, regardless of their income or net worth. Whether you are just starting out in your career or nearing retirement, there are many ways that financial planning can help improve your life.

Some of the benefits of financial planning include:

No matter what your financial situation is, there are many benefits to be gained from creating a financial plan.

Steps to Financial Planning.

Determine Your Financial Goals

The first step to Advice Only financial planning is to determine your financial goals. What do you want to achieve financially? Do you want to save for retirement, purchase a home, or pay off debt? Once you know your goals, you can begin to develop a plan to reach them.

Analyze Your Current Finances

The next step is to analyze your current finances. This will give you a good starting point for developing your financial plan. You will need to know how much income you have, what your expenses are, and what debts you owe. This information will help you create a budget and make informed decisions about investing your money.

Create a Budget

Once you have analyzed your current finances, you can begin to create a budget. A budget is a tool that can help you track your spending and make sure that your money is being used in ways that align with your financial goals. Creating a budget may seem like a daunting task, but there are many resources available to help you get started.

Invest Your Money

One of the most important aspects of financial planning is investing your money wisely. There are many different ways to invest money, and it is important to choose an investment strategy that fits your goals and risk tolerance. Some common investment options include stocks, bonds, mutual funds, and real estate.

Review Your Progress

It is important to periodically review your progress towards meeting your financial goals . This will allow you to make adjustments to your budget or investment strategy as needed . Reviewing your progress also allows you to celebrate successes and keep motivated towards reaching your goals .

Conclusion

Financial planning is important for everyone, regardless of their income level. By taking the time to understand your finances and set goals, you can make smart decisions with your money that will lead to a brighter future. Follow the steps outlined in this blog post and you'll be on your way to financial success.

#financial planning#retirement planning#financial advice#financial submission#financialadvisor#financial freedom#financial technology#personal finance#wealth management#personal savings#personal loans#business#financial market news#make money fast#income#loans#personalfinance#savings#earn money online

15 notes

·

View notes

Text

Life Update 1/14/23

Hey guys! So sorry it’s been so long, my pc needed parts and I had a bunch of other stuff going on as well, and then I proceeded to procrastinate on posting here, of course. All is well now though, so I would love to continue with daily updates again.

Since we last spoke I have been able to start a nice chunk of my savings, and I’ve been looking into either getting a better job, or even moving up in my current job. I’ve been trying to brainstorm on what I would like to do as a long term career, and honestly, I’ve been struggling quite a lot. I know one thing I’ve loved about all my jobs so far, has been the human interaction, and helping customers, the things I dislike specifically about my current place of work, is my management. I cannot stand who my upper management is, both my store manager and sales manager have made their way onto my shit list. The way that both of them talk to people is so demeaning and condescending, and it really grinds my gears. Another thing I dislike about my current position is how temporary it feels, I feel like this is just the filler chapter of my life, which I guess it kind of is, but I would love to still feel like my life has some meaning, ya know?

I’ve been working really hard to try and focus on my goals, and make sure I don’t over spend. I have a few things I need to spend on this month that are necessary but unbudgeted for, such as new sneakers to work in (my old ones were worn out and my feet have been killing me), and I also need an oil change and tire rotation for my car. Both of these are just parts of life, however I had not budgeted them in necessarily, since I barely started budgeting to begin with.

I am going to try to start putting away at least $50 from each paycheck, now that I get payed weekly, that will be $200 a month, which hopefully will be achievable. That will end up being a little over 2K saved this year just from that. I would also love to start Door-Dashing again to bump up how much I can afford to stash away each month. Even if that doesn’t happen though, I hope I will at least be able to keep up with the minimum of $200 a month.

I also think I am going to start doing a weekly spending log at the bottom here, instead of doing it as daily, so I will update it every time to adjust the amount per week, including bills and everything. But I will start that this week, since I have also fallen back on not tracking my spending as I was previously.

Finance Tracker:

Savings: $500

#personalfinance#PersonalGrowth#personal blog#personal financing#financial makeover#financialwellness#moneymakeover#money#MysStella#growthmindset#self improvement

15 notes

·

View notes